PRICE COULD BE $100

CNBC - President Donald Trump's sustained bid to sanction Iranian crude exports could trigger a dramatic shortfall in global supply, strategists told CNBC on Thursday, amid renewed worries oil prices could soon rally up to triple digits.

Earlier this week, Trump urged OPEC to ramp up production levels in order to prevent further price rises ahead of the mid-term elections in November.

But OPEC and non-OPEC producers were thought to be unlikely to immediately respond to Trump's demands, after Saudi Arabia and its allies decided against pressing for an official increase at a meeting in Algeria last week.

"The unwillingness of the 25 producing nations to declare their intention to ramp up production in their effort to replace Iranian barrels all of the sudden produced a very tight supply and demand balance for the fourth quarter of this year," Tamas Varga, senior analyst at PVM Oil Associates, said in a research note published Thursday.

"As a result, the talk is now (of) Brent reaching $100 a barrel this year," he added.

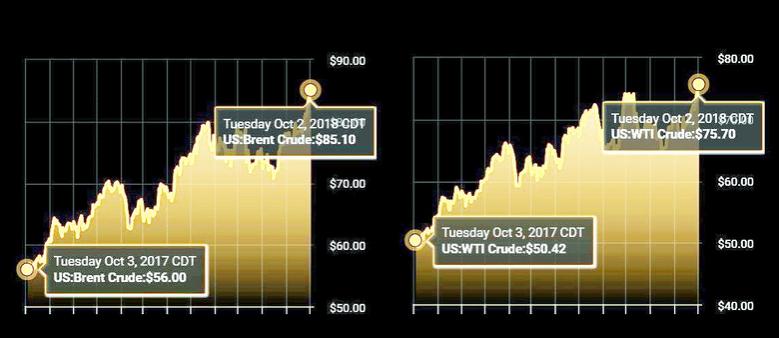

International benchmark Brent crude traded at around $81.87 on Thursday, up around 0.65 percent, while U.S. West Texas Intermediate (WTI) stood at $72.32, more than 1 percent higher.

OPEC seeks ways to 'mitigate losses'

The U.S. is scheduled to impose targeted crude sanctions against OPEC's third-largest oil producer in just five weeks' time. And the sanctions are widely expected to have an immediate impact on Iran's oil exports, although estimates of exactly how much of the country's oil could disappear from November 4 vary widely.

Some energy market analysts expect around 500,000 barrels per day (bpd) to disappear once U.S. sanctions against Iran come into force, while others have warned as much as 2 million bpd could come offline over the coming months.

At its 2018 peak earlier this summer, Iran exported around 2.7 million bpd of crude oil — that's the equivalent to almost 3 percent of daily global consumption.

Meanwhile, OPEC kingpin Saudi Arabia is thought to be prepared to quietly add extra oil to the market to offset a drop in Iranian crude production.

The Middle-East dominated oil cartel has little spare capacity to make up for any drop in Iran's crude exports, but sources confirmed to CNBC Thursday that Riyadh is now ready to put as much as 550,000 additional bpd onto the market.

This increased crude supply would be reliant on demand, OPEC insiders told CNBC, although if market demand is apparent, supply would grow accordingly.

"The lack of spare capacity will be the dominant market narrative over the coming months as OPEC seeks ways to mitigate losses in supply," Michael Tran, commodity strategist at RBC Capital Markets, said in a research note published Wednesday.

"While our long held, structurally bullish outlook remains tactfully in place, the pace of the supply outages may present further upside risk to our view."

-----

Earlier:

2018, October, 1, 11:45:00

OIL PRICE: NEAR $83REUTERS - Benchmark Brent crude oil futures LCOc1 rose to as much as $83.32 a barrel on Wednesday and were at $83.09 at 0335 GMT, still 36 cents, or 0.4 percent above their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 19 cents, or 0.3 percent, at $73.44 a barrel. |

2018, September, 21, 11:00:00

OIL PRICE: NEAR $79 STILLREUTERS - International benchmark Brent crude for November delivery LCOc1 was up 26 cents, or 0.33 percent, at $78.96 a barrel by 0647 GMT. U.S. West Texas Intermediate crude for October delivery CLc1 was up 7 cents, or 0.10 percent, at $70.39 a barrel. |

2018, September, 17, 15:25:00

OIL PRICE: NOT ABOVE $79 YETREUTERS - Brent crude oil was up 40 cents a barrel at $78.49 by 1155 GMT. U.S. light crude was up 45 cents at $69.44.

|

2018, September, 12, 11:35:00

OIL PRICES 2018-19: $73-$74U.S. EIA - EIA expects Brent spot prices will average $73/b in 2018 and $74/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for December 2018 delivery that traded during the five-day period ending September 6, 2018, suggest a range of $56/b to $85/b encompasses the market expectation for December WTI prices at the 95% confidence level. |

2018, August, 31, 11:40:00

OIL PRICE: ABOVE $77REUTERS -International Brent crude oil futures LCOc1 were at $77.64 per barrel at 0654 GMT, down 13 cents from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were unchanged at $70.25 a barrel.

|

2018, August, 20, 14:30:00

OIL PRICE: NEAR $72 AGAINREUTERS - Brent crude futures, a benchmark for international oil prices, were at $72.11 per barrel at 0803 GMT, up 28 cents. U.S. West Texas Intermediate (WTI) crude futures were up 3 cents at $65.94 per barrel. |

2018, August, 8, 12:05:00

OIL PRICES 2018 - 19: $72 - $71EIA - Brent crude oil spot prices averaged $74 per barrel (b) in July, largely unchanged from the average in June. EIA expects Brent spot prices will average $72/b in 2018 and $71/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. |