OPEC OIL PRICE UP 6% TO $49.6

OPEC - Oil Market Highlights September 2017

Crude Oil Price Movements

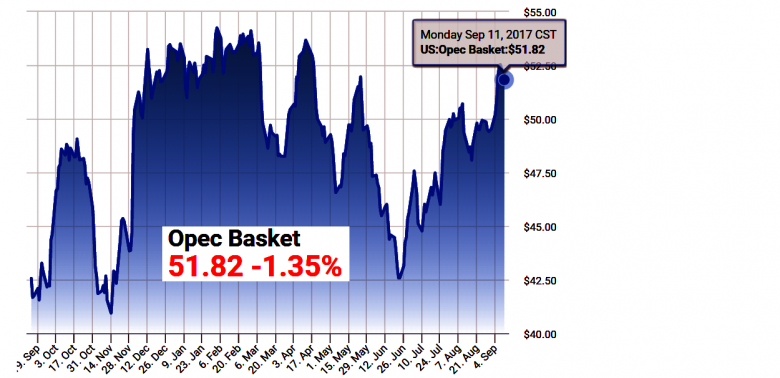

The OPEC Reference Basket rose for the second-consecutive month in August to average $49.60/b, representing a gain of $2.67/b or 6%. Year-to-date, the Basket was 30.9% higher at $49.73/b. Crude futures prices also saw gains with ICE Brent increasing 5.5% to $51.87/b and NYMEX WTI up 3.0% at $48.06/b.

Year-to-date, crude futures prices were more than 20% higher. During the week of 29 August money managers cut WTI futures and options net long positions by 105,671 contracts to 147,303 lots, the US Commodity Futures Trading Commission (CFTC) said. Money managers slightly reduced Brent futures and options net length contracts by 1,296 to 416,551 lots during the same week.

World Economy

World economic growth has been revised up for 2017 to 3.5% from 3.4%, while the growth forecast for 2018 remains unchanged at 3.4%. OECD growth has performed better-than-anticipated in the current year – particularly the Euro-zone and to some extent in the US – and is now forecast to grow by 2.2% in 2017 and 2.0% in 2018. India is expected to grow by 6.9% in 2017 and 7.5% in 2018. Brazil and Russia are both

forecast to expand their recovery to 0.5% and 1.5% in 2017, respectively, followed by growth of 1.5% and 1.4% in 2018. China is expected to grow by 6.7% in 2017 and 6.3% in 2018.

World Oil Demand World oil demand growth in 2017 is expected to rise by 1.42 mb/d after an upward revision of around 50 tb/d.

The adjustment mainly reflects better-than-expected data from OECD region for the 2Q17, particularly OECD Americans and Europe, as well as China. In 2018, world oil demand is anticipated to grow by 1.35 mb/d, an increase of 70 tb/d from the previous report. This reflects higher growth expectations for OECD Europe and China.

World Oil Supply Non-OPEC oil supply is expected to grow by 0.78 mb/d in 2017, unchanged from the last month due to offsetting revisions in Kazakhstan and US supply. In 2018, non-OPEC oil supply is forecast to grow by 1.0 mb/d, following a downward revision to Russia and Kazakhstan, totalling 0.1 mb/d. OPEC NGLs and non-conventional liquids production are seen averaging 6.49 mb/d in 2018, representing an increase of 0.18 mb/d, broadly in line with growth in the current year. In August, OPEC crude oil production decreased by 79 tb/d, according to secondary sources, to average 32.76 mb/d.

Product Markets and Refining Operations

Refinery margins in the Atlantic Basin strengthened in August. In the US, margins rose amid expectations for a product supply shortfall in the wake of Hurricane Harvey, coupled with already firm domestic demand, which supported product crack spreads. In Europe and Asia, product markets were supported by supply outages in the US, which encouraged higher arbitrage volumes, as well as healthy seasonal demand, which

helped lift refinery margins.

Tanker Market

Average spot freight rates in August followed the typical trend seen in the summer months, with a weakening on most reported routes. Dirty spot freight rates fell, influenced by high vessel availability, as new deliveries were reportedly added to the fleet, putting pressure on an already oversupplied tonnage market.

Clean tanker rates declined on average, influenced by lower rates registered on the West of Suez, despite a temporary hike in rates in the US due to Hurricane Harvey.

Stock Movements

Total OECD commercial oil stocks fell in July to stand at 3,002 mb. At this level, OECD commercial oil stocks were 195 mb above the latest five-year average. Crude and products stocks indicate surpluses of around 123 mb and 72 mb, respectively, above the seasonal norm. In terms of days of forward cover, OECD commercial stocks stood at 62.9 days in July, some 2.7 days higher than the latest five-year average.

Balance of Supply and Demand Based on the current global oil supply/demand balance, OPEC crude in 2017 is estimated at 32.7 mb/d,

around 0.5 mb/d higher than in 2016. Similarly, OPEC crude in 2018 is estimated at 32.8 mb/d, about 0.2 mb/d higher than in 2017.

-----

Earlier:

September, 11, 12:45:00

OIL PRICE: NOT ABOVE $53U.S. crude for October delivery CLc1 was up 41 cents, or 0.9 percent, at $47.89 a barrel by 0648 GMT, having tumbled 3.3 percent on Friday. London Brent crude for November delivery LCOc1 was up 30 cents, or 0.6 percent, at $54.08, having settled down 1.3 percent. |

September, 11, 12:40:00

ЦЕНА НЕФТИ: $40 - $43Глава "Роснефти" Игорь Сечин ожидает, что в 2018 году цена на нефть будет колебаться в пределах $40-$43 за баррель. "При предварительном анализе, в следующем году мы будем иметь цены в пределах $40-43 за баррель", - сказал он в интервью телеканалу "Россия 24". |

September, 8, 09:10:00

OIL PRICE: ABOVE $54U.S. West Texas Intermediate (WTI) crude futures were at $49.12 barrel at 0146 GMT, 4 cents below their last settlement, but not far off more than three-week highs reached in the previous session. Brent crude futures, the benchmark for oil prices outside the United States, dipped 8 cents to $54.12 a barrel, though still not far from May highs reached the previous day. |

September, 8, 08:30:00

ЦЕНА URALS: $50,09Средняя цена нефти марки Urals по итогам января-августа 2017 года составила $50,09 за баррель. |

September, 6, 18:20:00

OIL PRICE: ABOVE $53Brent LCOc1 had gained 51 cents to $53.89 a barrel by 1356 GMT. U.S. West Texas Intermediate (WTI) crude futures Clc1 were up 45 cents at $49.54 a barrel. |

September, 4, 12:40:00

OIL PRICE: NOT BELOW $ 52Brent crude futures LCOc1, the international benchmark for oil prices, had fallen by almost 1 percent from their last close, or 41 cents, to $52.34 per barrel by 0655 GMT. U.S. West Texas Intermediate (WTI) Clc1 crude futures were more stable, at $47.30 barrel, close to their last settlement. |

September, 4, 12:25:00

NIGERIA'S OIL PRODUCTION: 2.2 MBDThe figure of around 2.2 million to 2.3 million b/d includes about 300,000 to 400,000 b/d of condensates, which implies that its current crude oil production is at the coveted 1.8 million b/d mark. |