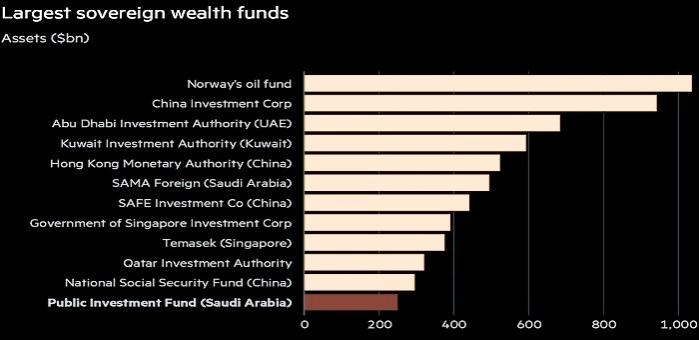

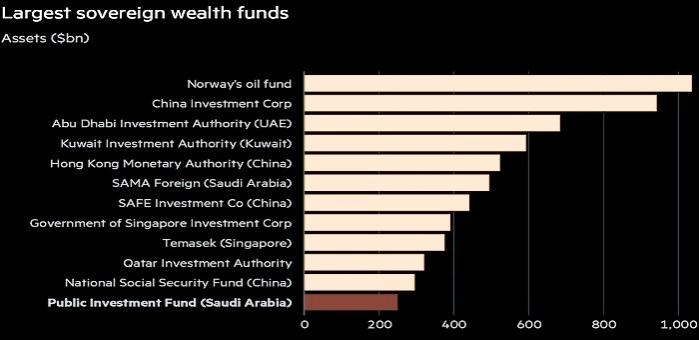

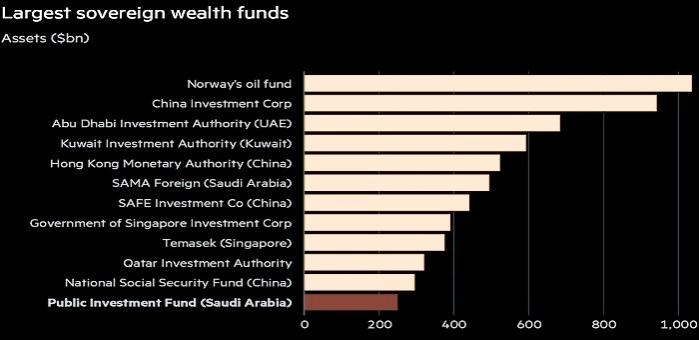

SAUDIS FUND: $600 BLN

МИНЭКОНОМРАЗВИТИЯ РОССИИ - Министр экономического развития РФ Максим Орешкин в ходе визита Президента РФ Владимира Путина принял участие в работе Российско-индийского бизнес форума.

В 2017 году товарооборот между Россией и Индией увеличился на 21% и составил 9,4 миллиарда долларов. В январе-июле 2018 года тенденция сохранилась: рост составил 20%, а товарооборот превысил 6,04 миллиардов долларов. «Перед нами поставлена задача роста товарооборота до 30 миллиардов долларов и роста инвестиций до 50 миллиардов долларов к 2025 году",- сообщил министр. Он напомнил, что Индия и Россия входят в десятку крупнейших мировых экономик, суммарный ВВП обеих стран превышает 10% мирового ВВП. «Однако если мы посмотрим на нашу долю в глобальной торговле, то здесь мы увидим цифру меньше одной десятой процента», - отметил он.

Максим Орешкин назвал четыре приоритетных действия, которые надо предпринять в первую очередь. Прежде всего, это укрепление правовых основ сотрудничества. Необходимо обновить соглашения об избежании двойного налогообложения и поощрении и защите инвестиций, активно работать над устранением барьеров во взаимной торговле и инвестициях.

Вторая задача – развитие инфраструктуры, обеспечивающей экономические связи. Министр выделил два элемента: развитие транспортно-логистической инфраструктуры и расширение взаимодействия в финансовой сфере. Он обозначил ключевые проекты - полномасштабный запуск транспортного коридора «Север–Юг», запуск таможенного «Зеленого коридора». Также важно создать удобные возможности для расчетов в национальных валютах и финансирования торговли и совместных проектов.

Кроме того, по словам министра, необходимо расширение сотрудничества в традиционных секторах экономики. «Мы идентифицировали группы товаров, благодаря которым уже в ближайшие годы взаимный экспорт может вырасти на 5 млрд. долл. в обоих направлениях. Это продовольствие, продукция химической, машиностроительной и металлургической отраслей», - сообщил он.

