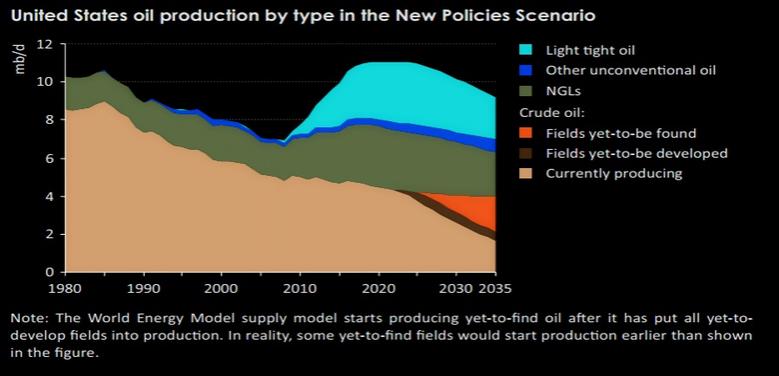

U.S. OIL PRODUCTION 11 MBD

API - The American Petroleum Institute's latest monthly statistical report shows the U.S. produced a record 11.0 million barrels of crude oil per day (mb/d) in September. U.S. liquid fuels production grew 2.2 mb/d year-over-year (y/y), and the U.S. met virtually all global oil demand growth. As supply increased, crude oil inventories also rose in September but remained nearly 14 percent below those of September 2017.

"The United States has continued to lead the world in oil production growth this year and that growth is helping to meet growing energy needs at home and abroad despite production losses by some OPEC nations," said API Chief Economist Dean Foreman. "As a result, consumers have continued to enjoy affordable fuel prices that also are a key advantage for the U.S. economy."

With seasonal slowing after the summer driving season, U.S. petroleum demand slowed to 20.1 mb/d in September from 20.8 mb/d in August. Despite weaker demand, product inventories fell between August and September as refinery throughput slowed due to scheduled maintenance turnarounds.

Consequently, the market remained balanced in a way that continued to support prices. West Texas Intermediate (WTI) oil averaged $70.23 per barrel in September, up $2.17 per barrel from August. By contrast, international Brent crude oil prices averaged $78.89 per barrel, up $6.36 from August. Higher international prices reflected a market that has grappled with geopolitical uncertainties and the effects of Iranian sanctions.

September highlights:

- Strongest year-to-date jet fuel demand on record.

- Refinery and petrochemical feedstock demand up more than 0.5 mb/d since September 2017

- Global and U.S. oil prices and volatility diverged.

- Interest rates rose along with a solid economy.

- U.S. petroleum exports rebounded.

- U.S. petroleum inventories stable in the 5-year range.

More information is here.

-----

Earlier:

2018, October, 17, 10:05:00

U.S. IN EUROPEREUTERS - The United States must not determine European energy policy or decide whether Germany buys Russian gas, a top German diplomat said on Tuesday. |

2018, October, 17, 09:40:00

U.S. PRODUCTION: OIL + 98 TBD, GAS + 957 MCFDU.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 98,000 b/d month-over-month in November from 7,616 to 7,714 thousand barrels/day , gas production to increase 957 million cubic feet/day from 73,104 to 74,061 million cubic feet/day . |

2018, October, 15, 12:25:00

BAD BOYS: IMF & WBGU.S. DT - On the borrower side, the IMF and World Bank should make efforts to obtain a comprehensive picture of members’ debt positions in both its bilateral surveillance and as part of its lending programs, with the goal of improving debt sustainability. |

2018, October, 15, 12:10:00

IRAN SANCTIONS DOWNPLATTS - Iran played down the impact of looming US sanctions on its economy with a senior official saying on Sunday that the current high oil prices should make up for any fall in oil sales, according to state-owned news agency IRNA. |

2018, October, 15, 12:00:00

U.S. RIGS UP 11 TO 1,063BHGE - U.S. Rig Count is up 11 rigs from last week to 1,063, with oil rigs up 8 to 869, gas rigs up 4 to 193, and miscellaneous rigs down 1 to 1. Canada Rig Count is up 13 rigs from last week to 195, with oil rigs up 8 to 127 and gas rigs up 5 to 68. |

2018, October, 8, 10:20:00

U.S. DEFICIT UP $3.2 BLN TO $53.2 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $53.2 billion in August, up $3.2 billion from $50.0 billion in July, |

2018, October, 4, 14:40:00

U.S. OIL INVENTORIES DOWNU.S. EIA - Crude oil inventories held at Cushing, Oklahoma, decreased by more than half since this time last year, recently falling to lows last reached in 2014. Logistical factors and strong demand for crude oil from both domestic refining and exports markets have contributed to the steep year-over-year decrease. |