NORWAY'S GAS FOR BRITAIN

PLATTS - Norwegian natural gas exports to the UK jumped to their highest in six months Wednesday as consistently high UK prices incentivized flows normally only reserved for wintry periods.

Supply through the Langeled pipeline, which makes landfall at the UK's Easington terminal, has sustained maximum throughput since reaching its technical capacity of 73 million cu m/d on Tuesday, while the Vesterled pipeline supply to St. Fergus jumped 15 million cu m/d to 27 million cu m/d.

This re-direction of Norwegian production culminated in aggregate supply to the UK reaching 121.5 million cu m/d by 1200 GMT on Wednesday.

Should these rates be sustained for the whole gas day, the Norwegian Continental Shelf would have delivered a daily quantity of gas tantamount to what the UK would normally receive from the NCS during meteorological winter periods.

The last time the UK imported from the NCS at such a rate was in mid-March, as unseasonably cold temperatures gripped the country following the so-called "Beast from the East" weather system.

Flows through the SEGAL pipeline, which delivers only to St Fergus Shell and separate from the main Gassco dry gas network, could also have been maximized were it not for maintenance on the Gjoa and Vega fields supplying SEGAL, which began on Wednesday is set to reduce availability by 12 million cu m/d. The work is set to continue until 1700 GMT on Thursday, at a cost of 6 million cu m/d for Thursday's gas day.

As a result of the increased in imports, the S&P Global Platts intraday assessment for within-day NBP gas tumbled by 3.85 p to 63.45 p/th.

SEA CHANGE

The timing of these imports represents another symptom of the changing UK gas dynamic since the long-term capacity contracts on the bi-directional gas interconnector between the UK and Belgium expired, leading to a cessation of consistent imports through this transit and higher LNG regasification from the UK's three terminals.

With Continental Europe currently not supplying a baseload, and following the closure of the UK's long-range seasonal storage site Rough, North Sea production has become critical in maintaining consistency of supply.

As the UK's Theddlethorpe terminal closed in August, the Barrow terminal remains short of full operational capability and current UK Continental Shelf production approximately only 30 million cu m short of multi-year production highs, the UK's winter import dependence is increasingly coming into sharp focus.

Despite the UK only being two weeks into the gas winter, its requirement for gas has already been reflected in day-ahead and month-ahead pricing, which in turn has been responded to by Norwegian offshore producers attracted to consistently high UK premiums to other mainland European destinations.

By market close on Tuesday, the NBP held a 1.083 p/th day-ahead premium to the Dutch TTF hub, and a 2.30 p/th day ahead spread with the Belgian Zeebrugge physical trading hub. The equivalent month ahead spreads came to 3.125 p/th and 2.90 p/th respectively, with NBP pricing evidently decoupling from Europe as October began.

-----

Earlier:

2018, September, 26, 09:05:00

TOTAL: GAS FOR BRITAINOGJ - Total SA made a natural gas discovery on the Glendronach prospect offshore UK West of Shetland that it believes can be commercialized quickly and at low cost by leveraging the existing Laggan-Tormore infrastructure. |

2018, September, 19, 13:10:00

IMF: BRITAIN'S ECONOMIC CHALLENGESIMF - Beyond Brexit, the UK faces a range of other economic challenges. These include persistently lackluster productivity growth, large public debt, and the wide current account deficit. The UK’s sound macroeconomic framework, regulatory environment, and deep capital and flexible labor markets will be advantages in implementing reforms to address them. |

2018, March, 16, 10:10:00

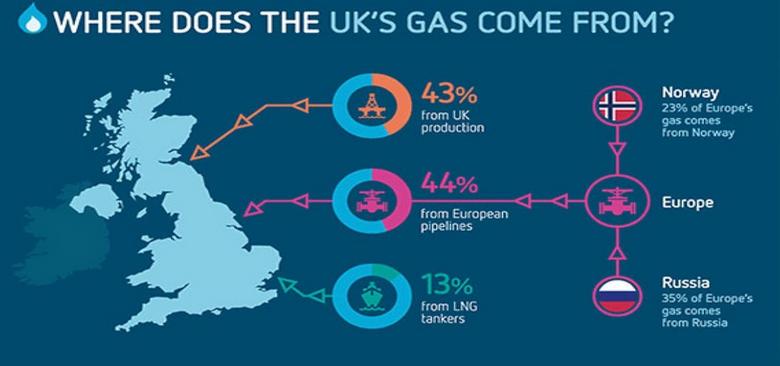

RUSSIAN GAS FOR BRITAIN ANEWBLOOMBERG - While Europe as a whole gets more than a third of its gas from Russia, that share is lower in the U.K., which receives the bulk of its fuel from North Sea fields and Norway. Still, Moscow-based Gazprom PJSC was the second-biggest supplier to major industrial consumers in the U.K. last year, according to Britain’s energy regulator Ofgem. |

2018, March, 16, 10:05:00

RUSSIAN GAS FOR BRITAIN AGAINFT - of the six LNG tankers that have made deliveries into the UK so far in 2018 three have carried cargoes originally from Russia, leading to questions about whether Moscow was gaining a foothold in the UK gas market after starting up the Yamal LNG facility in Siberia late last year. |

2018, March, 16, 10:00:00

RUSSIAN GAS FOR BRITAIN OVERREUTERS - So far this year, two Yamal cargoes unloaded at British terminals for domestic consumption, accounting for about a third of Britain’s 2018 LNG imports after typical supplier Qatar pre-sold the bulk of its winter output to Asia last year. |

2018, March, 14, 11:30:00

RUSSIAN GAS FOR BRITAINPLATTS - The Russia-UK poisoning row threatens to put renewed strain on the two countries' deep-seated energy ties, illustrated by some of the first ever LNG shipments from Russia's vast new Yamal LNG facility now arriving in the UK. |

2017, December, 25, 20:05:00

BRITAIN'S GAS DOWN 50%PLATTS - The amount of gas held within the UK's medium-range natural gas storage facilities has fallen by more than 50% since the end of November on the back of high demand allied to weaker UK gas production. |