EQUINOR ACQURIES 40%

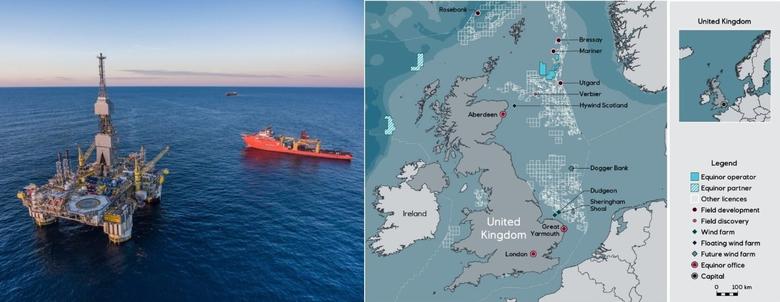

EQUINOR - Equinor has signed an agreement to acquire Chevron's 40% operated interest in the Rosebank project, one of the largest undeveloped fields on the UK Continental Shelf (UKCS). Once concluded, the transaction will strengthen Equinor's UK portfolio, which includes the Mariner development, attractive exploration opportunities and three producing offshore wind farms.

"We look forward to becoming the operator of the Rosebank project. We have a proven track record of high value field developments across the North Sea and will now be able to deploy this experience on a new project in the UK. Today's agreement allows us to buy back into an asset in which we previously had a participating interest, demonstrating our strategy of creating value through oil price cycles. The acquisition of Rosebank complements our portfolio of oil, gas and wind assets in this country, in line with our strategy as a broad energy company. This new investment underlines Equinor's commitment to be a reliable, secure energy partner for the UK," says Al Cook, Equinor's executive vice president for global strategy & business development and UK country manager.

The Rosebank field was discovered in 2004 and lies about 130 km northwest of the Shetland Islands in water depths of approximately 1,110m. The other partners in the field are Suncor Energy (40%) and Siccar Point Energy (20%).

"With Rosebank, a standalone development in the underexplored West of Shetland region, we strengthen our upstream portfolio, which also includes Mariner, one of the largest investments on the UKCS in over a decade. As we have done with other projects in our portfolio, such as Johan Castberg and Bay du Nord, we intend to leverage our experience and competence to create further value in Rosebank, in alignment with the UK Government's priority of maximising the economic recovery of the UKCS," says Hedda Felin, Equinor's senior vice president for UK & Ireland offshore.

The transaction is subject to customary conditions, including partner and authority approval, with completion targeted as soon as possible.

The parties have agreed not to disclose the commercial terms of the agreement.

-----

Earlier:

2018, June, 8, 13:15:00

OIL DEMAND UP TO 2030PLATTS - Global oil demand will peak around 2030 at 111 million b/d as a sharp rise in electric vehicles and energy efficiency gains offset growing demand from the aviation and petrochemical sectors, Norwegian producer Equinor said |

2018, April, 30, 09:45:00

STATOIL NET INCOME $1.3 BLNSTATOIL - Statoil reports adjusted earnings of USD 4.4 billion and USD 1.5 billion after tax in the first quarter of 2018. IFRS net operating income was USD 5.0 billion and the IFRS net income was USD 1.3 billion.

|

2018, April, 4, 09:05:00

STATOIL CONTRACTS: NOK 12 BLNSTATOIL - Statoil has awarded drilling contracts to Archer, KCA Deutag and Odfjell Drilling for drilling, completion, intervention services, plugging, maintenance and modifications on 18 of Statoil’s fixed platforms.

|

2018, January, 3, 15:35:00

NORWAY'S OIL PROBLEMSBLOOMBERG - Norway’s oil production has been halved since a 2000 peak. While natural-gas output has surged, total production is forecast to fall again in the middle of the next decade. A flurry of investment decisions at the end of last year hides a painful truth: after Statoil’s $6 billion Johan Castberg oil field starts production in the Barents in 2022, the project pipeline is scant. |

2017, November, 7, 12:10:00

BP, SHELL, STATOIL COOPERATIONEnergy majors BP, Shell and Statoil are to co-develop a blockchain-based digital platform for energy trading.

|

2017, October, 6, 12:40:00

STATOIL'S RENEWABLE INVESTMENT"Brazil is a core area for Statoil where our ambition is to deliver safe and sustainable growth in a significant energy market. Entering into solar in Brazil adds to the positions we have already in the producing Peregrino oil field and in the offshore licenses BM-S-8 and BM-C-33 which include the yet to be developed discoveries Carcará and Pão de Açúcar respectively. We are excited to have entered our first solar project with an experienced partner like Scatec Solar," says Irene Rummelhoff, Executive Vice President of New Energy Solutions in Statoil. |

2017, July, 28, 09:40:00

STATOIL NET INCOME $1.4 BLN“Our solid financial results and strong cash flow are driven by good operational performance with high production efficiency and continued cost improvements. At oil prices around 50 dollars per barrel, we have generated 4 billion dollars in free cash flow, and reduced our net debt ratio by 8.1 percentage points since the start of the year. We expect to deliver around 5% production growth this year, and at the same time realise an additional one billion dollars in efficiencies,” says Eldar Sætre, President and CEO of Statoil ASA. |