OIL PRICES 2018 - 19: $74 - $75

EIA - SHORT-TERM ENERGY OUTLOOK

Global liquid fuels

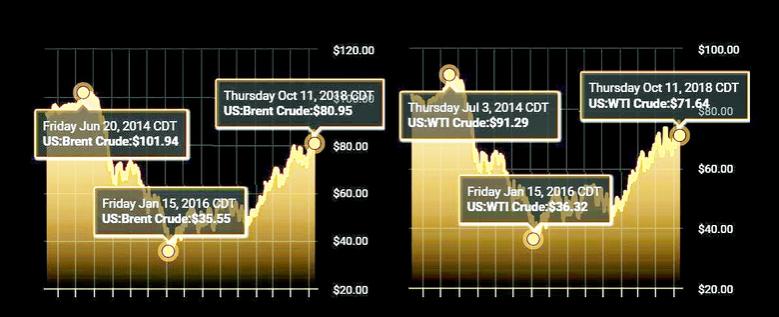

Brent crude oil spot prices averaged $79 per barrel (b) in September, up $6/b from August. EIA expects Brent spot prices will average $74/b in 2018 and $75/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for January 2019 delivery that traded during the five-day period ending October 4, 2018, suggest a range of $60/b to $93/b encompasses the market expectation for January WTI prices at the 95% confidence level.

EIA estimates that U.S. crude oil production averaged 11.1 million barrels per day (b/d) in September, up slightly from August levels. EIA forecasts that U.S. crude oil production will average 10.7 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 11.8 million b/d in 2019.

Natural Gas

EIA estimates dry natural gas production in the United States averaged 85.1 billion cubic feet per day (Bcf/d) in September, up 0.6 Bcf/d from August. EIA forecasts that dry natural gas production will average 82.7 Bcf/d in 2018, up by 7.9 Bcf/d from 2017 and establishing a new record high. EIA expects natural gas production will continue to rise in 2019 to an average of 87.7 Bcf/d.

EIA forecasts that U.S. natural gas storage inventories will total 3.3 trillion cubic feet (Tcf) at the end of October. This level would be 14% lower than both the 2017 end-of-October level and the five-year (2013–17) average for the end of October, and it would also mark the lowest level for that time of year since 2005.

EIA expects Henry Hub natural gas spot prices to average $2.99/million British thermal units (MMBtu) in 2018 and $3.12/MMBtu in 2019. NYMEX futures and options contract values for January 2019 delivery that traded during the five-day period ending October 4, 2018, suggest a range of $2.22/MMBtu to $4.85/MMBtu encompasses the market expectation for January Henry Hub natural gas prices at the 95% confidence level.

Elecriticty, coal, renewables, and emissions

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 32% in 2017 to 35% in both 2018 and 2019. EIA's forecast electricity generation share from coal averages 28% in 2018 and 27% in 2019, down from 30% in 2017. The nuclear share of generation was 20% in 2017 and EIA forecasts that it will be slightly below 20% in 2018 and in 2019. Wind, solar, and other nonhydropower renewables provided slightly less than 10% of electricity generation in 2017, and EIA expects them to provide more than 10% in 2018 and nearly 11% in 2019. The generation share of hydropower was 7% in 2017 and EIA forecasts that it will be about the same in 2018 and 2019.

In 2017, EIA estimates that U.S. wind generation averaged 697,000 megawatthours per day (MWh/d). EIA forecasts that wind generation will rise by 8% to 750,000 MWh/d in 2018 and by a further 6% to 793,000 MWh/d in 2019.

Solar power generates less electricity in the United States than wind power but continues to grow at a faster rate. EIA expects solar generation will rise from 211,000 MWh/d in 2017 to 267,000 MWh/d in 2018 (an increase of 26%) and to 305,000 MWh/d in 2019 (an increase of 14%).

EIA forecasts U.S. coal production will decline by 2% to 756 MMst in 2018, despite a 12% (11 MMst) increase in coal exports. The production decrease is largely attributable to a forecast decline of 4% (26 MMst) in domestic coal consumption in 2018. EIA expects coal production to decline by 2% (13 MMst) in 2019 because it forecasts that coal exports and coal consumption will decrease by 7% and 5%, respectively.

After declining by 0.8% in 2017, EIA forecasts that U.S. energy-related carbon dioxide (CO2) emissions will rise by 2.2% in 2018. This increase largely reflects higher natural gas consumption because of a colder winter and a warmer summer than in 2017. EIA expects emissions to decline by 1.1% in 2019, as forecast temperatures are forecast to return to normal. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

Prices

EIA forecasts that average U.S. household expenditures for most major home heating fuels will be higher this winter compared with last winter. Average increases vary by fuel; natural gas expenditures are forecast to rise by 5%, home heating oil by 20%, and electricity by 3%, while propane expenditures are forecast to remain similar to last year. Most of the increase reflects higher forecast energy prices. U.S. average heating degree days are expected to be 1% higher than last winter. However, realized expenditures are highly dependent on actual weather outcomes (Winter Fuels Outlook).

