UAE ECONOMY'S GROWTH

IMF - An IMF team led by Ms. Natalia Tamirisa visited the UAE during September 18-30, 2018, to conduct discussions for the 2018 Article IV Consultation. Upon conclusion of the visit, Ms. Tamirisa issued the following statement:

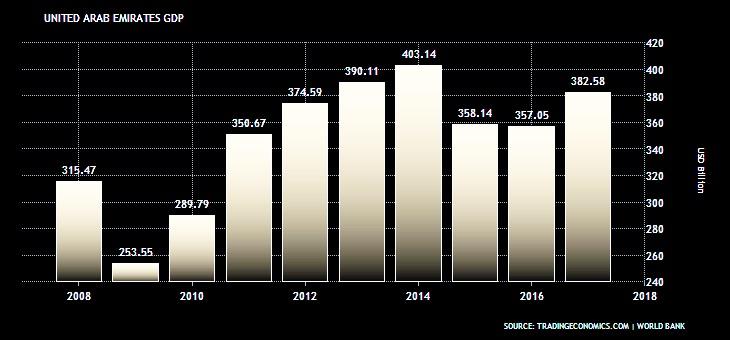

"The UAE economy has been adapting well to a prolonged decline in oil prices since 2014. A gradual recovery in non-oil activity is under way. With oil production and government spending set to rise, overall growth is projected to strengthen to 2.9 percent this year and 3.7 percent next year. Inflation is projected at 3.5 percent this year owing to the introduction of the value-added tax and should ease afterwards. The fiscal deficit is expected to remain stable at about 1.6 percent of GDP this year and turn to a surplus next year. The current account surplus will exceed 7 percent of GDP this year.

"Given large fiscal buffers, ample spare capacity, and rising investment needs for Expo 2020, the government has appropriately switched to providing stimulus to the economy. Front-loading stimulus measures and focusing them on productive spending, consistent with the Vision 2021 goals of diversifying the economy and raising productivity, would augment their impact on growth. Over the medium term, as the economic recovery gains momentum, a return to the path of gradual fiscal consolidation would help save an adequate portion of the exhaustible oil income for future generations. Continued improvements in spending efficiency and strengthening non-oil revenue, including by gradually replacing a system of numerous and regressive fees with corporate taxation, would help achieve these goals. In this context, the introduction of VAT in 2018 has been a historic milestone and is expected to substantially strengthen and diversify government revenues in the coming years.

"Improving medium-term growth and job prospects and advancing to a competitive knowledge-based economy require deepening and broadening structural reforms aimed at increasing the role of the private sector and fostering talent and innovation. The authorities' recently announced plans to liberalize foreign investment, introduce long-term visas for professionals, and ease licensing requirements and business fees—once implemented—will be a welcome step in this regard. Other reform priorities include promoting competition, privatizing nonstrategic government-related enterprises (GREs), and improving the ecosystem for SME development and access to finance. In particular, developing domestic government debt markets would catalyze financial market development and expand sources of financing for SMEs. Enhancing the quality of education and healthcare and promoting gender equality would cultivate talent.

"Tightening financial conditions and increased global and regional uncertainty call for continued vigilance in monitoring financial sector risks, including those from a downturn in real estate and concentrated loan portfolios. Ensuring consistency of the draft central bank and banking laws with international best practices and approving them swiftly would buttress the prudential framework. Continued upgrading of bank regulations and strengthening bank supervision are essential to maintain the resilience of the banking system.

"Continued improvement of economic policy frameworks and coordination, and enhancing statistics would help align policies with the Vision 2021 goals for non-oil growth and further diversification of the economy. Stronger fiscal anchors would help mitigate the impact of adverse shocks on the economy while ensuring long-term growth, debt sustainability and saving for future generations. Better monitoring and analysis of contingent fiscal liabilities stemming from GRE borrowing, delays in payments, and public-private partnerships, would help mitigate risks. Further improvements in the frequency and quality of economic statistics would support policy-making and inform business decisions.

"The IMF team would like to express its appreciation to the authorities and other stakeholders for their hospitality and thoughtful discussions."

| ----- |

| Earlier: |

2018, July, 4, 11:50:00

UAE NUCLEAR MOVINGIAEA - H.E. Ambassador Hamad Alkaabi, UAE’s Permanent Representative at the IAEA, said: “The UAE is rapidly moving forward with the development of its peaceful nuclear energy sector. The successful conclusion of the Phase 3 INIR mission is a testament to the UAE’s commitment to upholding the highest international standards of safety, security, and transparency as we approach the commissioning of the nation’s first nuclear energy plant." |

2018, June, 27, 10:45:00

ARABIAN INVESTMENT FOR INDIA: $44 BLNAOG - Sheikh Abdullah said: “This agreement strengthens the already close ties between the UAE and the Kingdom of Saudi Arabia and between the UAE and India. The UAE is unwavering in its commitment to its strategic multi-lateral relationships with both Saudi Arabia and India, as well as being a reliable partner in India’s energy security. We look forward to exploring further opportunities to expand our energy partnerships and to collaborating on new, broader, opportunities that will further strengthen and deepen the long-standing economic links between our three countries.” |

2018, April, 9, 11:15:00

UAE - S.KOREA COOPERATIONWNN - The Emirates Nuclear Energy Corporation (Enec) and its joint venture subsidiaries, Nawah Energy Company (Nawah) and Barakah One Company (BOC), have signed three agreements with Korean companies. Enec and Korea Electric Power Corporation (Kepco) in October 2016 signed a joint venture agreement that made Kepco a minority shareholder in Nawah and BOC. |

2018, February, 16, 23:20:00

ADNOC INVESTMENT $109 BLNAOG - ADNOC announced that it has launched the implementation phase of its new in-country value (ICV) strategy, aimed at increasing the company’s ICV contribution and strengthening its relationship with the UAE’s private sector. |

2017, July, 17, 13:45:00

UAE IS BETTER FOR IMFThe economy is weathering the post-2014 oil shock well. The key policy goal is to foster economic adjustment to the new oil market realities. To foster the adjustment, especially given downside risks, the momentum in fiscal reforms needs to be sustained and coordinated with structural reforms. To ensure credibility, fiscal adjustment should be accompanied by strengthening the medium-term policy framework and improving transparency. |

2015, October, 29, 19:40:00

UAE WANTS OILThe United Arab Emirates (UAE) was the world's sixth-largest oil producer in 2014, and the second-largest producer of petroleum and other liquids in the Organization of the Petroleum Exporting Countries (OPEC), behind only Saudi Arabia. Because the prospects for further oil discoveries in the UAE are low, the UAE is relying on the application of enhanced oil recovery (EOR) techniques in mature oil fields to increase production. |

2014, September, 25, 21:20:00

UAE: OPEC OIL TARGETThe United Arab Emirates is in no hurry to see OPEC cut its oil output target this year despite the sharp drop of global crude prices in the last few months, senior UAE energy officials indicated on Tuesday. |