SCHLUMBERGER NET LOSS $74 MLN

SCHLUMBERGER - Schlumberger Announces Second-Quarter 2017 Results

- Revenue of $7.5 billion increased 8% sequentially

- Pretax operating income of $950 million increased 25% sequentially

- GAAP loss per share, including charges of $0.40 per share, was $0.05

- EPS, excluding charges, was $0.35

- Quarterly cash dividend of $0.50 per share was approved

Schlumberger Limited (NYSE:SLB) reported results for the second quarter of 2017.

(Stated in millions, except per share amounts)

| Three Months Ended | Change | ||||

| Jun. 30, 2017 | Mar. 31, 2017 | Jun. 30, 2016 | Sequential | Year-on-year | |

| Revenue | $7,462 | $6,894 | $7,164 | 8% | 4% |

| Pretax operating income | $950 | $757 | $747 | 25% | 27% |

| Pretax operating margin | 12.7% | 11.0% | 10.4% | 175 bps | 231 bps |

| Net income (loss) (GAAP basis) | $(74) | $279 | $(2,160) | n/m | n/m |

| Net income, excluding charges & credits* | $488 | $347 | $316 | 41% | 54% |

| Diluted EPS (loss per share) (GAAP basis) | $(0.05) | $0.20 | $(1.56) | n/m | n/m |

| Diluted EPS, excluding charges & credits* | $0.35 | $0.25 | $0.23 | 40% | 52% |

| *These are non-GAAP financial measures. See section below entitled "Charges & Credits" for details. | |||||

| n/m = not meaningful | |||||

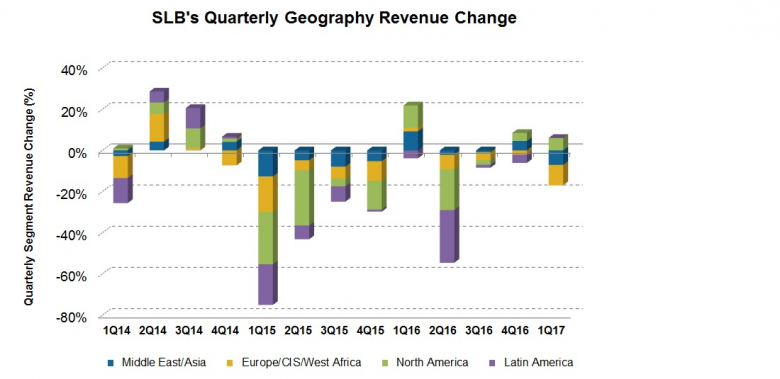

Schlumberger Chairman and CEO Paal Kibsgaard commented, "Our second-quarter revenue increased 8% sequentially while pretax operating income rose by 25%, resulting in earnings per share growth of 40%. Beyond seasonal effects, revenue grew in all of our Groups and Areas.

"North America revenue increased 18% following our rapid deployment of idle hydraulic fracturing capacity as land activity further accelerated during the second quarter, partially offset by further weakness offshore in the US Gulf of Mexico. In US land, revenue grew 42% sequentially, a rate almost double that of the 23% increase in land rig count, driven primarily by hydraulic fracturing revenue that grew 68% as completions activity intensified and pricing continued to improve. Directional drilling revenue in US land was also higher as longer laterals requiring rotary steerable systems and advanced drillbit technologies continued to drive drilling intensity. Despite the significant costs associated with reactivating equipment, all of our US land product lines were profitable in the second quarter, driven by higher pricing, market share gains, improved operational efficiency, timely resource additions, and proactive supply chain management.

"In the international markets, revenue increased 4% sequentially, led by Europe/CIS/Africa as activity recovered from the winter slowdown in Russiaand the North Sea. Latin America revenue increased due to higher reservoir characterization and drilling activities in the Mexico & Central America GeoMarket, as well as from increased unconventional land activity in Argentina. The Middle East & Asia Area benefited from a seasonal rebound in China, increased activities in Southeast Asia, and higher Integrated Drilling Services (IDS) activity in Iraq.

