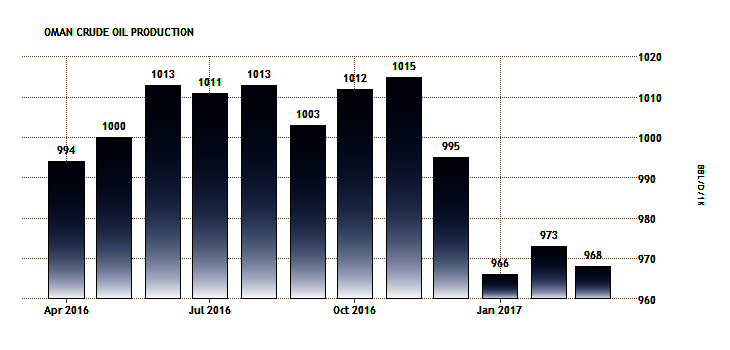

OMAN OIL PRODUCTION DOWN TO 970 TBD

EIA - OMAN COUNTRY ANALYSIS

Overview

Oman is the largest oil and natural gas producer in the Middle East that is not a member of the Organization of the Petroleum Exporting Countries.

Located on the Arabian Peninsula, Oman's proximity to the Arabian Sea, Gulf of Oman, and Persian Gulf grant it access to some of the most important energy corridors in the world, enhancing Oman's position in the global energy supply chain (Figure 1). Oman plans to capitalize on this strategic location by constructing a world-class oil refining and storage complex near Ad Duqm, Oman, which lies outside the Strait of Hormuz.

Like many countries in the Middle East, Oman is highly dependent on its hydrocarbons sector. The Oman Ministry of Finance stated that finances have been severely affected by the decline in oil prices since mid-2014. In 2016, Oman lost more than 67% of its oil and natural gas revenues compared with oil revenue the country earned in 2014, despite achieving record production.1 Oil revenue accounted for 27% of Oman's gross domestic product (GDP) in 2016, a decrease from 34% of GDP in 2015 and 46% in 2014, according to the Central Bank of Oman.

The ninth iteration of the Oman 5-Year Plan (2016-2020) released in 2016, created in the context of sustained low oil prices, aims to enhance the country's economic diversification by adopting a set of sectoral objectives, policies, and mechanisms that will increase non-oil revenue. Oman's diversification program is largely aimed at expanding industries such as fertilizer, petrochemicals, aluminum, power generation, and water desalination. Concerted efforts to develop these sectors would also accelerate non-oil job growth in coming years. However, with rising production levels and a growing petrochemical sector–which relies on liquefied petroleum gases (LPG) and natural gas liquids (NGL)–the country is unlikely to significantly alter its dependence on hydrocarbons as a major revenue stream in the short term.

Petroleum and other liquid fuels

Oman’s petroleum and other liquids production averaged more than 1 million barrels per day in 2016, its highest production level ever. Oman was on track to maintain this production level in 2017, but it reduced production to approximately 970,000 barrels per day in early 2017 to meet the production cut it agreed to, along with members of the Organization of the Petroleum Exporting Countries (OPEC).

Sector organization

The Ministry of Oil and Gas coordinates the government's role in Oman's hydrocarbon sectors. Final approval on policy and investment, however, rests with the Sultan of Oman. The majority state-owned Petroleum Development Oman (PDO) holds most of Oman's oil reserves and operates the Sultanate's largest block, Block 6. PDO is responsible for more than 70% of the country's crude oil production. In addition to the government's 60% ownership stake in PDO, Shell (34%), Total (4%), and Portugal's Partex (2%) also own stakes. In addition to the PDO, the Oman Oil Company (OOC) is responsible for energy investments both inside and outside of Oman. The OOC is fully owned by the government. The Oman Oil Refineries and Petroleum Industries Company (ORPIC) is owned by the Government of the Sultanate of Oman and by the OOC. It controls the country's refining sector and owns both of Oman's operating refineries, Sohar and Mina al-Fahal.

The U.S. firm, Occidental Petroleum (Oxy), is the second-largest operator after PDO and has the largest presence of any foreign firm in Oman. Oxy operates mainly in northern Oman at Block 62 and Block 9, along with the Mukhaizna field in the south. Lebanese independent, Consolidated Contractors Energy Development (CCED), operates Blocks 3 and 4 with a 50% stake alongside Sweden's Tethys Oil (30%) and Japan's Mitsui (20%). Daleel Petroleum is a 50:50 joint venture between Omani private firm Petrogas and Chinese state firm China National Petroleum Corporation (CNPC) and operates Block 5.

