KAZAKHSTAN'S GAS FOR CHINA

NIKKEI ASIAN REVIEW - Annual gas exports from Kazakhstan to China are set to double in 2019, as Beijing moves to cushion the impact of its trade war with the U.S.

Kazakhstan is expected to send 10 billion cu. meters of gas China's way next year, up from 5 billion cu. meters, based on an agreement KazTransGas and PetroChina International signed on Oct. 12.

Beijing is seeking alternatives now that liquefied natural gas has been caught up in the tit-for-tat tariff battle with Washington. It also wants a buffer against geopolitical instability on sea routes in Southeast Asia, which could threaten supplies of Middle Eastern LNG.

The five-year deal became possible after three high-tech compressor stations were built on the 1,454 km Beyneu-Bozoy-Shymkent gas pipeline from western to southern Kazakhstan, increasing its capacity by 5 billion cu. meters a year to 15 billion cu. meters. The pipeline links up to the 1,833 km Central Asia-China gas pipeline, which sends gas from Turkmenistan and Uzbekistan to China via Shymkent in Kazakhstan.

According to KazTransGas figures, gas sent through the Central Asia-China pipeline increased 13% last year, to 38.7 billion cu. meters. The pipeline is capable of handling 55 billion cu. meters.

"We are fully meeting the domestic demand for gas [in Kazakhstan's south] and are simultaneously able to increase gas exports to foreign markets," said Kayrat Sharipbayev, chairman of the board of directors of KazTransGas. "Rough calculations show that the increase in gas exports to 10 billion cu. meters a year to China alone will earn the country over $2 billion in hard currency."

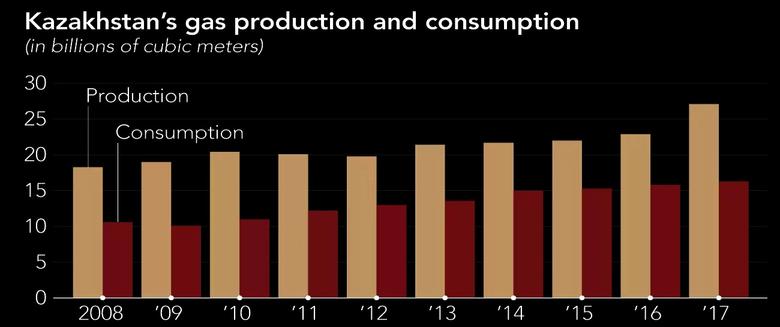

Ruslan Izimov, head of the China and Asian research program at the state-run Institute of World Economics and Politics in Astana, also said Kazakhstan produces sufficient volumes of natural gas to increase exports to China. Official figures show the country increased its natural gas output by 7% to 22.9 billion cu. meters and concomitant gas output by 20% to 30 billion cu. meters in 2017.

According to the BP Statistical Review of World Energy 2018, Kazakhstan increased gas production by 19% to 27.1 billion cu. meters in 2017, while the country's gas consumption increased only 3% to 16.3 billion cu. meters.

"The previous volumes of Kazakhstan's gas exports to China were conditioned not by the lack of sufficient volumes but the limited capacity of its pipelines," Izimov said.

When the construction of the Central Asia-China gas pipeline started in 2009, Kazakhstan's main priority was to supply its own gas produced in the west to populous southern regions, which depended on Uzbek imports. At the same time, it aimed to turn itself into a transit hub and seize the chance to export gas to China, explained Sergey Smirnov, an Almaty-based independent oil and gas expert.

Kazakhstan's growing supply capabilities raise questions about the future of a gas swap agreement with Uzbekistan, whereby Uzbekistan supplies about 3.5 billion cu. meters of gas to southern Kazakhstan while receiving the same amount on the Kazakh-Russian border to sell to Russia -- saving the cost of moving the gas via western Kazakhstan.

Experts suggest the neighbors may continue with this deal, since it still suits Kazakhstan's interests. They say it would be infeasible for Kazakhstan to sell gas to Russia at low prices, or export it to Europe via Russia, which is determined to guard its own interests in the European market.

"It is a far too great distance to sell Kazakh gas to Europe, so transport costs are very high," Smirnov said. "Whereas China is next door and it has a huge market that can hoover up everything on offer."

The increase in the capacity of the Beyneu-Bozoy-Shymkent pipeline has also made it possible to consider building a 1,100 km link to the Kazakh capital of Astana, via the industrial centers of Zhezkazgan and Karaganda in the center of the country.

Kazakhstan plans to pump 1.5 billion cu. meters of gas a year into the new pipeline to Astana from 2020, and 3.6 billion cu. meters a year from 2030, when the pipeline will be extended further to cover the northern cities of Kokshetau and Petropavl.

Turkmenistan, meanwhile, supplied 31.7 billion cu. meters of gas to China in 2017, according to BP, while Uzbekistan exported 3.4 billion cu. meters. Given a decrease in Turkmen gas output last year to 62 billion cu. meters, from 72.8 billion in 2015, and a relatively small decline in consumption to 28.4 billion cu. meters, Smirnov said it may take time for the Central Asia-China pipeline to reach full capacity.

Despite the falling output, in a bid to diversify its export markets, Turkmenistan is pressing ahead with the construction of a Turkmenistan-Afghanistan-Pakistan-India, or TAPI, pipeline. Beijing has shown interest in extending it further to China.

"Obviously, Beijing is interested in increasing energy imports from Turkmenistan and other countries in the region, especially when tension is growing along sea lines," Izimov said, referring to the military standoff between China and the U.S. over the South China Sea.

"Another matter is how far Turkmenistan is interested in increasing exports to China," the analyst said, since it already relies on the Chinese market.

Turkmenistan stopped exporting gas to Russia in 2016 and to Iran in 2017. Despite vast gas reserves and at least five potential export routes -- to Russia, Iran, TAPI and to Europe across the Caspian Sea, as well as China -- Izimov said Turkmenistan "is only using one route to China."

-----

Earlier:

2018, August, 31, 11:00:00

KASHAGAN OIL PRODUCTION: 470 TBDPLATTS - Oil production at Kazakhstan's giant Kashagan field could be as high as 470,000 b/d under its first development phase, the head of the consortium overseeing the field, Brune Jardin, has said, while also noting plans for a big maintenance shutdown, and for development of nearby fields with China's CMOC.

|

2015, November, 5, 19:05:00

KASHAGAN WILL RESTARTKazakhstan's vast Kashagan oil field, the world's biggest oil find in decades, is expected to restart production at the end of 2016, Exxon Mobil Production Vice President John Chaplin said.

|

2015, August, 2, 18:00:00

KAZAKHSTAN SELLS KMGThe transaction is ostensibly intended to help energy company KazMunayGaz (KMG) reduce its $20 billion debt portfolio, which has been exacerbated by low oil prices.

|

2014, December, 14, 02:30:00

CHINA & KAZAKHSTAN AGREE: $10 BLNChina, Kazakhstan to sign $10 billion in deals including oil, infrastructure

|

2014, October, 8, 20:45:00

BIG RESERVES OF KAZAKHSTANInvestors flocked to Kazakhstan’s first dollar-denominated bond in more than a decade, the first sovereign bond deal to include terms created in response to Argentina’s acrimonious default.

|

2014, June, 13, 21:10:00

KAZAKHSTAN: $50 B PROJECTKazakhstan to extend contract for $50bn Kashagan oil project |