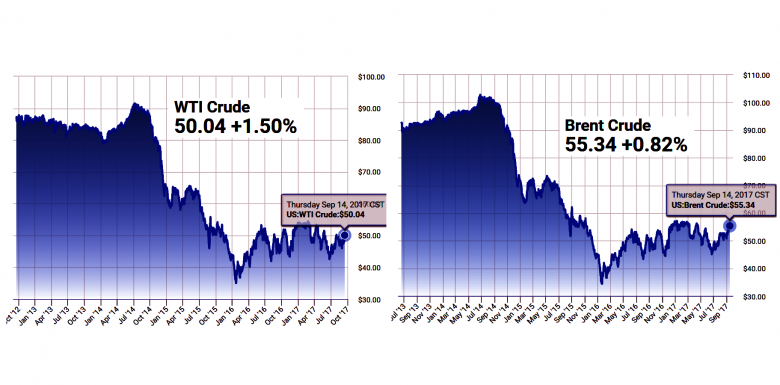

OIL PRICES: $50 - $60

REUTERS - Oil prices are expected to hold between $50 and $60 a barrel as bloated global stocks fall after a deal between OPEC and other producers to trim output, BP Chief Executive Bob Dudley said on Thursday.

"It was always going to take quite a while for stocks to come down. But for the OPEC and non-OPEC producer agreement, from everything we see, there is broadly compliance in place and stock levels are coming down," Dudley said in an interview with Reuters.

"We don't expect a spike up in prices nor do we expect a big drop in prices. So we're all trying to make our way in this world of between $50 and $60 and I would expect that to continue."

The Organization of the Petroleum Exporting Countries and other producers, including Russia, are reducing crude output by about 1.8 million barrels per day (bpd) until next March in an attempt to support prices by cutting a glut of crude oil on world markets.

OPEC top producer Saudi Arabia and several other countries have held talks in recent days on a possible extension of the deal.

-----

Earlier:

September, 13, 15:25:00

OIL PRICE: NOT ABOVE $55By 1021 GMT, international benchmark Brent crude LCOc1 was up 27 cents, or 0.5 percent, at $54.54 a barrel. U.S. West Texas Intermediate (WTI) CLc1 was up 38 cents, or 0.8 percent, at $48.61 a barrel. |

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation. |

August, 14, 14:35:00

OIL PRICES: $51 - $52North Sea Brent crude oil spot prices averaged $48 per barrel (b) in July, $2/b higher than the June average and almost $4/b higher than in July 2016. EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018. |

July, 24, 13:55:00

OIL OUTPUT CONSENSUSWith prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members. |

July, 14, 09:45:00

EIA OIL PRICES FORECASTS: $51 - $52EIA now forecasts Brent crude oil spot prices to average $51 per barrel (b) in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are expected to be $2/b lower than Brent prices in 2017 and 2018. |

July, 7, 08:10:00

MARKET WILL BE BETTERNovak said prices had room to rise from current levels and said inventories in industrialized nations were expected to ease back to the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018. |

June, 28, 15:20:00

MODEST OIL GAS PRICESThe August light, sweet crude contract on NYMEX gained 37¢ on June 26 to settle at $43.38/bbl. The September contract was up 34¢ to close at $43.61/bbl. The NYMEX natural gas price for July gained nearly 10¢ to a rounded $3.03/MMbtu. The Henry Hub cash gas price was $2.98/MMbtu, up 12¢. The Brent crude contract for August on London’s ICE increased 29¢ to $45.83/bbl while the September contract was up 29¢ to $46.04/bbl. The July gas oil contract dropped $1.75 to $409.50/tonne. OPEC’s basket of crudes on June 26 was $43.14/bbl, down 12¢. |