OIL PRICES: NOT ABOVE $70 YET

REUTERS, BLOOMBERG - Oil prices gave up some early gains on Wednesday as analysts warned of a downward correction, but remained well supported on the back of tightening supply and strong global demand.

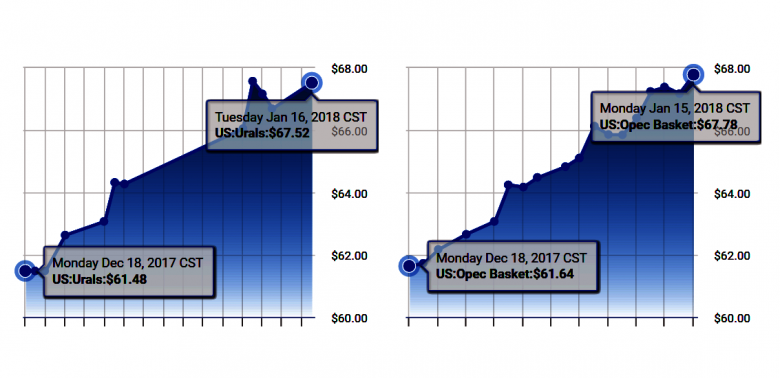

Tighter fundamentals have lifted both crude futures benchmarks about 13 percent above levels in early December, helped by production curbs by OPEC and Russia, as well as by healthy demand growth.

Brent crude futures LCOc1 were at $69.23 a barrel at 0808 GMT, up 8 cents from their last close, but down from a high of $69.37 earlier in the day. Brent on Monday rose to $70.37 a barrel, its highest since December 2014, the start of a three-year oil price slump.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $63.84 a barrel, down from a high of $63.89 earlier, but up 11 cents from their last settlement. WTI hit $64.89 on Tuesday, also the highest since December 2014.

Norbert Ruecker, head of commodity research at Swiss bank Julius Baer, said a price "correction should occur... (as) hedge fund expectations for further rising prices have reached excessive levels."

He said this was especially the case as political risk factors that have helped boost Brent, including tensions in Qatar, and the Kurdish region of Iraq and in Iran have so far not caused significant supply disruptions.

Money managers have raised the bullish positions in WTI and Brent crude futures and options to a record, according to data from the U.S. Commodity Futures Trading Commission and the Intercontinental Exchange.

BMI Research said "seasonally high refining run rates" from the northern hemisphere winter season "are set to fall substantially" as the end of winter approaches.

Brent spot crude futures contracts have already moved out of winter, now trading for March delivery.

"This will act as a substantial drag on global crude demand in Q1 and feeds into our bearish short-term outlook on Brent," BMI said.

Still, traders and analysts said overall oil markets were well supported, and steep price falls unlikely.

The Organization of the Petroleum Exporting Countries (OPEC) and Russia have been withholding production since January last year and the cuts are set to last through 2018.

This restraint has coincided with healthy oil demand.

"Oil remains underpinned by the solid economy with strong oil demand tightening global oil inventories. The past years' surplus supplies are slowly disappearing," Ruecker said.

One factor that in 2017 prevented crude prices from rising further was a surge in U.S. production.

Despite a recent drop due to extreme cold, U.S. crude output is expected to soon break through 10 million barrels per day (bpd), challenging top producers Russia and Saudi Arabia.

-----

Earlier:

2018, January, 15, 10:25:00

OIL PRICES: NOT ABOVE $70 AGAINREUTERS - Brent crude futures LCOc1, the international benchmark for oil prices, were at $70 per barrel at 0558 GMT, up 13 cents from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $64.53 a barrel, up 23 cents.

|

2018, January, 15, 09:50:00

OIL PRICES & IRAN SANCTIONSPLATTS - On Thursday, US Secretary of State Rex Tillerson told reporters that Trump would likely announce the decision in the afternoon in Washington. If that deal unravels, 800,000 b/d of Iranian crude exports would be at risk, according to analysts.

|

2018, January, 12, 13:05:00

OIL PRICES: NOT ABOVE $70REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $63.34 a barrel at 0755 GMT, down 46 cents, or 0.7 percent, from their last settlement. WTI the day before rose to its strongest since late 2014 at $64.77. Brent crude futures LCOc1 were at $68.97 a barrel, down 29 cents, or 0.4 percent, from their last close. Brent also marked a December-2014 high the previous day, at $70.05 a barrel.

|

2018, January, 10, 13:05:00

OIL PRICES: $60 - $61EIA - Brent crude oil prices averaged $54/b in 2017 and are forecast to average $60/b in 2018 and $61/b in 2019. West Texas Intermediate (WTI) crude oil spot prices are forecast to average $4/b less than Brent prices in both 2018 and 2019. EIA’s forecast for the average WTI price for December 2018 of $58/b should be considered in the context of NYMEX contract values for December 2018 delivery. NYMEX contract values traded during the five-day period ending January 4 suggest that a range of $40/b to $85/b encompasses the market expectation for WTI prices in December 2018 at the 95% confidence level.

|

2018, January, 4, 12:30:00

OIL PRICES: ABOVE $68REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $62.16 a barrel at 0752 GMT, up 53 cents, or 0.9 percent, from their last close. They touched $62.21 shortly before, their highest level since May 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $68.23 a barrel, up 39 cents, or 0.9 percent, after revisiting a May 2015 high of $68.27 shortly before.

|

2018, January, 3, 16:05:00

OIL PRICES: ABOVE $66 YETREUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.50 a barrel at 1017 GMT, up 13 cents from their last close, though still not far off the $60.74 reached on the previous day that was the highest since June 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $66.74 a barrel, up 17 cents but still trailing Tuesday’s high of $67.29 that was the most since May 2015.

|

2017, December, 29, 11:45:00

OIL PRICES: ABOVE $66 AGAINREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $60.30 a barrel at 0504 GMT, up 46 cents or 0.8 percent from their last close, the highest since June 2015. Brent crude futures - the international benchmark - were also up, rising 45 cents or 0.7 percent to $66.61 a barrel. Brent broke through $67 earlier this week for the first time since May 2015. |