Brent crude oil spot prices averaged $79 per barrel (b) in September, up $6/b from August. EIA expects Brent spot prices will average $74/b in 2018 and $75/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for January 2019 delivery that traded during the five-day period ending October 4, 2018, suggest a range of $60/b to $93/b encompasses the market expectation for January WTI prices at the 95% confidence level.

EIA expects Henry Hub natural gas spot prices to average $2.99/million British thermal units (MMBtu) in 2018 and $3.12/MMBtu in 2019. NYMEX futures and options contract values for January 2019 delivery that traded during the five-day period ending October 4, 2018, suggest a range of $2.22/MMBtu to $4.85/MMBtu encompasses the market expectation for January Henry Hub natural gas prices at the 95% confidence level.

Full report is here.

-----

Earlier:

2018, October, 10, 08:25:00

OIL PRICE: NEAR $85 ANEWREUTERS - Brent crude LCOc1 futures were down 2 cents at $84.98 a barrel by 0049 GMT, after a 1.3 percent gain on Tuesday. US. West Texas Intermediate (WTI) crude CLc1 was down by 16 cents, or 0.2 percent, at $74.8 a barrel, after rising nearly 1 percent in the previous session. |

2018, October, 8, 11:20:00

СТАБИЛЬНАЯ ЦЕНА НЕФТИМИНЭНЕРГО РОССИИ - Министр отметил, что Россия выступает за то, чтобы Иран как крупнейшая страна-экспортер энергоресурсов оставался участником рынка. "Мы не приемлем односторонних санкций, которые не соответствуют решениям ООН. Безусловно, нужно с юридической точки зрения оценивать дальнейшие возможности и механизмы взаимодействия с Ираном, чтобы наши компании не понесли ущерба», - отметил Министр. |

2018, October, 5, 12:45:00

РОССИЯ: РАВНОВЕСИЕ НА РЫНКЕМИНЭНЕРГО РОССИИ - Говоря о динамике цен на энергоресурсы, Александр Новак подчеркнул, что главной задачей как для России, так и для других участников договоренностей о регулировании добычи нефти всегда было балансирование рынка, а не рост стоимости до определенных уровней. |

2018, October, 5, 12:40:00

РОССИЯ: +300 000 БАРРЕЛЕЙМИНЭНЕРГО РОССИИ - цифры были названы президентом РФ: мы в краткосрочном периоде можем увеличить еще на 200-300 тысяч баррелей, если при этом будет необходимость и целесообразность, потому что основная задача — баланс спроса и предложения, чтобы не нарушить равновесие на рынке, а наоборот его сохранить. |

2018, October, 4, 15:05:00

ВЗАИМОДЕЙСТВИЕ РОССИИ И ОПЕКМИНЭНЕРГО РОССИИ - Президент России отметил, что за последние годы у России и ОПЕК сложились плодотворные контакты и эффективное взаимодействие. "Мне кажется, что эта совместная работа пошла на пользу всем участникам рынка. Это касается и производителей, и потребителей энергоресурсов. Благодаря нашим совместным усилиям впервые все участники этих договоренностей практически стопроцентно выполняют все свои обязательства», - отметил Владимир Путин. |

2018, October, 4, 15:00:00

СОТРУДНИЧЕСТВО САУДОВСКОЙ АРАВИИ И РОССИИМИНЭНЕРГО РОССИИ - «Видим постоянно растущую заинтересованность российских компаний в налаживании более тесных связей с саудовскими партнерами. Это особенно важно в свете той ответственной роли, которую наши страны играют на региональной и международной арене, особенно в сфере энергетики», - сказал Александр Новак. |

2018, October, 4, 14:45:00

ЦЕНА НЕФТИ: $65 - $75МИНЭНЕРГО РОССИИ - «Сейчас рынок пытается достичь баланса цен, который будет отвечать как интересам производителей, так и потребителей. И этот уровень, вероятно, чуть ниже, чем тот, что мы видим сейчас. На основной панели Российской энергетической недели президент Владимир Путин говорил о диапазоне $65-75 за баррель, который, с одной стороны, приемлем для производителей и потребителей, с другой - время позволяет возвращать деньги в отрасль для ее стабильного дальнейшего развития», - пояснил Александр Новак. |