В качестве четвертого направления Максим Орешкин выделил проекты в области новой экономики, в первую очередь, в сфере науки и технологий. «Очень важная история – это координация и взаимоувязка национальных программ социально-экономического развития наших стран. Мы предлагаем, например, запустить ряд проектов в рамках национальной программы Цифровая экономика России и программ Цифровая Индия, «Умные города» и «Сделано в Индии», запущенных Правительством Индии», - подчеркнул министр.

В ходе визита в присутствии лидеров двух стран Максим Орешкин подписал Меморандум о взаимопонимании между Минэкономразвития России и Национальным институтом трансформации Индии. С индийской стороны документ подписал заместитель председателя Национального института трансформации Индии Раджив Кумар. Документом зафиксирован предмет сотрудничества – обмен опытом по развитию экономической политики, подготовке и реализации государственных программ социального, экономического, промышленного и регионального развития. Кроме того, учреждается Российско-Индийской экономический форум, первое заседание которого состоится в 25-26 ноября 2018 года в г. Санкт-Петербурге.

-----

Раньше:

2018, March, 4, 11:00:00

РОСАТОМ - МОСКВА, 1 марта 2018 года – Госкорпорация «Росатом», Министерство науки и технологий Народной Республики Бангладеш и Департамент по атомной энергии Правительства Республики Индия подписали Меморандум о взаимопонимании по сотрудничеству в реализации проекта сооружения АЭС «Руппур» в Бангладеш.

|

2017, June, 9, 21:05:00

«Мы имеем возможность взаимодействовать со странами и компаниями азиатско-тихоокеанского региона и будем развивать наше сотрудничество в сфере энергетики», - сообщил глава Минэнерго России. Министр особо подчеркнул заинтересованность России в расширении взаимодействия с Индией в сфере поставок энергоресурсов: «Индия для нас является стратегическим партнером. Мы уже начали поставлять туда нефть, ведем переговоры по прокладке газопровода».

|

2017, June, 2, 16:30:00

По итогам встречи стороны приняли Санкт-Петербургскую Декларацию Российской Федерации и Республики Индии: Взгляд в XXI век. В Декларации, в частности, отмечено стремление двух стран к строительству «энергетического моста» и расширению двусторонних отношений по всем направлениям, включая атомную, углеводородную и гидроэнергетику, а также возобновляемые источники энергии и повышение энергоэффективности.

|

2016, October, 21, 08:20:00

РОСАТОМ - «Индия исторически входит в число наших ключевых зарубежных партнеров: на сегодняшний день на площадке АЭС «Куданкулам» успешно функционируют два энергоблока российского дизайна, еще два блока находятся на стадии сооружения. С целью усиления присутствия Госкорпорации на рынке было принято решение об открытии регионального центра в Мумбаи. Это позволит объединить наши усилия и повысить эффективность работы предприятий российской атомной отрасли в Южной Азии, а также предложить на рынке Индии другую ядерную неэнергетическую продукцию», - отметил региональный президент «Росатом Южная Азия» Алексей Пименов.

|

2016, February, 11, 19:10:00

Глава «Роснефти» отметил, что спрос на нефть и нефтепродукты будет расти. При этом рост стал более диверсифицированным — снизилась роль Китая, зато последовательно растет доля Индии, других азиатских стран, Африки. «Более диверсифицированный рост, — заявил Сечин, — представляется более устойчивым, и подтверждает, что пока многие озвучиваемые «угрозы» снижения роли нефти в мировой экономике сильно преувеличены». По словам Главы «Роснефти», «уже к концу 2016 года дисбаланс спроса и предложения нефти может существенно снизиться, а к концу 2017 года возможно даже возникновение ситуации дефицита предложения нефти на рынке».

|

2015, December, 25, 20:00:00

Стороны приветствовали проведение в Москве 6 ноября 2015 года первого заседания совместной Рабочей группы по изучению возможностей строительства углеводородной трубопроводной системы, соединяющей Россию и Индию, что предусмотрено Программой по расширению сотрудничества в нефтегазовой сфере, подписанной в декабре 2014 года в Нью-Дели.

|

2015, July, 9, 19:15:00

Председатель Правления ОАО «НК «Роснефть» Игорь Сечин и Учредитель Группы компаний Essar Шаши Руйя подписали долгосрочный контракт на поставку нефти для целей последующей переработки на НПЗ в г. Вадинар (Индия).

|

SAUDIS FUND: $600 BLN

REUTERS - Saudi Arabia's Crown Prince Mohammed bin Salman said the kingdom's main sovereign wealth fund (PIF) will surpass its target of increasing its assets to $600 billion by 2020, as part of a plan to reduce the economy's dependence on oil.

