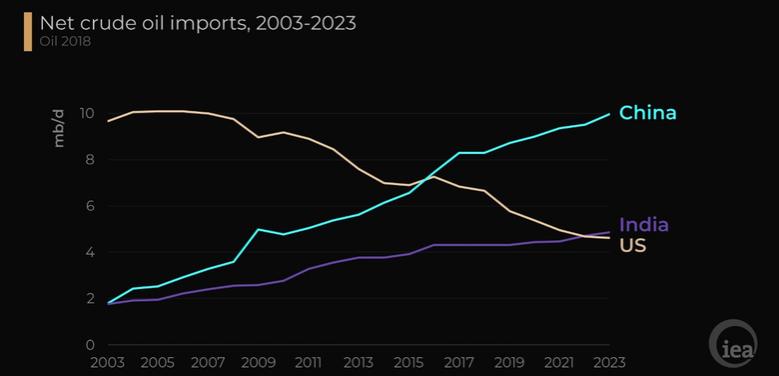

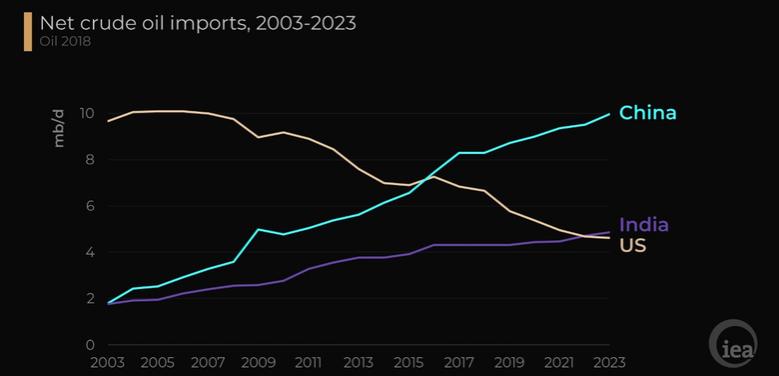

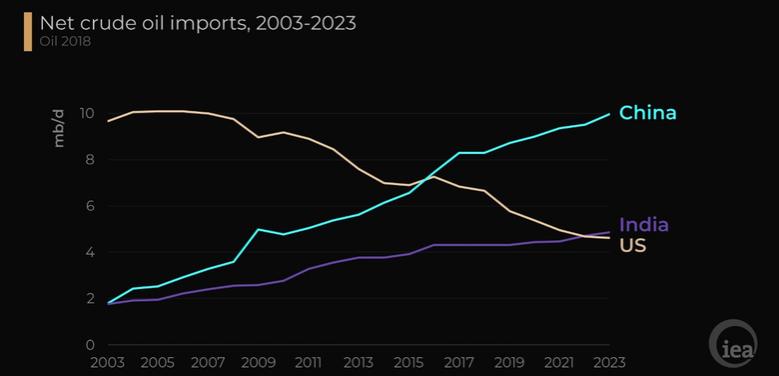

CHINA'S OIL IMPORTS UP

РОСНЕФТЬ - ПРОИЗВОДСТВЕННЫЕ РЕЗУЛЬТАТЫ ЗА 3 КВ. И 9 МЕС. 2018 Г.

- ЭФФЕКТИВНОЕ ВОССТАНОВЛЕНИЕ ДОБЫЧИ В РЕЗУЛЬТАТЕ СМЯГЧЕНИЯ ОГРАНИЧЕНИЙ В РАМКАХ СОГЛАШЕНИЯ ОПЕК+

- СРЕДНЕСУТОЧНАЯ ДОБЫЧА УГЛЕВОДОРОДОВ В 3 КВ. 2018 Г. СОСТАВИЛА 5,83 МЛН Б.Н.Э., ЧТО НА 2,1% ВЫШЕ УРОВНЯ 2 КВ. 2018 Г.

- СРЕДНЕСУТОЧНАЯ ДОБЫЧА ЖИДКИХ УГЛЕВОДОРОДОВ ВЫРОСЛА НА 2,6% КВАРТАЛ К КВАРТАЛУ

- РОСТ ДОБЫЧИ ГАЗА НА 1,0% К УРОВНЮ 2 КВ. 2018 Г.

- ОБЪЕМ ПЕРЕРАБОТКИ СЫРЬЯ НА НПЗ РФ ЗА 9 МЕС. 2018 Г. ВЫРОС НА 1,8% ГОД К ГОДУ ДО 76,6 МЛН Т

Ключевые производственные показатели за 3 кв. и 9 мес. 2018 г.:

| |

3 кв.

‘18 |

2 кв.

‘18 |

3 кв.

‘17 |

изм.

кв./кв. |

изм.

г./г. |

9 мес.

‘18 |

9 мес.

‘17 |

изм.