"Among the business segments, growth in the second quarter was led by the Production and Drilling Groups, where revenue increased sequentially by 14% and 6%, respectively, as hydraulic fracturing and directional drilling activity in US land accelerated. Reservoir Characterization Group revenue increased 9% due to higher international activities beyond the seasonal rebounds in the Russia & CIS and North Sea regions. Cameron Group revenue also increased 3% sequentially driven by higher project volume and product sales for Surface Systems and Valves & Measurement in North America.

"While the activity outlook in North America for the second half of the year remains robust, we are now also seeing more positive signs in the international markets with increases in activity and new project plans starting to emerge in several GeoMarkets. The strengthening in the international markets has so far been concentrated around land activity in Western Siberia and in the OPEC Gulf countries but we are now also seeing an increasing number of new offshore projects being prepared for tendering and final investment decision (FID) in many of the world's shallow water basins.

"In this market, we continue to focus on serving our customers and driving our business forward, building on our successful efforts over the past three years of broadening our technology portfolio and increasing our addressable market, further streamlining our execution machine, and pursuing more collaborative and commercially aligned ways of working with new and existing customers.

"As part of this focus, we announced a new agreement yesterday to acquire a majority equity interest in the Eurasia Drilling Company (EDC). This extends the successful long-term relationship that we have enjoyed with EDC through the strategic alliance that we signed in 2011. Closing of the transaction is subject to approval by the Federal Antimonopoly Service of Russia.

"We also remain on track to close the OneStimSM joint venture transaction in the second half of this year, which will allow us to further capitalize on the recovery in North America land unconventional activity. At the same time, our increasing investments in Schlumberger Production Management through the new projects with OneLNG, YPF, and NNPC and FIRST E&P are not only providing additional short-term opportunities for our various product lines, but also a long-term activity baseline with superior full-cycle financial returns for the company as a whole.

"Based on these, we continue to be optimistic about the future of Schlumberger, as we maintain an attentive watch and flexible approach to the shape and pace of the emerging oil market recovery."

-----

Earlier:

SCHLUMBERGER NET INCOME $279 MLNSCHLUMBERGER NET INCOME $279 MLN SCHLUMBERGER NET INCOME $279 MLN Schlumberger Announces First-Quarter 2017 Results: - Revenue of $6.9 billion decreased 3% sequentially - GAAP EPS, including Cameron integration charges of $0.05 per share, was $0.20 - ...

|

|

ROSNEFT - BP - SCHLUMBERGER COOPERATIONROSNEFT - BP - SCHLUMBERGER COOPERATION ROSNEFT - BP - SCHLUMBERGER COOPERATION The agreements were signed at the Eastern Economic Forum (EEF) in Vladivostok, Russia by Rosneft CEO Igor Sechin, the president of BP Russia David Campbell and Schlumberg ...

|

|

SCHLUMBERGER CUTS 2,000 JOBSSCHLUMBERGER CUTS 2,000 JOBS SCHLUMBERGER CUTS 2,000 JOBS Since November 2014, when the oil bust started to take hold of the energy industry, Schlumberger has cut 36,000 jobs, or 28% of its workforce. Since November 2014, when the oil bust started to ...

|

|

SCHLUMBERGER & CAMERON MERGERSCHLUMBERGER & CAMERON MERGER SCHLUMBERGER & CAMERON MERGER The transaction combines two complementary technology portfolios into a pore-to-pipeline products and services offering to the global oil and gas industry. The merger will create technology- ...

|

|

SCHLUMBERGER CUTS 20,000 JOBSSCHLUMBERGER CUTS 20,000 JOBS SCHLUMBERGER CUTS 20,000 JOBS He gave the warning in a statement as Schlumberger reported third-quarter earnings per share that were 48 per cent below the equivalent period of 2014, but slightly above analysts’ expectati ...

|

|

EURASIA DRILLING: $1.5 BLN... ed taking the oil services company private, after Schlumberger walked away from making a $1.7bn investment following resistance from Russian regulators. Eurasia Drilling’s top shareholders and management have proposed taking the oil services company ...

|

|

SCHLUMBERGER & EURASIA KEY FINANCIALSSCHLUMBERGER & EURASIA KEY FINANCIALS SCHLUMBERGER & EURASIA KEY FINANCIALS Issues have emerged in Russia that could delay or prevent Schlumberger Limited. (NYSE:SLB) from closing a deal with Eurasia. Earlier this year, Schlumberger made a $1.7 billi ...

|