CONTINUED AUSTRALIA'S GROWTH

IMF - Australia: Completing the Rebalancing after the End of the Mining Investment Boom

- Australia’s recent strong growth is expected to continue in the near term, further reducing slack in the economy and leading the way to gradual upward pressure on wages and prices.

- Despite recent strong growth and declining unemployment, it is not yet the time to withdraw macroeconomic policy support given remaining slack.

- While Australia benefits from a robust regulatory framework, further bolstering of financial sector systemic risk oversight and financial supervision would be helpful.

- The cooling of the housing market is welcome and can be weathered in a strong economy. Housing supply reforms will be critical to restoring housing affordability.

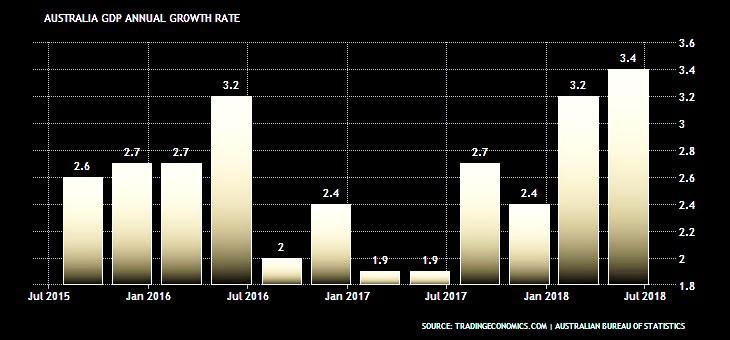

Australia is now on the final leg of its rebalancing and adjustment after the end of the commodity price and mining investment boom. Growth has picked up strongly to well above 3 percent in 2018, driven by business investment and private consumption, while the recent rebound in the terms of trade has been sustained. The strong economic momentum has resulted in further improvements in labor market conditions. Nonetheless, wage growth has remained weak, suggesting some remaining labor market slack. The disinflationary effects from continued strong retail competition still weigh on core inflation, while one-off declines in some administered prices have temporarily lowered headline inflation. After rising by 70 percent in the past ten years at the national level and by roughly 100 percent in Sydney and 90 percent in Melbourne, house prices have moderated recently in a cooling housing market. Several factors have contributed to the cooling, including tightening credit supply, increasing housing supply coming to the market, and easing foreign demand. Market dynamics have adjusted in the process.

The economy’s strong growth momentum is expected to continue in the near term. Private consumption growth is anticipated to remain buoyant, supported by strong employment gains. The rebound in non-mining private business investment and further growth in public investment is envisaged to offset a softening in dwelling investment. With growth above potential, the output gap will close and labor market slack will erode, eventually leading to upward pressure on wages and prices. Macroeconomic policies will then adjust, and growth is expected to moderate to that of potential in the medium term.

The balance of risks to economic growth is tilted to the downside with a less favorable global risk picture. A weaker-than-expected near-term outlook in China coupled with further rising global protectionism and trade tensions could delay full closure of the output gap, although there are also upside risks to the terms of trade in the near term. A sharp tightening of global financial conditions could spill over into domestic financial markets, raising funding costs and lowering disposable income of debtors, with the impact also depending on the response of the Australian dollar. On the domestic side, a stronger pickup in the non-mining business sector, larger spillovers from public infrastructure investment, and the Australian dollar depreciation in real effective terms over the past year could boost near-term growth more than projected. Domestic demand may equally turn out weaker if wage growth remained subdued or investment spillovers were smaller.

The housing market downturn is another source of risk. Under the baseline outlook, the correction remains orderly, reflecting a combination of continued strong underlying demand for housing in the context of population growth and no significant oversupply, the presence of other strong growth drivers, and a resilient banking sector continuing to extend credit to support economic growth. Nevertheless, other negative risk developments, as outlined above, could amplify the correction and lower domestic demand.

