PEMEX NET INCOME 27 BLN PESOS

PEMEX - Pemex reported its financial and operating results for the third quarter of 2018, which confirm its solid performance throughout the year.

Upon comparing the results of this quarter with the same quarter for the previous year, the following items stand out: (i) total sales increased by 33%; (ii) operation yield recorded a significant improvement of 83% and currently at 54 billion pesos; and (iii) the company recorded a net income of 27 billion pesos, compared to losses of 102 billion pesos recorded the previous year.

Additionally, the company's EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) amounted to 161 billion pesos, an increase of 39% compared to the third quarter of 2017. This reaffirms the company's capability of cash flow generation.

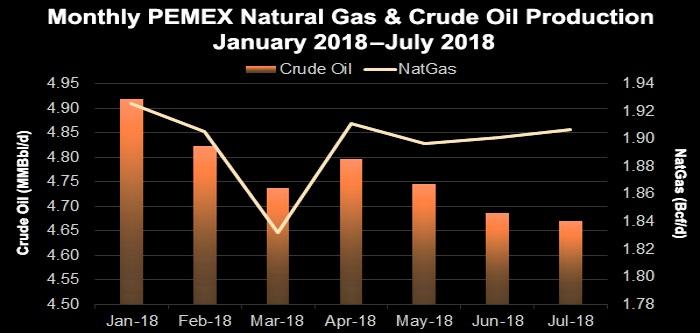

Total hydrocarbons production during this quarter averaged 2,536 Tbcoepd (thousands of barrels of crude oil equivalent per day), and crude liquid hydrocarbon production reached 1,850 Tbpd (thousands of barrels per day), of which 1,827 Tbpd are crude oil. PEMEX highlighted the growing production in its integrated field Ku-Maloob-Zaap, which increased by 53 Tbpd and represents an overall increase of 6% as compared to the third quarter of 2017.

Natural gas use was 96.8%, which is in line with the downward trend regarding gas flares, thus reaffirming PEMEX's commitment to environmental sustainability.

Regarding exploration activities and in compliance with the company's goal to increase recovery of oil reserves, PEMEX discovered two fields of light crude oil in the shallow waters of the Southeastern Basin, dubbed Manik and Mulach, which contain 3P reserves of 180 million barrels of crude oil equivalent, which could produce up to 210 thousand barrels of crude oil per day and 350 million cubic feet of gas per day. The great advantage of these projects is that the company already has established much of the necessary infrastructure nearby, and this can be used to accelerate production in these fields.

Regarding industrial transformation, the refineries of Salina Cruz and Cadereyta increased their crude oil processes by 94 Tbpd and 30 Tbpd, respectively. On the other hand, the variable refining margin continues to record positive values, because of the optimization of the crude oil process in these refineries, as well as due to the price increase in refined products.

In this open market setting, PEMEX's performance attests to its capacity of being a sustainable, competitive company that benefits its clients and the end users of its products, while maintaining its position as key player in the fuel supply of the country.

-----

Earlier:

2018, August, 1, 08:55:00

PEMEX NET LOSS MXN 163 BLNPEMEX - Pemex achieved total sales for 254 billion pesos in the second quarter of 2018, a figure 36% higher than the result obtained during the same quarter of the previous year. Operating yields were 120 billion pesos, a growth almost 37% greater than the second quarter of 2017. Operation, management, distribution and sales costs remained stable and aligned with the current austerity and expenditure policies.

|

2017, October, 30, 11:10:00

PEMEX PRODUCTION DOWN 18%Reuters - Mexican national oil company Pemex reported on Friday that September crude production fell 18 percent from the same month last year, marking three consecutive months with oil output coming in below 2 million barrels per day.

|

2016, November, 23, 18:35:00

IMF WANTS PEMEXA particularly important aspect of this consolidation pertains to reforms in PEMEX, the state-owned oil company. Earlier this month, PEMEX released a five-year business plan that aims at turning the company profitable by 2020, through efficiency improvements and a focus on high-return activities.

|

2016, November, 7, 18:40:00

MEXICO'S POTENTIAL: $415 BLNAfter a decade of volatile GDP growth and steadily increasing gas and power demand, Mexico continues to progress toward an unbundling of the monopolies Pemex and CFE once held over its gas and power sectors. According to a recent study by Wood Mackenzie, these reforms have created the potential for approximately US$415 billion in investment over the next two decades as the country builds pipelines, develops a renewables market to meet clean energy targets, and sets the stage for M&A.

|

2016, October, 4, 18:30:00

PEMEX DEBT UPThe two bonds, valued at USD 2 billion each and issued in a financial operation that started early in September, will carry maturities of seven and close to 31 years. They pay yields of 4.62% and 6.75%, respectively, according to Pemex CFO Juan Pablo Newman. Now with greater maturity, Pemex’s repurchased debt, which was due to mature in 2018 and 2019, has reduced the risks of the company’s debt portfolio.

|

2016, July, 29, 18:30:00

PEMEX NET LOSS $7.7 BLNMexican state oil company Petróleos Mexicanos on Thursday said it recorded an after-tax loss of $4.4 billion in the second quarter, as lower oil prices and output hit sales and hefty exchange losses boosted its financial costs.

|

2016, April, 5, 18:25:00

MEXICO'S RESERVES DOWN 21%Mexico's proven oil and gas reserves dropped 21.3 percent in 2015, the oil regulator said on Thursday, as the state-run oil company, Pemex, cut back on investment because of plunging crude prices. |