г./г. |

| Добыча углеводородов (тыс. б.н.э./сут.) |

5 826 |

5 706 |

5 674 |

2,1% |

2,7% |

5 747 |

5 720 |

0,5% |

| Добыча ЖУВ (млн т) |

58,68 |

56,54 |

56,74 |

3,8% |

3,4% |

170,68 |

168,94 |

1,0% |

| Добыча газа (млрд куб. м.) |

16,62 |

16,46 |

16,66 |

1,0% |

(0,2)% |

49,95 |

50,86 |

(1,8)% |

| Уровень полезного использования ПНГ |

83,6% |

84,2% |

88,3% |

(0,6) п.п. |

(4,7) п.п. |

84,5% |

89,1% |

(4,6) п.п. |

| Эксплуатационное бурение (тыс. м.)* |

3 258 |

3 143 |

3 342 |

3,7% |

(2,5)% |

9 225 |

8 825 |

4,5% |

| 2Д сейсмика (пог. км.)* |

325 |

1 197 |

27 611 |

(72,8)% |

(98,8)% |

5 087 |

38 306 |

(86,7)% |

| 3Д сейсмика (кв. км.)* |

1 699 |

1 837 |

6 576 |

(7,5)% |

(74,2)% |

8 285 |

12 225 |

(32,2)% |

| Переработка нефти (млн т) |

29,82 |

28,12 |

28,31 |

6,0% |

5,3% |

85,51 |

84,33 |

1,4% |

| На заводах РФ |

26,77 |

25,08 |

25,03 |

6,7% |

7,0% |

76,55 |

75,19 |

1,8% |

| Вне РФ |

3,05 |

3,04 |

3,28 |

0,3% |

(7,0)% |

8,96 |

9,14 |

(2,0)% |

| Выпуск нефтепродуктов в РФ (млн т) |

25,82 |

24,22 |

24,08 |

6,6% |

7,2% |

73,93 |

72,54 |

1,9% |

| Бензин |

4,01 |

3,56 |

3,89 |

12,6% |

3,1% |

11,25 |

11,42 |

(1,5)% |

| Нафта |

1,64 |

1,51 |

1,49 |

8,6% |

10,1% |

4,72 |

4,58 |

3,1% |

| Дизельное топливо** |

8,81 |

8,22 |

8,19 |

7,2% |

7,6% |

25,21 |

24,71 |

2,0% |

| Мазут |

6,17 |

5,87 |

5,29 |

5,1% |

16,6% |

17,69 |

17,28 |

2,4% |

| Керосин |

1,07 |

0,88 |

0,90 |

21,6% |

18,9% |

2,76 |

2,48 |

11,3% |

| Нефтехимическая продукция |

0,31 |

0,41 |

0,34 |

(24,4)% |

(8,8)% |

1,15 |

1,14 |

0,9% |

| Прочие |

3,81 |

3,77 |

3,98 |

1,1% |

(4,3)% |

11,15 |

10,93 |

2,0% |

| Выпуск нефтепродуктов вне РФ (млн т) |

3,10 |

3,11 |

3,24 |

(0,3)% |

(4,3)% |

9,09 |

9,10 |

(0,1)% |

* По управленческим данным

** С учетом судового топлива

Разведка и добыча

Добыча углеводородов в 3 кв. 2018 г. составила 72,4 млн т.н.э. (5,83 млн б.н.э. в сутки) и 211,8 млн т.н.э. (5,75 млн б.н.э. в сутки) за 9 мес. 2018 г., превысив уровень 2 кв. 2018 г. и 9 мес. 2017 г. на 3,3% и 0,5% соответственно.

В результате смягчения ограничений в рамках Соглашения ОПЕК+ среднесуточная добыча жидких углеводородов Компании в 3 кв. 2018 г. составила 4,73 млн барр., увеличившись на 2,6% квартал к кварталу и на 3,4% год к году, благодаря эффективному восстановлению добычи на ряде зрелых активов (в основном, РН-Няганьнефтегаз, Варьеганнефтегаз, РН-Пурнефтегаз, Оренбургнефть) посредством оптимального выбора и управления фондом скважин. Компания продолжает наращивать добычу с учетом предложений, озвученных на заседании Министерского мониторингового комитета стран-участниц Соглашения ОПЕК+ в Алжире в конце сентября 2018 г. В результате добыча нефти и газового конденсата Компании в октябре достигла 4,78[1] млн барр. в сутки, что превышает уровень мая 2018 г. на >200 тыс. барр. в сутки и уровень октября 2016 г.[2] (до начала реализации Соглашения ОПЕК+) на >100 тыс. барр. в сутки.

Прирост среднесуточной добычи нефти и газового конденсата в России в сентябре 2018 г. относительно уровня октября 2016 г. составил 138 тыс. барр., из которых более 62% – доля Роснефти. При этом среднесуточная добыча Компании в РФ в сентябре 2018 г. выросла на 4,7% по сравнению с уровнем сентября 2017 г.

Благодаря ключевому вкладу Роснефти уровень среднесуточной добычи нефти и газового конденсата в России достиг исторического максимума в октябре 2018 г., в кратчайшие сроки превысив уровень добычи до начала реализации Соглашения ОПЕК+ (октябрь 2016 г.).

Таким образом, Компания своевременно реализовала ранее заявленный технологический потенциал по наращиванию объемов производства жидких углеводородов в объеме ~200 тыс. барр. в сутки, что свидетельствует о корректности стратегического выбора активов для ограничения добычи. В соответствии с утвержденной Стратегией, Компания планирует продолжить рост добычи жидких углеводородов до 5,09 млн барр. в сутки (250 млн тонн) к 2022 году.

За 9 мес. 2018 г. среднесуточная добыча жидких углеводородов Компании выросла год к году на 48 тыс. барр. в сутки или на 1,0% в результате достижения рекордных показателей производства на крупнейшем активе Компании РН-Юганскнефтегаз и активной разработки новых проектов.

Проходка в эксплуатационном бурении увеличилась в 3 кв. 2018 г. на 4% квартал к кварталу и за 9 мес. 2018 г. на 5% год к году, превысив уровень 9 млн м при сохранении доли собственного бурового сервиса порядка 60%. За 9 мес. 2018 г. ввод новых скважин в эксплуатацию был увеличен на 13% по сравнению с уровнем аналогичного периода прошлого года до 2,6 тыс. единиц с ростом доли горизонтальных скважин до 46%, а количество новых введенных горизонтальных скважин с МГРП - на 69%.

В начале августа Компания установила новый отраслевой рекорд по суточной проходке бурения - 56 708 м, превысив предыдущее достижение практически на 7%. Рост показателей бурения стал возможен благодаря совершенствованию системы планирования и управления бурением, а также эффективному внедрению новых технологий.

В сентябре крупнейший актив Компании РН-Юганскнефтегаз установил новый отраслевой рекорд суточной добычи нефти - 195,3 тыс. т (1,45 млн барр.). Это самый высокий показатель РН-Юганскнефтегаз в новейшей истории России, который удалось достичь благодаря масштабному применению инновационных технологий, а также внедрению собственных научных разработок в бурении. За 9 мес. 2018 г. рост добычи жидких углеводородов актива достиг 6,5% по сравнению с аналогичным периодом прошлого года.

В соответствии с утвержденным планом Компания продолжает развивать и готовить к запуску новые активы. Суммарная добыча жидких углеводородов за 9 мес. 2018 г. на Сузунском, Восточно-Мессояхском, Юрубчено-Тохомском и Кондинском месторождениях составила более 58 млн барр.

На Сузунском месторождении начата реализация второй очереди обустройства, предусматривающая строительство объектов газовой программы (установка подготовки газа с компрессорной станцией, межпромысловый газопровод «Сузун-Ванкор», кусты газовых скважин). Ожидаемая полка добычи ~4,5 млн т планируется к достижению в 2019 г.

Успешно продолжается освоение Восточно-Мессояхского месторождения с использованием многоствольных и высокотехнологичных скважин с технологией Fishbone, проводятся опытно-промышленные работы по полимерному заводнению, повышающие эффективность разработки трудноизвлекаемых запасов. На полку добычи ~3 млн т (в доле Компании) планируется выйти в 2021 г.

Продолжается реализация комплекса мероприятий по обустройству Юрубчено-Тохомского месторождения и технологическому запуску объектов второй очереди, предусматривающего доведение объемов добычи нефти до 5 млн т в 2019 г. Ведется строительство второй установки подготовки нефти (УПН-2), на которой будет осуществляться подготовка нефти до товарного качества. Полка добычи ~5 млн т ожидается к достижению уже в следующем году.

В соответствии с планами ведется разработка Эргинского кластера. Эффективность буровых работ, а также применение современных технологических передовых решений позволили менее чем за год с начала промышленной эксплуатации Кондинского месторождения достичь показателя один миллион тонн накопленной добычи нефти. Высокие показатели были достигнуты благодаря эффективному управлению программой эксплуатационного бурения и последовательной реализации программы исследовательских работ по уточнению геологического строения залежей. В 2019 г. планируется достичь полку добычи >2,5 млн т.

На месторождениях Эргинского кластера применяются такие технологии как геонавигация в процессе бурения - управление траекторией скважины в режиме реального времени - что позволяет увеличить эффективность проходки по продуктивной части пласта. Кроме того, проводятся геофизические исследования скважин с использованием ядерно-магнитных, акустических и других методов, применяются современные способы гидродинамического и геомеханического моделирования с целью оптимизации процесса заканчивания горизонтальных скважин и планирования многостадийного гидроразрыва пласта.

Компания активно готовит к поэтапному вводу в эксплуатацию вторую очередь Среднеботуобинского, Тагульское, Русское и Куюмбинское месторождения.

На Среднеботуобинском месторождении запущены объекты второй очереди обустройства (нефтепровод, центральный пункт сбора, приемо-сдаточный пункт), обеспечивающие подготовку и сдачу нефти до 5 млн т / год. Продолжается работа по строительству объектов инфраструктуры и обустройства, реализуется программа бурения горизонтальных и многозабойных скважин. За 9 мес. 2018 г. добыча нефти на месторождении превысила 2 млн т. Ожидаемая полка добычи ~5 млн т планируется к достижению в 2021 г.

На Тагульском месторождении продолжается эксплуатационное бурение (за 9 мес. 2018 г. пробурено 39 скважин), также ведутся работы по строительству объектов обустройства месторождения (установка подготовки нефти, кустовые площадки, нефтепроводы и прочие), выполняется комплекс работ с использованием мобильных установок подготовки нефти для минимизации геологических рисков и обеспечения проектных уровней добычи. Полка добычи >4,5 млн т ожидается к достижению после 2022 г.

На Русском месторождении, характеризующимся существенными запасами высоковязкой нефти, завершаются работы по строительству напорного нефтепровода «ЦПС Русское – ПСП Заполярное», продолжаются строительно-монтажные работы и подготовка к технологическому запуску основных объектов обустройства. На конец 3 кв. 2018 г. на месторождении пробурено более 170 скважин с потенциалом добычи нефти более 9 тыс. тонн в сутки. Полка добычи >6,5 млн т ожидается к достижению после 2022 г.

Продолжаются строительно-монтажные работы и подготовка к технологическому запуску объектов сбора и подготовки нефти (ЦПС и нефтесборный трубопровод с правого берега р. Подкаменная Тунгуска) первого пускового комплекса Куюмбинского месторождения, наращиваются темпы эксплуатационного бурения. В рамках реализации первоочередных пуско-наладочных работ и комплексного опробования оборудования в октябре 2018 г. выполнено заполнение нефтью объектов ЦПС. На полку добычи >1,5 млн т (в доле Компании) планируется выйти после 2021 г.

Добыча газа в 3 кв. 2018 г. составила 16,62 млрд куб. м, увеличившись на 1,0% по сравнению со 2 кв. 2018 г., преимущественно за счет увеличения мощностей проекта Зохр на шельфе Египта, а также роста добычи попутного нефтяного газа (ПНГ) в связи со смягчением ограничений на добычу нефти в рамках Соглашения ОПЕК+. Уровень полезного использования ПНГ в 3 кв.2018 г. составил 83,6%.

В рамках реализации проекта Роспан продолжается активная фаза строительства ключевых производственных объектов инфраструктуры, ведутся работы по антикоррозийной защите трубопроводов и эстакад на установке комплексной подготовки газа и конденсата Восточно – Уренгойского лицензионного участка, заканчивается монтаж технологического оборудования на установке регенерации метанола второй очереди. На газотурбинной электростанции Восточно-Уренгойского лицензионного участка продолжаются работы по монтажу инженерных систем. Запуск проекта планируется в 2019 г. с последующим ростом добычи газа до более 19 млрд куб м, ЖУВ - более 5 млн т в год.

Компания приступила к проекту по разработке газовой опции Харампурского месторождения, которое является вторым после Роспана перспективным газовым проектом. Пробурено 34 из 63 скважин, произведена укладка 28 км из 156 км линейного трубопровода на газопроводе внешнего транспорта. В ближайшей перспективе планируются работы по обустройству газового промысла Сеноманской залежи. Запуск проекта планируется в 2020 г. с последующим выходом на полку добычи в объеме 11 млрд куб. м в год.

Опережающими темпами ведется освоение месторождения Зохр на шельфе Египта, где в декабре 2017 г. была начата добыча газа. Производственные мощности месторождения увеличены более чем на 25% - до объема свыше 56,6 млн куб. м газа в сутки (100% проекта, ~10,2 млн куб. м в сутки в доле Компании). Это стало возможным благодаря вводу в эксплуатацию 5 технологической линии установки комплексной подготовки газа (УКПГ), а также запуску 2 транспортного газопровода от месторождения до УКПГ и новых скважин . Такой результат удалось достичь спустя всего 9 месяцев после запуска месторождения. Добыча газа за 9 мес. 2018 г. составила ~7,1 млрд куб. м газа (100% проекта, 1,3 млрд куб. м в доле Компании). С учетом достигнутого темпа ввода новых объектов, проектный уровень добычи в объеме более 76 млн куб. м газа в сутки может быть достигнут уже в 2019 г.

По итогам 9 мес. 2018 г. на суше выполнено сейсмических работ 2Д в объеме 4,8 тыс. пог. км, 3Д - в объеме 8,2 тыс. кв. км. Компания реализовала масштабную работу по сейсморазведке в стратегически важных регионах присутствия – Хатангском кластере и продолжила реализацию проектов в Якутии. В настоящее время продолжаются работы по обработке и интерпретации полученных данных, по результатам которых будет проводиться поисково-оценочное бурение.

В соответствии с утвержденной Стратегией, Компания стремится к повышению качества и успешности поисково-разведочного бурения. За 9 мес. 2018 г. на суше РФ завершены испытанием 77 поисково-разведочных скважин с успешностью 84%. Открыто 58 новых залежей и 14 новых месторождений с запасами АВ1С1+B2С2 в размере 117 млн т.н.э.

Переработка, коммерция и логистика

Объем переработки на российских НПЗ Роснефти в 3 кв. 2018 г. вырос на 6,7% квартал к кварталу - до почти 26,8 млн т. За 9 мес. текущего года переработка сырья выросла до 76,6 млн т - на 1,8% по сравнению с аналогичным периодом прошлого года в условиях улучшения конъюнктуры рынка. Общий объем нефтепереработки с учетом зарубежных предприятий в 3 кв. увеличился на 6,0% - до почти 30 млн т, а за 9 мес. - до 85,5 млн т или на 1,4% год к году.

За 9 мес. 2018 г. показатели выхода светлых нефтепродуктов на российских НПЗ Компании незначительно снизились на 0,2 п.п. год к году - до 58,2%. Показатель глубины переработки сохранился на уровне 9 мес. 2017 г. и составил 75,2%.

В августе текущего года Компания ввела в эксплуатацию второй за год экологический объект водоочистки – блок доочистки с мембранным биореактором на сооружениях биохимической очистки сточных вод на Новокуйбышевском НПЗ. Данный блок обеспечивает высокую степень очистки и возврат воды в производственный цикл, что позволяет свести к минимуму потребление водных ресурсов. Ввод инновационной технологии доочистки стоков является важным шагом в практической реализации политики Роснефти в области охраны окружающей среды и окажет положительное воздействие на состояние окружающего водного бассейна.

Вслед за Уфимской группой НПЗ Компании в сентябре 2018 г. на Саратовском нефтеперерабатывающем заводе приступили к промышленному выпуску высокооктановых автомобильных бензинов «Евро-6» с улучшенными экологическими и эксплуатационными свойствами. Топливо уже поступило на большинство АЗС Роснефти в Краснодарском крае.

Компания особое внимание уделяет развитию технологического потенциала. Так, в 3 кв. 2018 г. на Уфимской группе НПЗ стартовало промышленное производство дорожных битумов, соответствующих требованиям нового межгосударственного стандарта. Новая технология производства обеспечивает долговечность получаемых дорожных битумных вяжущих материалов.

В части развития партнерских отношений с крупными российскими компаниями на полях Восточного экономического форума в сентябре Роснефть заключила соглашение о поставках ракетного топлива нафтила с Роскосмосом и долгосрочный договор с Русской Рыбопромышленной Компанией на отгрузку судового топлива.

Кроме того, в сентябре между Роснефтью и компанией SOCAR Trading S.A. был подписан контракт на поставку нефти сорта REBCO на турецкий НПЗ на условиях FOB Новороссийск в объеме до 1 млн т по формульной цене, период поставки декабрь 2018 г. - ноябрь 2019 г.

В рамках диверсификации поставок нефти Компания продолжила наращивать отгрузки сырья в восточном направлении. Так, за 9 мес. 2018 г. поставки увеличились год к году на 22,4% до 43,1 млн т. Рост показателя в 3 кв. 2018 г. составил 12,9% квартал к кварталу до 15,7 млн т.

В части развития бизнеса смазочных материалов специалистами Корпоративного научного-проектного комплекса Роснефти был разработан и запатентован состав и технология производства первого российского многофункционального пакета присадок к гидравлическим маслам для промышленного оборудования. Данные масла адаптированы к работе в самых тяжелых условиях, состоят из отечественного сырья и по стоимости в 1,5 раза дешевле импортных аналогов.

Кроме того, специалистами Компании были разработаны моторные масла для Арктики и Крайнего Севера, которые обеспечивают надежную работу при температуре окружающей среды минус 60 С. Технология не имеет аналогов в России и будет использоваться на Ангарской НХК.

В 3 кв. 2018 г. реализация нефтепродуктов через розничный канал выросла на 20% по сравнению с показателем 3 кв. 2017 г.

Выручка от продаж сопутствующих товаров в 3 кв. 2018 выросла на 6% по сравнению с показателем 3 кв. 2017 г., в основном за счет внедрения новой ассортиментной политики на всех АЗС и АЗК Компании, а также развития фуд-предложения. Валовый доход от деятельности кафе за 3 кв. 2018 г. вырос на 17% к уровню 3 кв. 2017 г.

После завершения тиража новой программы лояльности в 57 субъектах Российской Федерации продолжено наращивание базы участников двух программ лояльности – «Семейная Команда» и «BP CLUB» за счет таргетированных акций. По состоянию на конец 3 кв. 2018 г. привлечено 9,7 млн участников. Реализован запуск топлива Pulsar 100 на АЗС Роснефти в Московском регионе, а также Евро-6 на базе топлива АИ-95 на АЗС Роснефть-Кубаньнефтепродукт.

На постоянной основе ведется работа по контролю качества реализуемого топлива на нефтебазах и АЗС Компании посредством стационарных и мобильных лабораторий. С использованием собственных мобильных лабораторий на АЗС и АЗК проведено более 5,7 тыс. проверок в 46 субъектах РФ. С начала года проверки качества топлива на нефтебазах и АЗС проводятся во всех регионах присутствия розничной сети Компании. Подобный контроль позволяет исключить риски реализации потребителям топлива с отклонениями по качеству. Также на АЗС и АЗК Компании на периодической основе осуществляется контроль дозы отпуска топлива в адрес конечного потребителя.

В части развития многотопливного предложения завершены работы и введены в режиме опытно-промышленной эксплуатации 10 станций в Ульяновске, Воронеже, Саратове и Ставропольском крае, реализующие компримированный природный газ в качестве моторного топлива. Ежедневно на действующих станциях осуществляется заправка более 1 тыс. автомобилей. В ближайшее время будет осуществлен запуск еще 1 станции в Саратове.

Международная деятельность

Компания и Китайская Национальная Нефтегазовая Корпорация (CNPC) в рамках IV Восточного экономического форума в г. Владивосток подписали Соглашение о сотрудничестве в области разведки и добычи в Российской Федерации. По условиям соглашения CNPC получает возможность приобрести миноритарные доли в крупных нефтегазовых проектах Роснефти, в частности в Восточной и Западной Сибири. Кроме того, стороны договорились рассмотреть предложение CNPC об оказании на рыночных принципах сервисных услуг для данных месторождений в области геологоразведки, разработки и добычи углеводородов.

Роснефть и Equinor в рамках IV Восточного экономического форума подписали соглашение о сотрудничестве в области промышленной и пожарной безопасности, охраны труда и окружающей среды, а также безопасности организации перевозок, в том числе при реализации совместных нефтегазовых проектов. Обеспечение промышленной безопасности, охраны труда и окружающей среды – приоритетная задача для Роснефти во всех сферах ее деятельности. Документ предусматривает развитие взаимодействия в данной области, в том числе, обмен опытом и лучшими практиками. Стороны также согласовали формат взаимодействия, позволяющий обеспечить повышение уровня управления вопросами промышленной безопасности, охраны труда и окружающей среды.

Также в рамках IV Восточного Экономического Форума между Роснефтью и Beijing Gas Group Company Limited было подписано соглашение о создании в России совместного предприятия по строительству и эксплуатации более 160 автомобильных газонаполнительных компрессорных станций, а также возможность использования СПГ в качестве газомоторного топлива.

Rosneft Deutschland GmbH, дочернее общество Роснефти, подписало контракты с немецкими компаниями о реализации нефтехимической продукции собственного производства, начиная с 2019 г. В частности, с компанией HELM AG было подписано соглашение о реализации пропилена, производимого Rosneft Deutschland на НПЗ PCK, Bayernoil и MiRO в Германии. С Brenntag International Chemicals GmbH подписан контракт о купле-продаже ароматических углеводородов и серы производства собственного производства.

-----

Раньше:

2018, September, 14, 12:20:00

РОСНЕФТЬ - ПАО «НК «Роснефть» и Китайская Национальная Нефтегазовая Корпорация (CNPC) в рамках IV Восточного экономического форума в г. Владивосток подписали Соглашение о сотрудничестве в области разведки и добычи в Российской Федерации.

|

2018, September, 14, 12:15:00

РОСНЕФТЬ - По условиям Соглашения стороны планируют построить в России более 160 АГНКС, обсуждается также возможность использования СПГ в качестве газомоторного топлива.

|

2018, September, 7, 12:21:00

РОСНЕФТЬ - в соответствии с принятым решением Совета директоров об одобрении программы приобретения акций ПАО «НК «Роснефть» на открытом рынке (далее – «Программа») Компания назначила банк UBS в качестве независимого агента, который в рамках Программы будет осуществлять операции на открытом рынке от лица ПАО «НК «Роснефть».

