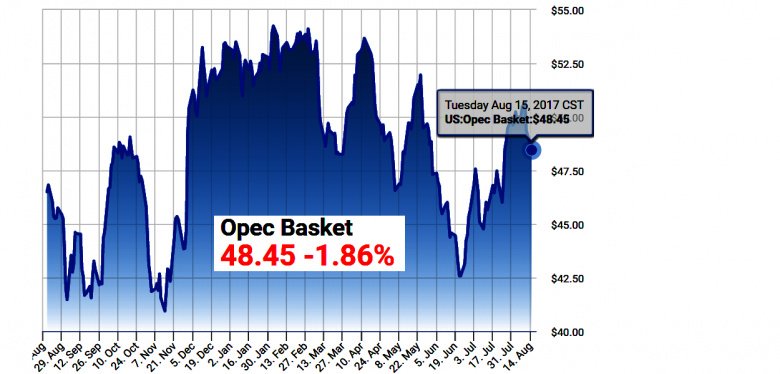

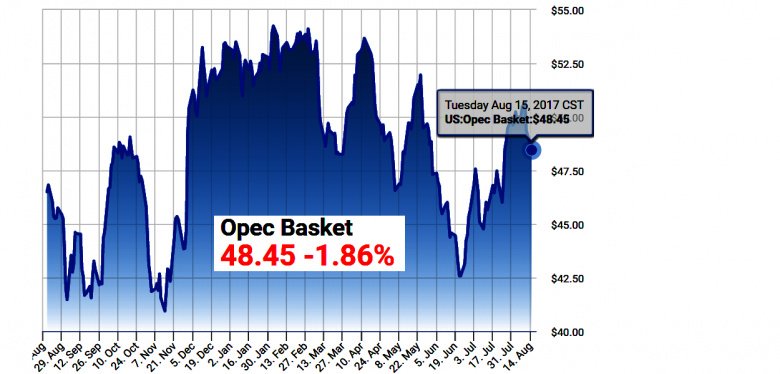

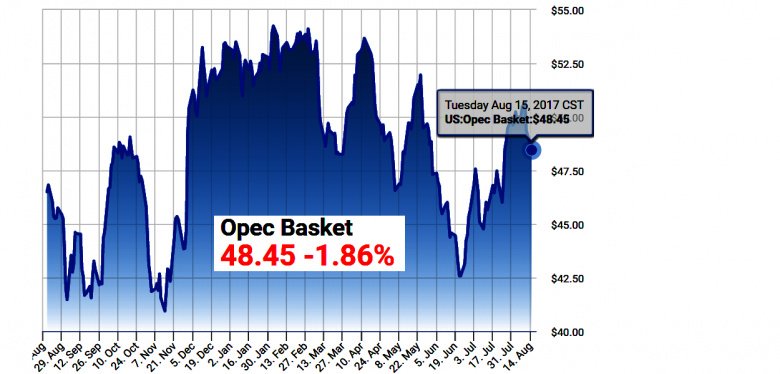

ЦЕНА НЕФТИ: НЕ ВЫШЕ $51

РЕЙТЕР , BLOOMBERG , OILPRICE - Цены на нефть немного выросли утром четверг после вчерашнего снижения, спровоцированного наращиванием добычи сырья в США.

К 9.12 МСК фьючерсы на нефть сорта Brent поднялись на 0,22 процента до $50,38 за баррель.

Фьючерсы на американскую нефть WTI к этому времени торговались у отметки $46,80 за баррель, на 0,04 процента выше предыдущего закрытия.

Североморская смесь Brent подешевела почти на 12 процентов с начала января, когда нефтеэкспортный картель ОПЕК и несколько стран вне организации, включая Россию, договорились сократить добычу примерно на 1,8 миллиона баррелей в сутки ради восстановления равновесия мирового спроса и предложения.

В пользу пакта ОПЕК+ говорит сокращение запасов нефти в США, которые, как показали данные Управления энергетической информации (EIA), за неделю к 11 августа снизились на 8,9 миллиона баррелей до 466,49 миллиона баррелей, тогда как аналитики предсказывали снижение на 3,06 миллиона.

В то же время текущая цена нефти заставляет некоторых аналитиков усомниться в эффективности сделки в восстановлении баланса на мировом рынке в более отдалённой перспективе, в том числе из-за наращивания производства сырья в США.

По данным EIA, добыча нефти в США на прошлой неделе выросла на 79.000 баррелей в сутки до 9,5 миллиона баррелей в сутки. Это самый высокий показатель с июля 2015 года и прирост на 12,75 процента с середины 2016 года.

Не внушают оптимизма инвесторам и прогнозы замедления темпов роста потребления топлива в Китае.

"Рост потребления бензина в Китае может серьёзно замедлиться в следующие годы из-за макроэкономических факторов и конкуренции со стороны альтернативных источников топлива, – говорят аналитики BMI Research. – По нашим прогнозам, годовой прирост в среднем составит 1,3 процента в 2017-2021 годах против 9,6 процента в 2011-2016 годах".

-----

Раньше:

August, 16, 09:45:00

Brent crude futures LCOc1 were at $51.02 per barrel at 0218 GMT, up 22 cents or 0.4 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $47.70 a barrel, up 15 cents, or 0.3 percent.

