MARKET WILL BE BETTER

REUTERS - Russian Energy Minister Alexander Novak said a global pact by OPEC, Russia and other producers to cut oil output had dampened price volatility and was reducing bloated inventories, so no immediate extra measures were needed to prop up prices.

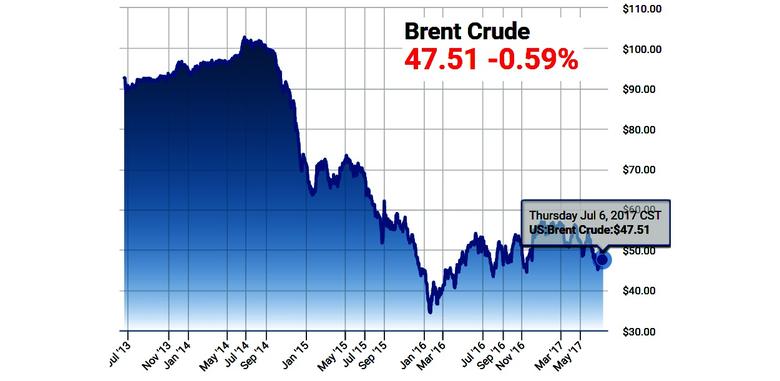

The minister also told Reuters there was potential for an oil price rise from current levels and that $50 to $60 was "fair" value for a barrel, after benchmark Brent fell 20 percent in the first half of the year. It now trades at around $48.

The Organization of the Petroleum Exporting Countries and other producers led by Russia agreed to cut production by almost 1.8 million barrels per day (bpd) from January this year to rein in inventories and support prices. The deal runs to March 2018.

Despite the initiative, oil prices have registered their biggest first-half decline in almost two decades, as OPEC-led supply cuts have been undermined by rising output in the United States and from other producers not bound by the global pact.

Some market analysts have suggested OPEC states, Russia and their allies might now need to implement additional steps, such as deepening the cuts or extending them beyond March.

"We believe that it is necessary to move within the framework of the agreed decisions and that new, snap decisions are not necessary," Novak said in an interview in Moscow.

"I think that the decisions that were taken, they were the right ones," he said, adding that any additional measures would create "chaos" and more misunderstanding in the market.

"We have got the positive effect for market stabilization. The prices have been stabilized at higher levels, which allows the interests of investors, producers and consumers to be taken into account," Novak said.

Although oil prices are now back near November levels seen before OPEC announced its plan to cut output, they are still well off lows of around $27 reached in early 2016.

Novak said prices had room to rise from current levels and said inventories in industrialized nations were expected to ease back to the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018.

MARKET MONITORING

The Joint OPEC-Non-OPEC Ministerial Monitoring Committee (JMMC), set up to monitor the global supply pact, meets on July 24 in the Russian city of St Petersburg.

Ministers from Russia, Oman, Algeria, Venezuela, Kuwait and Saudi Arabia, alongside OPEC's secretary general, are to attend.

Novak said there were no proposals for more nations to be represented at that regular committee meeting, which plans to discuss the deal implementation and the market situation.

The committee had the authority to recommend "any decisions" to participants involved in the pact if needed, Novak said.

While he saw no need for further action, he said: "I can't predict what the proposals could be from (other) ministers."

OPEC and its allies face a challenge from U.S. shale producers, which ramped up output as oil prices rose from 2016 lows. In addition, Libya and Nigeria, two OPEC members which are exempt from the cuts, have also pushed up production.

Novak said it was up to OPEC to decide how to stick to its pledges on cuts while Libyan and Nigerian output climbed.

The Russian energy minister also said any exit from the global pact at the end of the first quarter would be "smooth", adding that inventories would have fallen by that stage and demand would be picking up in the second quarter of 2018.

"We are not going - as we discussed with our colleagues - to all hike oil production on April 1 at once," he said.

"Other OPEC members have also confirmed their interest to exit the deal in a way that any supply increase would follow a demand rise during the second and third quarters," he added.

Russia, the world's biggest oil producer, agreed under the output deal with OPEC and others to cut its production by 300,000 bpd from its October 2016 level, when it was just below 11 million bpd.

-----

Earlier: