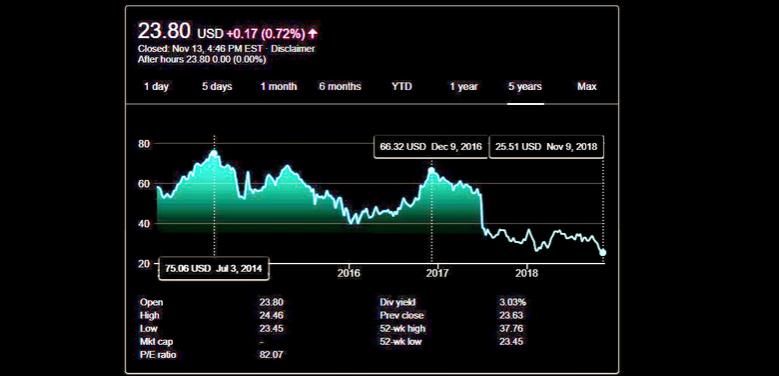

BHGE, GE MAXIMIZES VALUE

GE - Baker Hughes, a GE company (NYSE:BHGE) (“BHGE” or the “Company”) and General Electric Company (NYSE:GE) (“GE”) jointly announced today the entry into a series of long-term agreements (the “Agreements”) that amend the commercial and technological relationships between the two companies. The Agreements focus on:

- Long-term collaboration on critical rotating equipment, including aeroderivative and heavy-duty gas turbine technology.

- BHGE access to GE Digital software and technology.

- A series of agreements relating to operations and pricing within BHGE Digital Solutions’ Controls product line, pensions, tax matters and intercompany services costs.

- BHGE and GE agreed to maintain current operations and pricing levels with regards to the Controls product line BHGE offers within its Digital Solutions segment for the four years commencing on the Trigger Date.

- GE will transfer to BHGE certain UK pension liabilities on what is intended to be a fully funded basis. No liabilities associated with GE’s primary U.S. pension plan will be transferred to BHGE.

- The current Tax Matters Agreement with GE that was negotiated at the time of the merger between Baker Hughes Incorporated and GE Oil & Gas (the “Merger”) in July 2017 will remain largely in place and both companies retain the ability to monetize certain tax benefits.

- The intercompany services fee that BHGE agreed to pay to GE as part of the Merger will be reduced over time beginning on January 1, 2019.

- BHGE and GE agreed to amend the terms of their stockholders agreement to provide that (i) GE’s right to nominate five directors to BHGE’s nine-person board will continue until the Trigger Date, and (ii) GE will have a right to nominate one director to the BHGE board following the Trigger Date until GE ceases to own at least 20% of the voting power of BHGE’s outstanding common stock.

-----

Earlier:

2018, October, 31, 12:40:00

BHGE NET INCOME $13 MLNBHGE - Orders of $5.7 billion for the quarter, down 5% sequentially and flat year-over-year. Revenue of $5.7 billion for the quarter, up 2% sequentially and up 7% year-over-year. GAAP operating income of $282 million for the quarter, increased $204 million sequentially and increased $475 million year-over-year.

|

2018, October, 10, 07:30:00

BHGE ACCURES 5% IN ADNOC: $11 BLNBHGE - BHGE will acquire a five percent stake in ADNOC Drilling. The transaction values ADNOC Drilling at approximately $11 billion.

|

2018, September, 5, 10:30:00

BAKER HUGHES & SAUDI ARAMCO CONTRACTPLATTS - Saudi Aramco has awarded Baker Hughes a major services contract to boost crude oil production from Saudi Arabia's offshore Marjan oil field.

|

2018, July, 23, 13:05:00

BAKER HUGHES NET LOSS $19 MLNBAKER HUGHES A GE - Orders of $6.0 billion for the quarter, up 15% sequentially and up 9% year-over-year on a combined business basis. Revenue of $5.5 billion for the quarter, up 3% sequentially and up 2% year-over-year on a combined business basis. GAAP operating income of $78 million for the quarter, increased $119 million sequentially and increased $223 million year-over-year on a combined business basis.

|

2018, April, 23, 14:05:00

BAKER HUGHES GE NET INCOME $70 MLNBHGE - Baker Hughes, a GE company Announces First Quarter 2018 Results Revenue of $5.4 billion for the quarter, down 7% sequentially and up 1% year-over-year on a combined business basis GAAP operating loss of $41 million for the quarter, decreased 63% sequentially and increased unfavorably year-over-year on a combined business basis Adjusted operating income (a non-GAAP measure) of $228 million for the quarter, down 20% sequentially and down 19% year-over-year on a combined business basis

|

2017, October, 23, 11:05:00

BAKER HUGHES NET LOSS $104 BLN“The combination of GE Oil & Gas and Baker Hughes closed on July 3, and we are pleased with our progress during our first operating quarter. Despite the continuing challenging environment, we delivered solid orders growth and secured important wins from customers, advanced existing projects and enhanced our technology offerings in the quarter. We also achieved key integration milestones and made significant progress working as a combined company. I am now more convinced than ever that we combined the right companies at the right time,” said Lorenzo Simonelli, BHGE chairman and chief executive officer.

|

2017, July, 5, 12:10:00

GE & BAKER HUGHES DEALGeneral Electric Co. closed its deal to combine its long-suffering energy business with Baker Hughes Inc. on Monday, creating one of the largest companies in the oil-field services industry. |