Upstream

Oman had 5.4 billion barrels of estimated proved oil reserves as of January 2017, ranking Oman as the 7th largest proved oil reserve holder in the Middle East and the 22nd largest in the world. The majority of the fields are located within PDO’s concession area.

Exploration and production

Enhanced oil recovery techniques helped Oman's oil production rebound from a multi–year decline in the early 2000s.

Oman's petroleum and other liquids (total oil) production ranks 7th in the Middle East and ranks among the top 25 oil producers in the world. Oman is the largest oil producer in the Middle East that is not a member of the Organization of the Petroleum Exporting Countries (OPEC). Oman's annual petroleum and other liquids production peaked at 972,000 barrels per day (b/d) in 2000, but dropped to 715,000 b/d by 2007. Oman successfully reversed that decline, and total oil production has risen, hitting a new peak of a little more than 1 million b/d in 2016 (Figure 3). Enhanced Oil Recovery (EOR) techniques helped drive this production turnaround, along with additional production gains as a result of previous discoveries.

Several recent developments could contribute to future oil production growth in Oman. The major oil discoveries of 2016 were in north Oman (Figure 2).

Enhanced oil recovery

Oman's ability to increase its oil and natural gas production relies heavily on innovative extraction technologies, such as EOR. Several EOR techniques are already used in Oman, including polymer, miscible, and steam injection techniques. Because of the relatively high cost of production in the country, Oman's government offers incentives to international oil companies (IOCs) for exploration and development activities related to the country's difficult-to-recover hydrocarbons. The government enlists foreign companies in new exploration and production projects, offering generous terms for developing fields that require the sophisticated technology and expertise of the private sector. Given the technical difficulties involved in oil production, the contract terms for IOCs have become more favorable in Oman than in other countries in the region, with some allowing significant equity stakes in certain projects.

Block 6, located in central and southern Oman and operated by PDO, is the center of current EOR operations, using all four of the EOR techniques with the Marmul field (polymer), Harweel field (miscible), Qarn Alam field (steam), and Amal-West field (solar). Solar EOR at Alam-West in southern Oman was the first solar EOR project in the Middle East, completed by GlassPoint Solar in 2012 and commissioned in early 2013. This project uses the production of emissions-free steam that feeds directly into current thermal EOR operations, reducing the need to use natural gas in EOR projects.

In partnership with PDO, GlassPoint Solar is currently building the Miraah solar thermal plant to improve recovery of heavy and viscous crude oil from Amal oil field. The plant is expected to produce 1,021 megawatts (MW) of peak thermal energy in the form of 6,000 tons of solar steam each day (no electricity is produced). Construction on the project began in October 2015, with steam generation from the first glasshouse module expected in 2017.

However, in 2016, because of relatively low crude oil prices and the resource-intensive nature of EOR, PDO announced it was placing more emphasis on accelerating conventional oil and gas opportunities instead of short-term expansion of EOR projects.

Consumption and refining

Oman consumed 186,000 b/d of petroleum and other liquids in 2016 (Figure 4), most of which were petroleum products refined at Oman's refineries and a small amount that was imported.

Oman is not a major refined petroleum product producer, although it has plans to expand the country's refining and storage sectors. Oman aims to capitalize on its strategic location on the Arabian Peninsula by expanding its refining capabilities.

Oman has two refineries, Mina al Fahal and Sohar. As of early 2017, Minal al Fahal was operating at 106,000 b/d and Sohar at 116,000 b/d. Plans are underway to upgrade the facility at Sohar as part of the ORPIC-led Sohar Refinery Improvement Project (SRIP), scheduled for completion in 2017. Sohar's capacity is expected to expand to 197,000 b/d from 116,000 b/d. In February 2017, ORPIC announced the mechanical completion of all Sohar units as part of the expansion project. A major bunkering and storage terminal near Sohar is scheduled to be completed in 2017, and the facility's location outside the Strait of Hormuz could make it an attractive option for international crude oil shippers.

