OIL PRICE: NEAR $86

REUTERS - Oil held near four-year highs on Thursday, supported by the imminent loss of Iranian supply through U.S. sanctions, but also tempered by the prospect of a rapid production boost from Saudi Arabia and Russia.

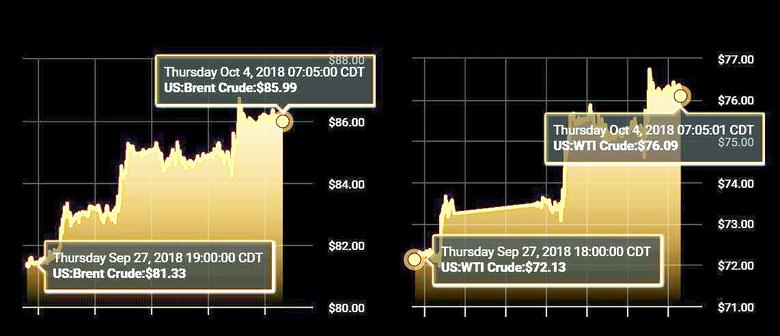

Brent crude oil futures LCOc1 were down 19 cents at $86.10 a barrel by 1133 GMT, having risen to a late 2014 high of $86.74 the day before. U.S. crude futures CLc1 fell 17 cents on the day to $76.24.

"Prices will probably rise further into overshoot territory. Once we see $90 I would expect decisive supply reaction," Commerzbank strategist Carsten Fritsch told the Reuters Global Oil Forum.

"Major economies won't let oil prices rise to triple digits and harm economic growth."

Nitin Gadkari, India's transport minister, said his country faced "economic crisis" due to its huge oil imports, two local TV channels reported.

India imports more than 4 million barrels per day (bpd) of oil and is one of the biggest buyers of Iranian crude, along with China, and has been hurt by a slide in the rupee against the dollar.

Saudi Energy Minister Khalid al-Falih said OPEC was able to raise output by 1.3 million bpd, but offered no signal that the producer group would do so.

Not all members of the Organization of the Petroleum Exporting Countries have the scope to raise output enough to offset any supply losses stemming from U.S. sanctions on Iran.

Russia and Saudi Arabia struck a private deal in September to raise oil output, Reuters reported on Wednesday, before consulting with other producers including the rest of OPEC.

The impact of oil prices at their highest in four years, together with dollar strength, is starting to show on demand.

"We have been taking a very close look at the demand signals in the market, and what we have been seeing is not good," JBC Energy said on Wednesday in a note to clients.

The consultancy lowered its oil demand forecast amid diving currencies in many emerging markets, as well as burgeoning product stocks and the China-U.S. trade dispute.

"We have cut our forecast for 2018 demand growth by a whopping 300,000 bpd to below 1.1 million bpd," it said.

Meanwhile, U.S. crude stocks rose by nearly 8 million barrels last week, the biggest increase since March 2017, Energy Information Administration data showed.

U.S. crude production remained at a record high of 11.1 million bpd.

-----

Earlier:

2018, October, 3, 09:10:00

OIL PRICE: NEAR $85REUTERS - Brent crude oil futures LCOc1 were at $84.86 per barrel at 0340 GMT, up 6 cents from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up just 1 cent at $75.24 a barrel.

|

2018, October, 3, 09:00:00

ЦЕНА URALS: $70.61МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – сентября 2018 года составила $ 70,61 за баррель. В 2017 году средняя цена на Urals в январе – сентябре составила $ 50,55 за баррель. Средняя цена на нефть марки Urals в сентябре 2018 года сложилась в размере $ 78,06 за баррель, что в 1,4 раза выше, чем в сентябре 2017 года ($54,24 за баррель). |

2018, October, 3, 08:55:00

PRICE COULD BE $100CNBC - International benchmark Brent crude traded at around $81.87 on Thursday, up around 0.65 percent, while U.S. West Texas Intermediate (WTI) stood at $72.32, more than 1 percent higher.

|

2018, October, 1, 11:45:00

OIL PRICE: NEAR $83REUTERS - Benchmark Brent crude oil futures LCOc1 rose to as much as $83.32 a barrel on Wednesday and were at $83.09 at 0335 GMT, still 36 cents, or 0.4 percent above their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 19 cents, or 0.3 percent, at $73.44 a barrel.

|

2018, September, 28, 10:15:00

OIL PRICE: NEAR $82 YETREUTERS - The most-active Brent crude futures contract, for December,LCOZ8 was up 15 cents, or 0.2 percent, at $81.53 per barrel at 0548 GMT. U.S West Texas Intermediate (WTI) futures CLc1 were up 19 cents, or 0.3 percent, at $72.32 per barrel. It is set to gain rose 3.6 percent this month, the biggest increase since June. |

2018, September, 26, 09:50:00

OIL PRICE: NEAR $82REUTERS - Brent crude futures were down 4 cents at $81.83 a barrel by 0342 GMT, after gaining nearly 1 percent the previous session. Brent rose on Tuesday to its highest since November 2014 at $82.55 per barrel. U.S. crude futures were down 13 cents, or 0.2 percent, at $72.15 a barrel. They rose 0.3 percent on Tuesday to close at their highest level since July 11. |

2018, September, 26, 09:15:00

IRANIAN OIL EXPORTS DOWNREUTERS - Exports of crude oil and condensates have declined by 0.8 million barrels a day (mbd) from April to September 2018, the IIF, which represents major banks and financial institutions from around the world, said.

|

2018, September, 24, 15:35:00

OIL PRICE: NEAR $80REUTERS - Benchmark Brent crude LCOc1 hit its highest since November 2014 at $80.94 per barrel, up $2.14 or 2.7 percent, before easing to around $80.75 by 1150 GMT. U.S. light crude CLc1 was $1.25 higher at $72.03.

|

2018, September, 24, 15:30:00

BALANCED OIL MARKETOPEC - The JMMC noted that, despite growing uncertainties surrounding market fundamentals, including the economy, demand and supply, the participating producing countries of the DoC continue to seek a balanced and sustainably stable global oil market, serving the interests of consumers, producers, the industry and the global economy at large. The Committee also expressed its satisfaction regarding the current oil market outlook, with an overall healthy balance between supply and demand. |

2018, September, 24, 15:25:00

СОТРУДНИЧЕСТВО РОССИИ И САУДОВСКОЙ АРАВИИМИНЭНЕРГО РОССИИ - «Благодаря нашей с Вами работе, прежде всего по линии ОПЕК+, отношения между нашими странами значительно укрепились. Видим постоянно растущую заинтересованность российских компаний в налаживании более тесных связей с саудовскими партнерами. Это особенно важно в свете той ответственной роли, которую наши страны играют на региональной и международной арене, особенно в сфере энергетики», - сказал глава энергетического ведомства. |