SAUDI ARAMCO IPO $2 TLN

BLOOMBERG - Saudi Arabia's crown prince insisted the stalled plan to sell shares in oil giant Aramco will go ahead, promising an initial public offering by 2021 and sticking to his ambitious view the state-run company is worth $2 trillion or more.

The comments show 33-year-old Mohammed bin Salman's determination to press ahead with the IPO even after Riyadh's original timetable was undone by skepticism over the company's valuation and a plan for Aramco to buy a controlling stake in the country's biggest chemical producer.

"I believe late 2020, early 2021," he said, discussing the timing of the IPO in an interview at the royal palace in Riyadh. "The investor will decide the price on the day. I believe it will be above $2 trillion. Because it will be huge."

The IPO project was first announced in 2016 as the cornerstone of the prince's Vision 2030 plan to modernize the Saudi economy. Officials repeatedly said the deal was "on track, on time" for the second half of 2018, but earlier this year they said it would be delayed into 2019. Soon after, Aramco put the IPO on hold and instead started talks to buy a majority stake in local petrochemical giant Sabic, a deal potentially worth $70 billion.

-----

Earlier:

2018, September, 24, 15:05:00

SAUDI ARAMCO WANTS +50%ARAB NEWS - Saudi's Aramco Trading Company (ATC) expects to increase its oil trading volume to 6 million barrels per day (bpd) in 2020, 50 percent higher than current levels, the company's top official said on Monday. |

2018, September, 19, 13:05:00

SAUDI ARAMCO INVESTMENT: $133 BLNREUTERS - State oil giant Saudi Aramco will spend more than 500 billion riyals ($133 billion) on oil and gas drilling over the next decade, a senior company executive said on Monday.

|

2018, August, 24, 11:25:00

SAUDI ARAMCO IPOARAB NEWS - The Government remains committed to the IPO of Saudi Aramco at a time of its own choosing when conditions are optimum. This timing will depend on multiple factors, including favorable market conditions, and a downstream acquisition which the Company will pursue in the next few months, as directed by its Board of Directors. |

2018, August, 20, 14:15:00

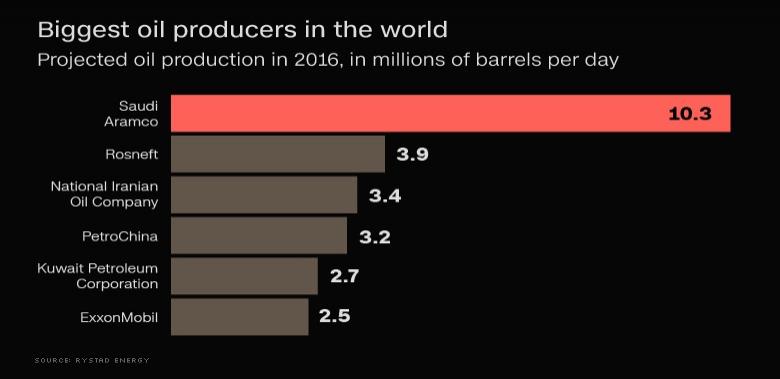

SAUDI ARAMCO: THE GLOBAL LEADERSAUDI ARAMCO - 2017 highlights: Produced an average of 10.2 million barrels per day of crude oil including condensate Increased amount of natural gas supplied for fourth straight year, to an average of 8.7 billion standard cubic feet per day Crude oil exports averaged 6.9 million barrels per day |

2018, June, 15, 11:00:00

SAUDI ARAMCO INVESTMENTS WILL UPREUTERS - Saudi Aramco plans to boost investments in refining and petrochemicals to secure new markets for its crude, and sees growth in chemicals as central to its downstream strategy to lessen the risk of a slowdown in oil demand. |

2018, April, 11, 13:10:00

SAUDI - INDIA'S REFINERY: $44 BLNPLATTS - India's state-run refiners and Saudi Aramco signed an agreement Wednesday to jointly build an integrated refinery and petrochemical complex on India's west coast at a cost of $44 billion, Saudi energy minister Khalid al-Falih said. |

2017, October, 16, 11:50:00

SAUDI ARAMCO IPOSaudi Arabia is considering delaying the international portion of the giant initial public offering of its state oil company until at least 2019, according to people familiar with the situation, who said a domestic share sale in Riyadh could still happen next year. |