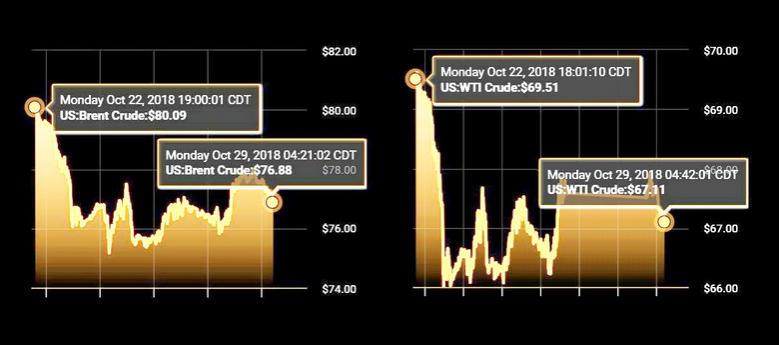

OIL PRICE: NEAR $77

REUTERS - Oil prices dipped on Monday amid cautious sentiment as a plunge in financial markets last week and dollar strength early this week underscored concerns that growth may be slowing, especially in Asia's emerging economies.

Front-month Brent crude oil futures LCOc1 were trading down 46 cents, or 0.6 percent, at $77.16 a barrel at 0745 GMT.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $67.19 a barrel, down 40 cents, or 0.6 percent.

Investors remained wary after hefty losses last week, while a stronger dollar on safe-haven buying puts pressure on the purchasing power of emerging markets.

"The bears seem well in control of the market and there are many reasons to justify their actions," said Hussein Sayed, chief market strategist at futures brokerage FXTM.

He pointed to "weakening global economic growth, the ongoing U.S.-China trade war, monetary policy tightening, fears of a hard Brexit (and) Italy's budget woes" as main reasons for the selloffs.

Singapore-based ship tanker brokerage Eastport said financial market turmoil may "weigh on investment and consumer spending, reducing trade flows and ultimately hitting demand".

Hedge funds slashed their bullish wagers on U.S. crude in the latest week to the lowest level in more than a year, the U.S. Commodity Futures Trading Commission said on Friday.

The speculator group cut its combined futures and options position in New York and London by 42,644 contracts to 216,733 in the week to Oct. 23, the lowest level since September 2017.

There were also signs of a slowdown in global trade, with rates for dry-bulk and container ships - which carry most raw materials and manufactured goods - coming under pressure.

On the supply side, however, oil markets remain tense ahead of looming U.S. sanctions against Iran's crude exports, which are set to start next week and are expected to tighten supply, especially to Asia which takes most of Iran's shipments.

Hoping to keep some exports up, Iran has started selling crude to private companies via a domestic exchange for the first time, he oil ministry's news website SHANA reported on Sunday.

The tight market in Asia is visible in the low amount of unsold crude oil stored on tankers on waters around Singapore and southern Malaysia, the region's main oil trading and storage hub.

Just four stationary supertankers are currently filled with crude oil, according to Refinitiv Eikon ship tracking data.

That's down from around 15 a year ago, and from 40 in mid-2016 during the peak of the supply glut.

In North America, however, there is no oil shortage as U.S. crude oil production C-OUT-T-EIA has increased by almost a third since mid-2016 to around 11 million barrels per day.

Production is set to rise further. U.S. drillers added two oil rigs in the week to Oct. 26, bringing the total count to 875, the highest level since March 2015, Baker Hughes energy services firm said on Friday.

More than half of all U.S. oil rigs are in the Permian basin in West Texas and eastern New Mexico, the country's biggest shale oil formation.

-----

Earlier:

2018, October, 26, 13:00:00

OIL PRICE: NOT ABOVE $77REUTERS - Brent crude oil LCOc1 was down 70 cents at $76.19 per barrel by 0740 GMT, on course for a weekly loss of more than 4 percent. It has fallen by close to $10 in the last three weeks. U.S. crude CLc1 was 70 cents lower at $66.63, set for a 3.5 percent loss this week.

|

2018, October, 24, 11:40:00

OIL PRICE: NEAR $76REUTERS - Front-month Brent crude oil futures LCOc1 were at $76.52 a barrel at 0658 GMT, up 1 cent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were weaker, down 10 cents at $66.33 a barrel, pressured by a report by the American Petroleum Institute (API) that U.S. crude stocks rose by 9.9 million barrels in the week to Oct. 19 to 418.4 million barrels. |

2018, October, 24, 11:35:00

NO OIL EMBARGOTASS - Saudi Arabia is a very responsible country, for decades we used our oil policy as responsible economic tool and isolated it from politics. So lets hope that the world would deal with the political crisis, including the one with Saudi citizen in Turkey, with wisdom. And we will exercise our wisdom both in political and economic fronts. |

2018, October, 22, 12:25:00

OIL PRICE: NEAR $80 AGAINREUTERS - Benchmark Brent crude oil futures LCOc1 were at $80.26 a barrel at 0646 GMT, up 48 cents, or 0.6 percent, above their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $69.60 a barrel, up 48 cents, or 0.7 percent. |

2018, October, 22, 12:00:00

IRAN'S OIL SELLINGSHANA - First Vice President Eshaq Jahangiri said the country had plans for ensuring continuation of its oil sales under fresh US sanctions.

|

2018, October, 19, 11:25:00

OIL PRICE: NOT ABOVE $80REUTERS - Benchmark Brent crude oil LCOc1 was up 20 cents a barrel at $79.49 by 0740 GMT. U.S. light crude CLc1 was 15 cents higher at $68.80.

|

2018, October, 17, 10:35:00

OIL PRICE: ABOVE $81 ANEWREUTERS - U.S. West Texas Intermediate crude CLc1 was up 25 cents, or 0.4 percent, at $72.17 a barrel by 0648 GMT on Wednesday, having settled up 14 cents. Brent crude LCOc1 was up 26 cents, or 0.3 percent, at $81.67 a barrel, after settling up 63 cents the session before. |