IMPORTANT OIL STRAITS

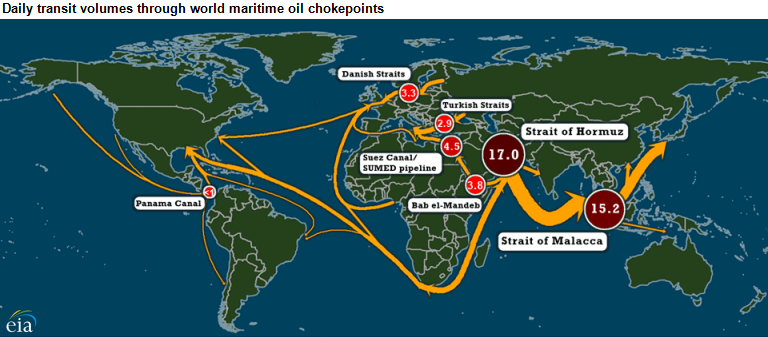

EIA - The Danish Straits and Turkish Straits, together transited by a combined volume of more than 5 million barrels per day (b/d) in 2016, are important chokepoints for Europe's crude oil and petroleum liquids supply. Nearly 59 million b/d of global petroleum and other liquids production moved on maritime routes in 2015. Although most discussions of maritime chokepoints for oil trade focus on the Strait of Hormuz and the Strait of Malacca, which together were transited by a combined volume of more than 30 million b/d, other chokepoints are significant for specific regions.

Chokepoints are narrow channels along widely used global sea routes and are critical to global energy security. The inability of oil to transit a major chokepoint, even temporarily, can lead to substantial supply delays and higher shipping costs, resulting in higher world energy prices.

The Danish Straits, a series of channels that connect the Baltic Sea to the North Sea, are an important route for Russian seaborne oil exports to Europe. An estimated 3.2 million b/d of crude oil and petroleum products flowed through the Danish Straits in 2016. Russia shifted a significant portion of its crude oil exports to its Baltic ports after opening the port of Primorsk in the Gulf of Finland in 2005. A relatively small amount of oil, less than 50,000 b/d, primarily from Norway and the United Kingdom, flowed eastward through the Danish Straits to Scandinavian markets in 2016.

The Turkish Straits, which include the Bosporus and Dardanelles waterways, divide Asia from Europe. The Bosporus is a 17-mile waterway that connects the Black Sea with the Sea of Marmara, and the Dardanelles is a 40-mile waterway that links the Sea of Marmara with the Aegean and Mediterranean Seas. Both waterways are located in Turkey and supply Western and Southern Europe with oil from Russia and the Caspian Sea region.

Only half a mile wide at the narrowest point, the Turkish Straits are among the world's most difficult waterways to navigate because of their sinuous geography. About 48,000 vessels transit the Turkish Straits each year, making this area one of the world's busiest maritime chokepoints. Commercial shipping has the right of free passage through the Turkish Straits in peacetime, although Turkey claims the right to impose regulations for safety and environmental purposes.

An estimated 2.4 million b/d of crude oil and petroleum products flowed through the Turkish Straits in 2016, more than 80% of which was crude oil. These Black Sea ports are among the primary oil export routes for Russia and other Eurasian countries, including Azerbaijan and Kazakhstan. At its peak in 2004, more than 3.4 million b/d transited the Turkish Straits, but volumes have fallen as Russia has shifted crude oil exports away from the Black Sea and toward the Baltic ports.

Subsequent increases in production and exports from Azerbaijan and Kazakhstan resulted in an increase in shipments through the Turkish Straits, but those increases were short-lived. These volumes may increase in the future as Kazakhstan's production of crude oil increases and the country exports more crude oil via the Black Sea. EIA expects Kazakhstan's crude oil production to increase through at least the end of 2018 as volumes from the country's Kashagan field continue to rise.

-----

Earlier:

| STRAITS: | EUROPE: | ||||||

WORLD OIL TRANSIT... rlds oil production moves on maritime routes. The Strait of Hormuz and the Strait of Malacca are the worlds most important strategic chokepoints by volume of oil transit. World chokepoints for maritime transit of oil are a critical part of global ene ...

|

IMF WANT EUROPEIMF WANT EUROPE IMF WANT EUROPE The European Union could do more to convince countries to put EU reform recommendations into practice. For example, targeted support from the EU budget could be provided to incentivize reforms. The EU should also conti ...

|

||||||

WORLD OIL CHOKEPOINTS... production moved on maritime routes in 2015. The Strait of Hormuz and the Strait of Malacca are the worlds most important strategic chokepoints by volume of oil transit. EIA - World chokepoints for maritime transit of oil are a critical part of glob ...

|

GAZPROM UP 12%GAZPROM UP 12% GAZPROM UP 12% Our gas in Europe sees increasing demand. Gas export pipeline Nord Stream is in demand by more than 100%. On certain days at the last fall/winter season, the flow stood at 111% of its capacity, Miller said. Our gas in Eu ...

|

||||||

GAZPROM: RUSSIAN GAS FOR EUROPE... : БОЛЬШЕ ГАЗА ДЛЯ ЕВРОПЫ GAZPROM: RUSSIAN GAS FOR EUROPE Для Газпрома основным рынком является рынок Европы. Это рынок №1. Мы на этом рынке работаем уже почти 50 лет. И, конечно, для нас очень приятно, что потребление газа на европейском рынке в 2016 ...

|

|||||||

RUSSIAN GAS CORRIDOR... hing its own southern corridor for gas exports to Europe, in competition with the EU-backed project. One of the highest priorities in Russias gas export and marketing strategy is establishing its own southern corridor for gas exports to Europe, in co ...

|

|||||||

TURKEY'S GAS DIVERSIFICATION... has both problematic and good relations with the European Union, but unlike Russia it wants to be the part of Euro-Atlantic Security Community. Although Turkey has a lack of energy reserves itself, it is a good transit state and can bring benefit to ...

|

|||||||

NORD STREAM-2 FOR EUROPENORD STREAM-2 FOR EUROPE NORD STREAM-2 FOR EUROPE Russian state gas exporter Gazprom, which supplies around a third of the EUs gas, with much coming via Ukraine, is keen for Nord Stream 2 to be built by 2019, when it must renegotiate gas transit fees ...

|

|||||||

EUROPEAN ENERGY MARKET BALANCEEUROPEAN ENERGY MARKET BALANCE EUROPEAN ENERGY MARKET BALANCE “There are no easy buttons to push. It’s not simply about the oil price, the Paris Agreement or the still incomplete single market. It’s about the interdependencies and how these factors a ...

|

|||||||