|

2018, August, 8, 11:45:00

РОСНЕФТЬ - Чистая прибыль, относящаяся к акционерам Компании, во II кв. 2018 г. увеличилась в 2,8 раза к I кв. 2018 г., до 228 млрд руб. (3,6 млрд долл. США), за счет роста операционной прибыли, влияния курсовых разниц, а также признанного единовременного дохода от приобретения доли в СП по разработке месторождений с иностранным партнером и справедливой оценки ранее имевшейся доли в СП.

|

2018, August, 8, 11:40:00

РОСНЕФТЬ - Совет директоров ПАО «НК «Роснефть» в соответствии с объявленными Компанией 25 апреля 2018 г. стратегическими инициативами одобрил параметры и начало реализации программы приобретения на открытом рынке акций ПАО «НК «Роснефть», в том числе в форме глобальных депозитарных расписок, удостоверяющих права на такие акции, в максимальном объеме до 2 млрд долл. США

|

2018, May, 16, 11:30:00

РОСНЕФТЬ - ФИНАНСОВЫЕ РЕЗУЛЬТАТЫ ЗА I КВ. 2018 Г. - РОСТ ВЫРУЧКИ ЗА 1 КВ. 2018 Г. НА 22%, ДО 1,72 ТРЛН РУБ. - УВЕЛИЧЕНИЕ EBITDA ЗА 1 КВ. 2018 Г. НА 15,6% ДО 385 МЛРД РУБ. - РОСТ ЧИСТОЙ ПРИБЫЛИ БОЛЕЕ ЧЕМ В 7 РАЗ ДО 81 МЛРД РУБ. - ЗНАЧИТЕЛЬНОЕ УЛУЧШЕНИЕ СВОБОДНОГО ДЕНЕЖНОГО ПОТОКА ДО 142 МЛРД РУБ. - СОКРАЩЕНИЕ УРОВНЯ КРАТКОСРОЧНЫХ ФИНАНСОВЫХ ОБЯЗАТЕЛЬСТВ НА 49%

|

2018, May, 7, 08:20:00

РОСНЕФТЬ - Компания не имеет отношения к изменению холдинговой структуры консорциума Glencore-QIA, но, в то же время, «Роснефть» поддерживает решение своих акционеров о переходе на прямое владение акциями, динамика стоимости которых (с 15%-м ростом в долларовом выражении) показала эффективность вложений QIA и Glencore в рамках недавней приватизационной сделки.

|

CHINA'S OIL IMPORTS UP

PLATTS - China's crude oil imports surged almost 32% year on year to 9.65 million b/d or 40.8 million mt in October, preliminary data from the General Administration of Customs showed Thursday.

On a barrels-per-day basis, the inflow represented a 6.2% increase from 9.09 million b/d in September, which was within expectations.

Platts trade flow software cFlow showed previously that crude barrels delivered to China in October hit a record high of 8.88 million b/d in October.

China imports crude both by water and pipeline, while cFlow covers arrivals from the seaborne market.

The last record high was at 9.64 million b/d in April, when seaborne imports rose to 8.75 million b/d, according to cFlow data.

Robust imports in October lifted the country's crude oil imports over the January-October period to 377.16 million mt (9.09 million b/d), up 8.1% from the same period a year earlier.

However, Platts Analytics kept its projection at 9.2 million b/d for China's crude imports in Q4 to average 9.2 million b/d, which means inflows in November and December would fell from the record high in October.

"Refining demand for crude oil from the state-owned refineries in northern China is weakening as the peak season for oil products nearly ends in winter, while they are not allowed to send more products to overseas in Q4," said a Beijing-based analyst.

State-owned Sinopec, PetroChina, CNOOC and Sinochem have cut their average refinery run rates to 82% of nameplate capacity in October from 84% in September, according to the Platts survey.

However, heavy arrivals for the independent sector were likely to cap the decrease.

"Propelled by the strong buying [from the independent sector], it is likely that their imports will stay above 9 million mt [2.16 million b/d] in the coming two months," the analyst added.

Crude imports by the independent sector rose 28% on the month to a seven-month high of 2.2 million b/d in October, according to a Platts survey.

They started a buying spree in mid-August till end-September -- when refining margins were good -- for the cargoes to arrive in Q4.

Moreover, independent refineries typically look to use up their crude oil import quotas before the end of the year, so that they can secure full allocations for the next year.

After taking October arrivals into account, the quota holders had used up only 67% of their total quotas for the current year, with around 40 million mt still available for the November-December period, according to Platts data.

PRODUCT EXPORTS

China's oil product exports fell to 4 million mt in October, an eight-month low, as export availability remained tight. The October total was down by 1.7% from September but increased 7.8% year on year. It was last lower in February at 3.48 million mt.

The low exports in October were also within expectation, due to low export quota availability for the month.