Notwithstanding recent strong growth, it is not yet the time to withdraw macroeconomic policy support given remaining slack. With the cash rate at 1.5 percent, monetary policy remains appropriately accommodative. Normalization should remain conditional on evidence of more substantive upward pressures on wages and prices, as inflation is still below the target range. The broadly neutral fiscal policy stance is welcome. With more limited conventional monetary policy space, a fiscal stimulus would likely need to be part of an effective overall policy response if major downside risks materialized.

With the economy expected to return to full employment, the government’s medium-term fiscal strategy appropriately aims to reach budget balance by FY2019/20 and run budget surpluses thereafter. Under the baseline outlook, this fiscal path would still be consistent with the Commonwealth and state governments continuing to run ambitious infrastructure investment programs and structural reforms in support of higher growth. The principle of running budget surpluses in good times has been a core element of fiscal strategies required under Australia’s fiscal framework, which has helped in preserving fiscal discipline and substantial fiscal space, notwithstanding shocks with protracted effects. Given the fiscal space, Australia remains in a position to respond flexibly in case large downside risks should materialize. A role for medium-term debt anchors as a complementary element in fiscal strategies might also be considered.

The Australian banks are well capitalized and profitable. Following the requirement for capital to be unquestionably strong, banks’ capital levels are high in relation to international comparators.

Managing financial vulnerabilities and risks from high household debt requires macroprudential policy to hold the course. Earlier prudential intervention by the Australian Prudential Regulation Authority has lowered the risks to financial stability from higher-risk household debt and other vulnerabilities, in particular reducing the share of investor and interest-only borrowing. This has supported the strengthening of lending standards and the increase in bank resilience. Nevertheless, heightened systemic risks remain from high household debt levels and banks’ concentrated exposure to mortgage lending. Given prospects of interest rates remaining low for some time, macroprudential policy should focus on expanding the available toolkit by addressing any data, legal and regulatory requirements and thus enhancing readiness to implement such measures if and when needed.

The Australian authorities have developed a robust regulatory framework, but further reinforcement in two broad domains would be beneficial.

- The systemic risk oversight of the financial sector could be strengthened. The IMF’s Financial Sector Assessment Program (FSAP) recommends buttressing the financial stability framework by strengthening the transparency of the work of the Council of Financial Regulators on the identification of systemic risks and actions taken to mitigate them. Improving the granularity and consistency of data collection and provision would support the analysis of systemic risks and formulation of policy.

- Financial supervision and financial crisis management arrangements should be further bolstered. The FSAP’s specific recommendations include increasing the independence and budgetary autonomy of the regulatory agencies, strengthening the supervisory approach, particularly in the areas of governance, risk management, and conduct, and enhancing the stress testing framework for solvency, liquidity, and contagion risks. The FSAP also recommends strengthening the integration of systemic risk analysis and stress testing into supervisory processes, completing the resolution policy framework and expediting the development of bank-specific resolution plans. Recent announcements of additional funding for the regulatory agencies are welcome.

The cooling of the housing market is welcome and contributes to improving housing affordability. In the absence of a sharp rise in unemployment, interest rates, or housing inventories, an orderly correction in housing prices will help contain macro-financial vulnerabilities. Pressures on housing affordability, which is critical for growth to remain inclusive, will be relieved in the process.

Housing supply reforms will be critical to restoring housing affordability, and progress has been ongoing. Planning, zoning, and other reforms affect supply and prices only with long lags, and underlying demand for housing is expected to remain robust. Housing supply reforms should, therefore, not be delayed because of the housing market correction. Progress has been made through better integration of policies across government levels through “city deals,” including for western Sydney and its new airport, and for Darwin. Some states should still take the opportunity for further consolidation in planning and zoning regulation. These policy efforts should be complemented by broader tax reforms that also address housing and land use. Such reforms would strengthen the effectiveness of supply-side measures and reduce structural incentives for leveraged investment by households, including in residential real estate.

There is scope to expand infrastructure spending further to stimulate productivity. Australia is a fast-growing economy supported by high population growth, and its infrastructure needs are also increasing rapidly. Even with the recent increase in the infrastructure spending envelope, an infrastructure gap will remain. Reducing the gap further would help in lowering congestion and increase the economy’s potential in the long term, as would improving the effective use of existing infrastructure. The improvements that have been made in the institutional framework for infrastructure planning and assessment support policy efforts in this respect.

