UK M&A $6 BLN

OIL&GAS UK - Almost $6 billion worth of mergers and acquisitions have taken place in the UK oil and gas sector in the first half of the year – sending a strong vote of confidence in a basin that has been grappling with the challenges of a major downturn, a new report reveals.

Assets changing hands and the increasing diversity in their ownership suggests that the UK Continental Shelf may start to benefit from a badly needed investment boost, says Oil & Gas UK's Economic Report 2017 – the trade body's annual review of industry performance and outlook, launched at Offshore Europe: a major industry conference and exhibition taking place this week in Aberdeen.

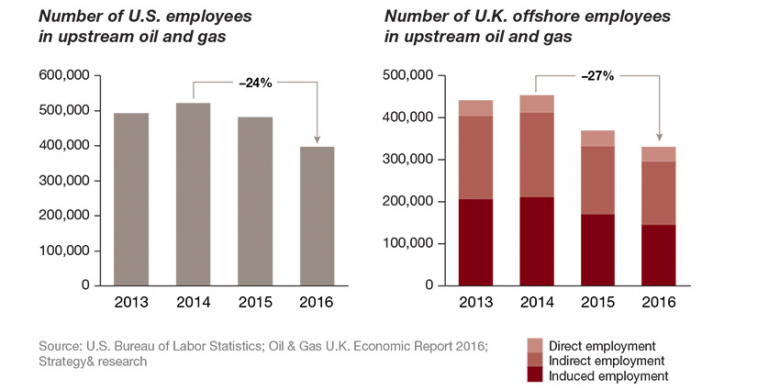

Although market conditions remain difficult, the report demonstrates that the UK sector is reinventing itself. It is differentiating its offering from competing oil and gas provinces with its efficiency gains, fiscal competitiveness and world-class supply chain. While investors still want more certainty over Brexit and clarity over the role of oil and gas through a more comprehensive energy policy, the transformation underway is restoring the UK's position as an attractive basin for investment – and one still supporting over 300,000 UK jobs.

The challenge now is to ensure this renewed interest in the basin translates into tangible activity that could help unlock around £40 billion worth of potential development opportunities known to be in company business plans.

The Economic Report also shows:

• Companies are becoming more efficient and competitive – better placed to cope with the lower oil price environment

• The cost of lifting oil from the North Sea has almost halved since 2014 – this improvement to unit operating cost is greater than improvements achieved by any other basin

• Production has increased by 16% since 2014 – driven by production efficiency improvements, brownfield investment and new field start-ups

• Businesses have rationalised but the pace of contraction is slowing• Over 300,000 UK jobs are now supported by the sector

• Changes to the tax regime have helped create one of the most competitive fiscal regimes for upstream investment globally

While confidence is slowly returning, challenges continue across the sector. The report says:

• The low levels of exploration and appraisal activity remain a serious concern with drilling at record lows

• The basin still needs further fresh capital investment, as only three new field approvals have been sanctioned since the start of 2016

• If activity does not pick up this could have further negative implications for jobs that could threaten core capabilities

• Industry needs the UK Government's ongoing commitment to the Driving Investment Plan and for Government to implement transferable tax history (TTH) to facilitate asset transfer

Deirdre Michie, Chief Executive of Oil & Gas UK, said:

"There are still serious issues facing our industry which has suffered heavy job losses since the oil price slump. But we are hopeful that the tide is turning and expect employment levels to stabilise if activity picks up.

"Despite our difficulties, we've got more reasons to be positive and some great stories to tell that demonstrate the real progress that we are now making.

"Our sector is successfully re-positioning through efficiency and cost improvements. We are transforming in a way that is getting UK oil and gas back in the game.

"We are increasingly being seen as a much more attractive basin in which to invest with further M&A activity expected over the remainder of this year and into the next.

"Although we are getting to a much better place, we still need further investment to generate new activity and sustain hundreds of thousands of UK jobs.

"While industry will maintain its relentless focus on improving its cost and efficiency performance, Government can continue to play its part – by developing a clear energy policy that reinforces the role for oil and gas in the Industrial Strategy, supporting a Sector Deal and confirming in the Autumn Budget that decommissioning tax relief will be modified to support further investment activity.

"Our potential is captured in Vision 2035 – an aspiration for our sector that shows that we can continue to deliver hundreds of billions of pounds in revenue over the next generation and beyond if we maximise recovery of our resources and help our supply chain grow.

"With global oil and gas demand forecast expected to rise by 25% to 2035, we have a crucial part to play now and during the transition to a lower carbon future.

"It's vital that industry and government work together to secure our future. There are billions of barrels of oil and gas still to go after in our own back yard. Government and industry must make the most of the opportunity offered by our sector."

• The Economic Report was being launched at a business breakfast briefing, sponsored by Deloitte, taking place at Offshore Europe.

-----

Earlier:

U.S. LNG FOR BRITAINU.S. LNG FOR BRITAIN U.S. LNG FOR BRITAIN The UKs first US LNG cargo will arrive at the Isle of Grain terminal on around July 8, according to shipping sources. The UKs first US LNG cargo will arrive at the Isle of Grain terminal on around July 8, acc ...

|

|

BREXIT GIVES CHANCE... LNG, pledged almost $6.2bn worth of investment in Britain on Monday in a show of support, as UK Prime Minister Theresa May begins the formal process of negotiating a separation settlement with the European Union. Qatar, the worlds biggest exporter of ...

|

|

BRITAIN'S SHALE GASBRITAINS SHALE GAS BRITAINS SHALE GAS Britain is estimated to have substantial amounts of shale gas trapped in underground rocks and the government wants to exploit it to help offset declining North Sea oil and gas output. It said the shale gas indus ...

|

|

LETTERONE IS LOOKING... energy and oil assets in the North Sea outside of Britain, its executive chairman John Browne told. LetterOne, Russian billionaire Mikhail Fridmans investment vehicle, is looking at acquisitions in renewable energy and oil assets in the North Sea out ...

|

|

BRITAIN HAS CUT TO 90%BRITAIN HAS CUT TO 90% BRITAIN HAS CUT TO 90% We recognise that market conditions are currently very difficult but nevertheless we have a shared goal of making the basin as attractive as possible for exploration, Andy Samuel, chief executive of the O ...

|

|

BRITAIN'S HEADLESS CHICKENSBRITAINS HEADLESS CHICKENS BRITAINS HEADLESS CHICKENS WHILE politicians run around like headless chickens, the Bank of England, at least, is trying to stabilise the British economy. Within hours of the announcement of the EU referendum result, Mark C ...

|

|

BRITAIN LOSE 120,000 JOBSBRITAIN LOSE 120,000 JOBS BRITAIN LOSE 120,000 JOBS As many as 120,000 oil workers will have lost their jobs in Britain by the end of the year compared to mid-2014 when oil prices started declining and unleashed sector-wide cost cuts, the industrys l ...

|