The OOC and Kuwait Petroleum International (KPI) have signed a partnership agreement for their Ad Duqm Refinery and Petrochemical Industries Company (DRPIC) joint venture to build a 230,000 b/d export refinery in a special economic zone under development at Ad Duqm on the Arabian Sea coast of central Oman and a 200 million barrel crude oil storage terminal at Ras Markaz. The storage terminal, with phase one estimated to be complete in 2019, will be one of the world's largest crude oil storage facilities. The Ad Duqm refinery could be operational by 2022, with most of the plant's output to be exported. According to the OOC, the cost of developing the refinery will be $6 billion–$7 billion. Both Oman and Kuwait will provide crude feedstock.

Oman does not have any international oil pipelines, although plans are in place to expand the country's domestic pipeline infrastructure. The Muscat Sohar Pipeline Project (MSPP), built by ORPIC and scheduled to be completed in 2017, is a 180-mile refined product pipeline that will connect the Mina al-Fahal and Sohar refineries with a new storage terminal near Muscat airport and reduce tanker traffic between the two coastal facilities.

Exports

Oman is an important oil exporter, particularly to Asian markets. In 2016, virtually all of the country's crude oil exports went to countries in Asia, with 78% going to China.

Oman's only export crude oil stream is the Oman blend, with an API gravity of 32, medium-light and sour (high sulfur- 1.33%) crude. Oman is an important crude oil exporter, particularly to Asian markets (Figure 5). In 2016, Oman exported 912,500 b/d of crude oil and condensate, its highest level since 1999.

China is Oman's largest export market, and that country received 78% of Oman's crude oil exports in 2016, while Taiwan received the second-highest volume, despite falling by almost one-third from 2015 levels. Thailand, which had previously been a consistent purchaser of 40,000 to 50,000 b/d of Omani exports, bought only two small cargoes in 2016.

Natural gas

The greatest growth potential for Oman's natural gas production is in the Khazzan-Makarem field, Block 61. The planned start–up of that field in late 2017 could significantly ease pressure on Oman's natural gas supplies.

Sector organization

PDO has an even greater presence in the natural gas sector than it does in the oil sector, accounting for nearly all of Oman's natural gas supply, along with smaller contributions from Occidental Petroleum, Oman's largest independent oil producer, and Thailand's PTTEP. The Oman Gas Company (OGC) directs the country's natural gas transmission and distribution systems. The OGC is a joint venture between the Omani Ministry of Oil and Gas (80%) and OOC (20%). Oman Liquefied Natural Gas (Oman LNG)–owned by a consortium including the government, Shell, and Total–operates all liquefied natural gas (LNG) activities in Oman through its three liquefaction trains in Qalhat near Sur.

Exploration and production

Oman's potential for natural gas production growth may be substantial, supported by promising developments in several new projects.

According to the Oil & Gas Journal, Oman held 23 trillion cubic feet (Tcf) of proved natural gas reserves in 2016. Oman's natural gas production grew to 1.16 Tcf in 2016, turning around a recent decline and surpassing the previous high of 1.15 Tcf in 2013. Approximately 80% of production was from non-associated fields.

Consumption more than doubled from 2006 to 2016, increasing from 380 billion cubic feet (Bcf) in 2006 to 820 Bcf in 2016 (Figure 6). Oman consumes slightly more than 70% of the natural gas it produces. Natural gas is becoming a key source of energy to the Omani economy with its increased focus on economic diversification away from oil. The Central Bank of Oman estimates that demand for natural gas will continue to rise going forward with the number of energy-intensive industries coming online combined with rising demand in the electric power sector. The concern over rising natural gas consumption prompted the Oman LNG company to announce in 2015 that it would divert all its exported volumes of natural gas away from foreign markets and toward domestic consumers by 2024.

The greatest growth potential for Oman's natural gas production is in the Khazzan-Makarem field in BP's Block 61. The field is a tight gas formation, and BP proposed two phases to develop the 10.5 Tcf of recoverable gas resources. Combined plateau production from Phases 1 and 2 is expected to total approximately 1.5 billion cubic feet per day (Bcf/d), equivalent to about 40% of Oman's current total domestic gas production.27 This project will involve construction of a three-train central processing facility with associated gathering and export systems and drilling about 325 wells over a 15-year period.28 BP estimates that Phase 1 of the project is more than 80% complete29 and will be online by the end of 2017.30 The start-up of the Khazzan tight gas field will significantly ease the pressure on Oman's natural gas supplies.