"We are now above $300 billion, we're getting close to $400 billion. Our target in 2020 is around $600 billion. I believe we will surpass that target in 2020," the prince said in a Bloomberg interview published on Friday.

He added that the fund, with more than 50 percent of its investments located in Saudi Arabia, will be investing in more places next year.

The fund would invest another $45 billion in Softbank Vision fund, the world's largest private equity fund, backed by Japan's Softbank Group and the PIF, which invests in technology sectors such as artificial intelligence and robotics.

"We have a huge benefit from the first one. We would not put, as PIF, another $45 billion if we didn't see huge income in the first year with the first $45 billion," the prince said.

Locally, one of the biggest investments for the PIF is a planned $500 billion business and industrial zone called NEOM extending into Jordan and Egypt, announced in October 2017.

Prince Mohammed said the first town in NEOM will be ready in 2019 or 2020, with the entire site completed by 2025.

PRIVATISATION

The Crown Prince said his country will privatize more than 20 companies in 2019, helping the government's strategy of diversifying away from oil exports.

"In 2019, we will have more than 20 services that will be privatized, most of them in water, agriculture, energy and some of it in sports", the prince said in an interview with Bloomberg published on Friday.

In April, the Saudi government said it aims to generate 35 billion to 40 billion riyals ($9 billion to $11 billion) in non-oil revenues from its privatization program by 2020 and create up to 12,000 jobs.

The privatization initiative targets 14 public-private partnership (PPP) investments worth 24 billion to 28 billion riyals. It includes the corporatization of Saudi ports and the privatization of the production sector at the Saudi Saline Water Conversion Corp (SWCC) and the Ras Al Khair desalination and power plant, according to official document published in April.

The prince said unemployment, which now stands at a record level near 13 percent is part of the side effects of restructuring the economy.

He added that the kingdom's economy today was much more powerful, with 2019 budget planned to exceed one trillion riyals ($267 billion) for the first time, and with non-oil revenue rising by 300 percent.

"I believe the unemployment rate will start to decline from 2019 until we reach 7.0 percent in 2030 as targeted," he said.

-----

Earlier:

2018, September, 24, 15:05:00

ARAB NEWS - Saudi's Aramco Trading Company (ATC) expects to increase its oil trading volume to 6 million barrels per day (bpd) in 2020, 50 percent higher than current levels, the company's top official said on Monday.

|

2018, September, 19, 13:39:00

PLATTS - Saudi production has since risen to 10.42 million b/d in August, the country reported to OPEC in the organization's most recent monthly oil market report. Saudi Arabia's crude oil stocks, which have been declining steadily over the last three years, fell to 229.41 million barrels in July, down 11.4% since May 2017, the JODI data showed.

|

2018, September, 19, 13:05:00

REUTERS - State oil giant Saudi Aramco will spend more than 500 billion riyals ($133 billion) on oil and gas drilling over the next decade, a senior company executive said on Monday.

|

2018, September, 12, 11:45:00

REUTERS - Saudi Arabia has started marketing U.S. dollar-denominated sukuk, or Islamic bonds, with the issue expected to be around $2 billion in size, a document showed on Wednesday.

|

2018, September, 5, 10:55:00

REUTERS - “The Saudis need oil at about $80 and they don’t want prices to go below $70. They want to manage the market like this,” one of the sources told.

|

2018, August, 24, 11:25:00

ARAB NEWS - The Government remains committed to the IPO of Saudi Aramco at a time of its own choosing when conditions are optimum. This timing will depend on multiple factors, including favorable market conditions, and a downstream acquisition which the Company will pursue in the next few months, as directed by its Board of Directors.

|

2018, June, 15, 11:00:00

REUTERS - Saudi Aramco plans to boost investments in refining and petrochemicals to secure new markets for its crude, and sees growth in chemicals as central to its downstream strategy to lessen the risk of a slowdown in oil demand.

|

Tags:

SAUDI ARABIA,

OIL,

FUND