Chinese oil companies usually have their export plans a month ahead of the loading days, which means they had their October loading plans in September when they were short of export quota.

Over the January-October period, China's product exports totaled 48.09 million mt, up 19% year on year, the data showed.

The GAC did not release the list of oil products included in the preliminary statistics, but market sources estimated gasoline, gasoil, jet fuel and fuel oil accounted more than 99% of the basket. The export data by product for October will be release later this month.

Market sources said they expected product exports in November would rebound as Beijing released a fresh batch of oil products export quotas in October, totaling 2.93 million mt.

With the new allocation, Chinese companies were allowed to export up to 2.2 million mt of gasoline in Q4, 3.48 million mt gasoil and 5.24 million mt jet fuel.

Among these products, the strong rebound was more likely to go to jet fuel. Its quota availability averaged 1.75 million mt/month in Q4, higher than the actual exports of 1.16 million/mt averaged in January-September.

Moreover, Q4 is Asia's peak season for jet/kerosene consumption, with increased traveling during the Christmas and New Year holiday, and higher heating demand during winter. The strong demand in international markets would also likely encourage jet/kerosene exports.

However, the rebounds were expected to be modest for gasoline and gasoil due to the relatively tight the availability for October-December, at 733,000 mt/month and 1.16 million mt/month, respectively.

In January-September, China's gasoline and gasoil exports averaged at 1.15 million mt/month and 1.59 million mt/month, respectively.

PRELIMINARY IMPORT, EXPORT DATA (million mt)

| |

Oct-18 |

Oct-17 |

Change |

Sep-18 |

Change |

| Crude imports |

40.80 |

31.03 |

31.5% |

37.21 |

9.6% |

| Crude exports |

0.14 |

0.27 |

-47.8% |

0.29 |

-50.5% |

| Net crude imports |

40.66 |

30.76 |

32.2% |

36.93 |

10.1% |

| Oil product imports |

2.55 |

1.95 |

30.8% |

2.92 |

-12.6% |

| Oil product exports |

4.00 |

3.71 |

7.8% |

4.07 |

-1.7% |

| Net oil product exports |

1.45 |

1.76 |

-17.7% |

1.15 |

25.9% |

| Fuel oil imports |

1.19 |

0.79 |

51.1% |

1.73 |

-31.0% |

| |

Jan-Oct 18 |

Jan-Oct 17 |

Change |

| Crude imports |

377.16 |

348.83 |

8.1% |

| Crude exports |

2.34 |

3.85 |

-39.3% |

| Net crude imports |

374.83 |

344.98 |

8.7% |

| Oil product imports |

27.14 |

24.35 |

11.4% |

| Oil product exports |

48.09 |

40.29 |

19.4% |

| Net oil product exports |

20.95 |

15.94 |

31.4% |

| Fuel oil imports |

13.38 |

11.07 |

20.8% |

Source: China's General Administration of Customs

-----

Earlier:

2018, November, 7, 11:25:00

REUTERS - The United States on Monday restored sanctions targeting Iran’s oil, banking and transport sectors and threatened more action. Treasury Secretary Steven Mnuchin said Washington aimed to bring Iranian oil exports to zero, but 180-day exemptions were granted to eight importers: China, India, South Korea, Japan, Italy, Greece, Taiwan and Turkey.

|

2018, October, 31, 13:10:00

PLATTS - China's Sinopec is in discussions with government authorities and suppliers regarding its Iranian crude imports and is trying to make special arrangements on the flow in the coming weeks, an executive said during the company's third quarter results briefing call

|

2018, October, 1, 11:25:00

REUTERS - China’s Sinopec Corp is halving loadings of crude oil from Iran this month, as the state refiner comes under intense pressure from Washington to comply with a U.S. ban on Iranian oil from November, said people with knowledge of the matter.

|

2018, September, 7, 12:09:00

PLATTS - China's crude imports from Iran are likely to have peaked in August at 874,000 b/d ahead of the looming re-imposition of US sanctions in November,

|

2018, August, 31, 11:20:00

PLATTS - China's consumption of oil products rose 7.2% year on year to 27.54 million mt in July, data released Tuesday by the National Development and Reform Commission showed.

|

2018, August, 22, 13:00:00

U.S. API - API emphasized the counterproductive effects of Section 301 tariffs on America’s natural gas and oil sector, underscoring the damaging impact that Chinese retaliatory tariffs would have on U.S. LNG exports, and urged the Administration not to impose additional tariffs on Chinese products at today’s hearing before the U.S. Trade Representative on Section 301.

|

2018, August, 15, 11:00:00

REUTERS - Chinese oil importers are shying away from buying U.S. crude as they fear Beijing’s decision to exclude the commodity from its tariff list in a trade dispute between the world’s biggest economies may only be temporary.

|