Recent policy decisions should help encourage innovation. A reform of the research and development (R&D) tax credit system is with Parliament, aiming for a more efficient and targeted use of the tax credit. It will be complemented by higher funding for research infrastructure. The recommendations of the science agenda laid out in Australia 2030: Prosperity through Innovation are constructive and should be implemented, as envisaged in the government’s response to the report.

Energy policy should further reduce uncertainty for investment decisions.Governments have already made substantial progress on pricing and reliability issues. The clarification in due course of policies to achieve Australia’s greenhouse gas emissions target commitments will also help reduce uncertainty.

Broad tax reform to support productivity and inclusive growth would be desirable. The share of direct taxes in Australia’s federal tax revenue is higher than the average of OECD economies, and shifting from direct to indirect taxes would lower tax distortions and enhance productivity. The Commonwealth government has to date lowered company tax rates for SMEs and introduced personal income tax cuts. These reforms should be combined with reforms to raise the GST revenue, lower the company tax rate more broadly, and reduce tax concessions. To offset the regressive element from higher GST revenue, an income tax-based rebate scheme to reduce the negative impact on lower income groups should be considered.

Australia’s continued efforts toward further trade liberalization and promoting the global multilateral trading system are welcome. This includes supporting new WTO agreements and modernization efforts. The formal ratification of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (also known as CPTPP or TPP-11), which replaces the Trans-Pacific Partnership, sends a positive signal in a time of increasing global trade tensions.

-----

Earlier:

2018, October, 22, 11:35:00

SANTOS LNG UP BY 10%SANTOS - Strong production and revenue growth Third quarter production up 6% to 15 mmboe due to strong performance across the core assets Sales revenue up 10% to $973 million, including record quarterly LNG revenues of $405 million PNG LNG achieved record daily rates equivalent to ~9.2 mtpa annualised production

|

2018, October, 12, 11:00:00

AUSTRALIAN - VIETNAMESE NUCLEARWNN - The Australian Nuclear Science and Technology Organisation (ANSTO) and the Vietnam Atomic Energy Agency (VAEA) have signed a Memorandum of Understanding to allow further collaboration between the two organisations.

|

2018, October, 3, 08:25:00

AUSTRALIA'S RESOURCE EXPORTS: $182 BLNREUTERS - Australia’s government expects the nation’s resource and energy exports to hit a record of A$252 billion ($182 billion) in 2018-2019, buoyed by climbing prices for commodities such as natural gas and by a weaker Australian dollar.

|

2018, June, 20, 12:15:00

EXXON - AUSTRALIA LNGPLATTS - ExxonMobil's planned LNG import project in Victoria will compete with AGL's planned LNG import terminal in the same state -- at Crib Point near Melbourne -- projected to come online by financial year 2020-2021, and AIE's project next door in the state of New South Wales, potentially at Port Kembla, Newcastle or Port Botany, expected by as early as 2020.

|

2018, June, 6, 11:55:00

AUSTRALIA'S ECONOMY UPBLOOMBERG - Gross domestic product advanced 1 percent from the prior quarter, with overseas shipments accounting for half the expansion, the Australian Bureau of Statistics said in Sydney Wednesday. Economists had forecast a 0.9 percent gain. The economy expanded at an annual pace of 3.1 percent, also beating estimates for a 2.8 percent increase.

|

2018, February, 9, 10:55:00

AUSTRALIAN LNG: $111 BLNTWA - The Gorgon and Wheatstone LNG projects are now enjoying cash margins of more than $US30 a barrel at a $US50 price, Chevron says, and production from the $111 billion mega-projects is expected to increase this year.

|

2017, June, 28, 15:00:00

AUSTRALIA - CHINA LNG UPAmong China's LNG suppliers Australia has fared best, with imports rising 42.7 percent in the first five months to 5.39 million tonnes, almost double that of second-placed Qatar at 2.84 million tonnes. |