August, 16, 09:35:00

Средняя цена нефти марки Urals по итогам января - июля 2017 года составила $ 49,94 за баррель.

August, 14, 14:40:00

К 9.26 МСК фьючерсы на нефть сорта Brent опустились на 0,33 процента до $51,93 за баррель. Фьючерсы на американскую нефть WTI к этому времени торговались у отметки $48,71 за баррель, на 0,23 процента ниже предыдущего закрытия.

August, 14, 14:35:00

North Sea Brent crude oil spot prices averaged $48 per barrel (b) in July, $2/b higher than the June average and almost $4/b higher than in July 2016. EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018.

August, 14, 14:30:00

Global oil stocks fell by 500,000 b/d and preliminary data for July, particularly in the US where stocks fell by 790,000 b/d, is supportive of rebalancing supplies with demand, according to the most recent Oil Market Report from the International Energy Agency.

August, 14, 14:25:00

Total crude oil production from the Organization of Petroleum Exporting Countries increased 173,000 b/d month-over-month in July to average 32.87 million b/d.

August, 3, 12:50:00

К 8.50 МСК фьючерсы на нефть сорта Brent опустились на 0,42 процента до $52,14 за баррель. Фьючерсы на американскую нефть WTI к этому времени торговались у отметки $49,40 за баррель, на 0,38 процента ниже предыдущего закрытия.

OIL PRICE: NOT ABOVE $51

REUTERS , BLOOMBERG , OILPRICE - Oil prices steadied on Thursday after U.S. data showed a big fall in crude stockpiles but also an increase in production, taking U.S. crude output to its highest in more than two years.

Brent crude LCOc1 was unchanged at $50.27 a barrel by 0845 GMT. U.S. light crude CLc1 was 5 cents lower at $46.73.

Both benchmarks fell more than 1 percent on Wednesday.

Energy Information Administration (EIA) data showed commercial U.S. crude stocks have fallen by almost 13 percent from their peaks in March to 466.5 million barrels. Stocks are now lower than in 2016.

But U.S. oil output is rising fast as shale producers take advantage of a recent increase in prices.

U.S. production jumped by 79,000 barrels per day (bpd) to over 9.5 million bpd last week, its highest level since July 2015, and 12.75 percent above the most recent low in mid-2016.

"The EIA data suggest the U.S. oil market is becoming more balanced, with crude inventories falling," said Tamas Varga, senior market analyst at London brokerage PVM Oil Associates.

"But the big jump in production was the focus."

Rising U.S. output has been undermining efforts by the Organization of the Petroleum Exporting Countries and non-OPEC producers including Russia to drain a global fuel glut.

They have promised to restrict output by a total of 1.8 million bpd between January this year and March 2018.

William O'Loughlin at Rivkin Securities said that if inventory declines continued at the current pace, U.S. stocks would fall below the five-year average in two months.

"The pace of the declines indicates that OPEC production cuts are having an effect, although the current oil price suggests that the market is sceptical about the longer-term prospects for rebalancing of the oil market," he added.

Brent prices are down almost 12 percent since OPEC and its allies began cutting production in January.

Oil producers have enjoyed years of rocketing demand, fuelled largely by China's voracious thirst coming from over 2 million new car sales a month.

But this boom is coming to an end as its vehicle sales slow in a maturing market, and as cars become more efficient and start using alternative fuels.

"Gasoline consumption growth in China is set to see a marked slowdown over the coming years, due to macroeconomic headwinds, improving fuel economy and competition from alternative fuels," BMI Research said.

-----

Earlier:

August, 16, 09:45:00

Brent crude futures LCOc1 were at $51.02 per barrel at 0218 GMT, up 22 cents or 0.4 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $47.70 a barrel, up 15 cents, or 0.3 percent.

August, 16, 09:35:00

Средняя цена нефти марки Urals по итогам января - июля 2017 года составила $ 49,94 за баррель.

August, 14, 14:40:00

Brent crude futures, LCOc1 the international benchmark for oil prices, were at $51.92 per barrel at 0652 GMT, down 18 cents, or 0.4 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $48.70 a barrel, down 12 cents, or 0.3 percent.

August, 14, 14:35:00

North Sea Brent crude oil spot prices averaged $48 per barrel (b) in July, $2/b higher than the June average and almost $4/b higher than in July 2016. EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018.

August, 14, 14:30:00

Global oil stocks fell by 500,000 b/d and preliminary data for July, particularly in the US where stocks fell by 790,000 b/d, is supportive of rebalancing supplies with demand, according to the most recent Oil Market Report from the International Energy Agency.

August, 14, 14:25:00

Total crude oil production from the Organization of Petroleum Exporting Countries increased 173,000 b/d month-over-month in July to average 32.87 million b/d.

August, 3, 12:50:00

Benchmark Brent crude was up 20 cents a barrel at $52.56 by 0920 GMT. U.S. light crude was 20 cents higher at $49.79.

Tags:

OIL,

PRICE,

ЦЕНА,

НЕФТЬ,

BRENT,

WTI,

URALS,

OPEC