The Rabab Harweel integrated project (RHIP), located in Block 6, is PDO's largest capital project underway. The project integrates sour miscible gas injection (MGI) in multiple oil reservoirs with production and pressure maintenance of a government gas condensate field, and it will also contribute to easing Oman's overall natural gas demand. The RHIP is slated for completion in 2019.

Exports

Oman is a member of the Gas Exporting Countries Forum (GECF) and exports natural gas as LNG through its Oman LNG facilities near Sur, in the Gulf of Oman. In 2016, Oman exported 358 Bcf of natural gas (Figure 7). Nearly all of Oman's natural gas exports go to South Korea and Japan, accounting for 80% of exports in 2016.

Oman's natural gas sector grew in importance over the past two decades, largely the result of two LNG trains that opened in 2000 at the LNG complex at Qalhat, near Sur, operated by Oman LNG (a joint venture between PDO and other shareholders). The third LNG train, operated by Qalhat LNG SAOC and built alongside the two existing trains, entered into production in 2005. Qalhat merged into Oman LNG in 2013. Its main shareholders are the Omani state (51%) and Shell Gas B.V (30%).

South Korea is Oman LNG's primary buyer. Oman's LNG exports have increasingly been under pressure as rising domestic consumption has cut into volumes available for export. LNG supplies received a boost last year with lower consumption from power stations, and these supplies will see a further boost from new production when the Khazzan gas field comes online in 2017. Khazzan volumes are primarily designated for domestic consumption, with excess volumes exported from Oman's LNG facilities.

The Sultanate has been focused on diversifying its LNG export destinations because regional demand for LNG is growing. Oman LNG's 2016 Annual Report reported the first-ever sales of two spot cargoes to Kuwait and Jordan as representing "new departures for our company" by exporting to new geographic destinations.

Imports

Oman has one international natural gas pipeline–the Dolphin Pipeline–that runs from Qatar to Oman through the United Arab Emirates (UAE). Oman is not a major importer of natural gas, although the country imported approximately 74 Bcf of natural gas in 2016 from Qatar through the Dolphin Pipeline. According to the Omani government, the imports through the Dolphin Pipeline are necessary to meet the rising level of domestic natural gas consumption (including re–injection in oil wells).

In March 2014, Oman signed a memorandum of understanding with Iran on a natural gas import contract. The deal will deliver approximately 353 million cubic feet of natural gas per year through a new pipeline under the Gulf of Oman, much of which is slated to be re-exported as LNG. A new route was agreed upon in February 2017 to avoid UAE waters, and Iran is expecting natural gas to begin flowing in 2020.

-----

Earlier:

OPEC & NON-OPEC AGREEMENT... salam, Kazakhstan, Malaysia, Mexico, Sultanate of Oman, the Russian Federation, Republic of Sudan, and the Republic of South Sudan, taking into account the decision reached by OPEC at the 172nd Meeting of the Conference, recognized the need for conti ...

|

|

IRAN - OMAN GAS PIPELINEIRAN - OMAN GAS PIPELINE IRAN - OMAN GAS PIPELINE The 400-kilometer pipeline, stretching from Iran to Oman is defined in two onshore and offshore sections. Land part of the gas pipeline extends for 200 kilometers from Rudan to Mobarak Mount in southe ...

|

|

BP & OMAN AGREEMENTBP & OMAN AGREEMENT BP & OMAN AGREEMENT BP and Oman Oil today signed a heads of agreement with the Government of the Sultanate of Oman committing to amend the Oman Block 61 exploration and production sharing agreement (EPSA), extending the licence ar ...

|

|

OMAN TO DELIVER OFFSHORE PLATFORMSOMAN TO DELIVER OFFSHORE PLATFORMS OMAN TO DELIVER OFFSHORE PLATFORMS Oman to deliver offshore platforms to Abu Dhabi Oman to deliver offshore platforms to Abu Dhabi

|

|

USA: BIG BROTHER SEES U - 2... R SEES U - 2 Iran says seals gas export deal with Oman Iran says seals gas export deal with Oman

|

|

OMAN TO INCREASE GASOMAN TO INCREASE GAS OMAN TO INCREASE GAS Oman to increase gas production Oman to increase gas production

|

|

PDO ACHIEVES 1.25 M BPD... BPD PDO ACHIEVES 1.25 M BPD Petroleum Development Oman achieves 1.25m bpd production in 2013 Petroleum Development Oman achieves 1.25m bpd production in 2013

|

|