OIL PRICES: ABOVE $49 ANEW

REUTERS, BLOOMBERG, OILPRICE - Oil prices traded higher on Wednesday, supported by a strong gasoline market, but rising output from OPEC producers revived concerns about a fuel supply overhang.

Brent crude futures LCOc1, the international benchmark, were up 11 cents at $48.95 per barrel at 0925 GMT.

U.S. West Texas Intermediate crude futures CLc1 were at $46.50 per barrel, up 10 cents.

While U.S. crude stocks rose by 1.6 million barrels to 497.2 million barrels in the week to July 14, gasoline stocks fell by a whopping 5.4 million barrels, the American Petroleum Institute said on Tuesday.

"The (gasoline) draws reported by the API are very large and gasoline was already strong," Olivier Jakob of oil consultancy Petromatrix said.

"As long as you have gasoline that strong, it's very difficult to sell crude oil aggressively."

Refinery upsets on the U.S. East Coast pushed the U.S. gasoline crack spread RBc1-CLc1, or the profit from refining crude into the motor fuel, to a three-month high at over $20 a barrel.

But supplies from the Organization of the Petroleum Exporting Countries remain high, largely due to rising output from member states Nigeria and Libya, casting a shadow on efforts by the group to rebalance the market.

"Production in Libya is currently reported at or above 1 million barrels per day, while August loading schedules for Nigeria have risen to just over 2 million barrels per day," BNP Paribas said.

A Saudi Arabian industry source said on Tuesday that the kingdom, by far OPEC's biggest producer, was committed to tightening the market.

"We hope to accommodate the rise in production from Libya and Nigeria taking into consideration other supply adjustments as well. But we emphasize that we have to work together with other producers and with the two countries," the source said.

Nigeria and Libya are exempt from a deal between OPEC and other producers, including Russia, to cut production by around 1.8 million barrels per day between January this year and March 2018.

"Talk of capping Nigerian and Libyan output has been growing fast (within OPEC). But it is very unlikely that both countries will acquiesce to a cap so soon after restoring production," BNP said.

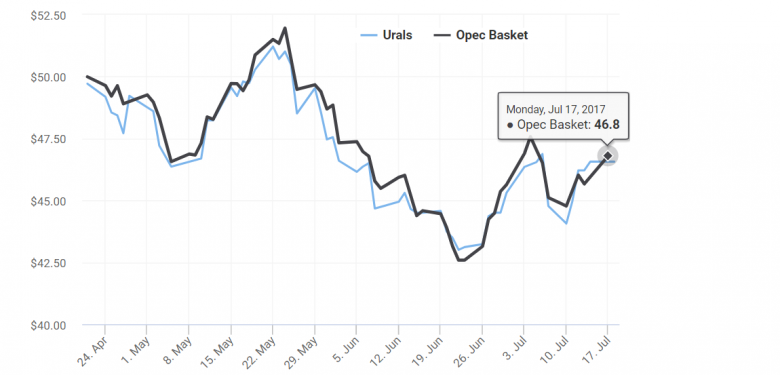

Crude prices are down around 15 percent this year, making oil one of the worst-performing commodities in 2017.

-----

Earlier:

EIA OIL PRICES FORECASTS: $51 - $52