U.S. ENERGY INVESTMENT: $1.3 TLN

API - API President and CEO Jack Gerard welcomed the President's commitment to advancing our nation's energy security through pro-growth tax reform and economic policies during his remarks today at a North Dakota oil refinery.

"In today's speech the President recognized the importance of America's energy infrastructure and workers. The oil and natural gas industry knows the value of both as it continues response and recovery efforts in the wake of Hurricane Harvey and remains focused on the safety of its workers, communities, and the environment. Industry employees, many impacted personally by the storm, are working to safely bring production, pipeline and refining operations back on line to continue to meet the needs of American energy consumers.

"Our industry is committed to securing our critical energy infrastructure system, which has provided multiple supply lines and paths to help offset supply disruptions. It's important that we have public policies that support additions and improvements to our energy infrastructure to help mitigate the impacts of one region. The industry's ability to build and maintain infrastructure across the country to provide safe access to vital energy resources will benefit U.S. consumers, manufacturers, and businesses.

"We welcome the President's commitment to pro-growth tax reform, and look forward to working with the administration and Congress on continuing our nation's energy leadership. Pro-growth tax reform and economic policies can further strengthen our energy infrastructure and benefit consumers. As an industry that invests billions in the U.S. economy each year, pro-growth policies would allow us to accelerate these economic investments while keeping energy affordable. Private investment in our nation's energy infrastructure could exceed $1.3 trillion and support 1 million jobs annually through 2035."

-----

Earlier:

U.S. RIGS UP 3 TO 943U.S. RIGS UP 3 TO 943 U.S. RIGS UP 3 TO 943 U.S. Rig Count is up 446 rigs from last years count of 497, with oil rigs up 352, gas rigs up 95, and miscellaneous rigs down 1 to 2. Canada Rig Count is up 64 rigs from last years count of 137, with oil ri ...

|

|

U.S. OIL PRODUCTION: 9.35 - 9.91 MBD... ODUCTION: 9.35 - 9.91 MBD EIA continues to expect US production to rise over the next two years and cross the 10 million b/d threshold in November 2018. It sees output averaging 9.35 million b/d in 2017, up 20,000 b/d from last months outlook, and 9. ...

|

|

U.S. - CHINA OIL RECORD... L RECORD U.S. - CHINA OIL RECORD Chinas import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an opportunity to dive ...

|

|

U.S. GLOBAL LEADERSHIP... S. GLOBAL LEADERSHIP U.S. GLOBAL LEADERSHIP While US demand for gas is rising because of higher industrial consumption, more than half of the production increase will be used for LNG for export. By 2022, IEA estimates that the US will be on course to ...

|

|

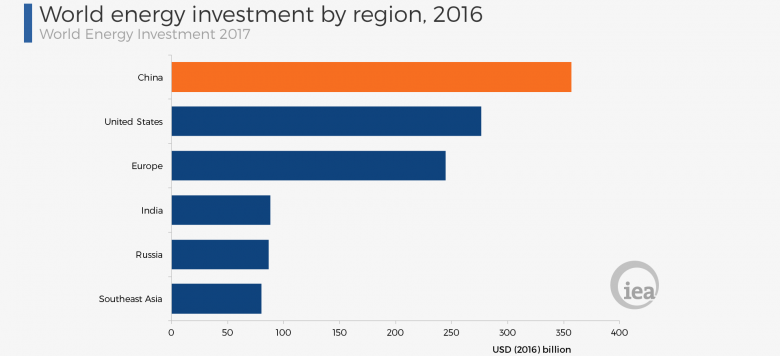

IEA: ENERGY INVESTMENT UPDOWN... WN Total energy investment worldwide in 2016 was just over $1.7 trillion, accounting for 2.2% of global GDP. Investment was down by 12% compared to IEA’s revised 2015 energy investment estimate of $1.9 trillion. Total energy investment worldwide in 2 ...

|

|

RUSSIA FINANCES U.S.RUSSIA FINANCES U.S. RUSSIA FINANCES U.S. “If you connect the dots, it is clear that Russia is funding US environmental groups in an effort to suppress our domestic oil and gas industry, specifically hydraulic fracturing,” Committee Chairman LaMar Sm ...

|

|

U.S. - S.KOREA BUSINESSU.S. - S.KOREA BUSINESS U.S. - S.KOREA BUSINESS South Korean companies announced plans to import more American shale gas and build new factories in the U.S. as the two countries leaders prepare to hold summit talks in Washington where trade is expect ...

|