GLOBAL OIL INVENTORIES WILL UP

U.S. EIA -Global inventory builds put downward pressure on crude oil prices

In the November 2018 update of its Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) decreased its Brent spot price forecast from last month to $73 per barrel (b) in 2018, down $1/b, and $72/b in 2019, down $3/b. EIA expects that West Texas Intermediate (WTI) crude oil prices will average about $7/b lower than Brent prices next year. Brent crude oil spot prices averaged $81/b in October, up $2/b from September. Despite the increase in monthly average prices, Brent spot prices declined from $85/b on October 1 to $75/b on October 31 (Figure 1).

Crude oil prices approached four-year highs in early October because of the uncertainty about the amount of Iranian crude oil coming off the market and whether or not other producers could replace the shortfall. However, increased indications of a global economic slowdown, as well as higher than expected global petroleum supply, contributed to rapid price declines later in the month.

Crude oil production in Saudi Arabia and Russia reached some of their highest levels in history last month, helping to offset supply losses from Iran and Venezuela. Venezuela's crude oil production declines have slowed, and estimates of its crude oil exports have increased as its domestic refining system is operating at low utilization rates. Libyan production has resumed at a faster rate than expected because of improved security. Libya produced more than 1 million barrels per day (b/d) for two consecutive months in September and October. As a result of these developments, the November STEO's estimate of production from the Organization of the Petroleum Exporting Countries (OPEC) for 2018 and 2019 was revised up by 60,000 b/d to 39.1 million b/d and 40,000 b/d to 38.8 million b/d, respectively.

EIA forecasts the Brent crude oil price will average $72/b in 2019, which is $3/b lower than previously forecasted, and forecasts the WTI crude oil price to average $65/b in 2019, which is $5/b lower than previously forecasted. The lower STEO crude oil price forecasts are partly the result of higher expected crude oil production in the United States in the second half of 2018 and in 2019. The increased U.S. crude oil production is expected to contribute to global crude oil inventory growth and put downward pressure on crude oil prices.

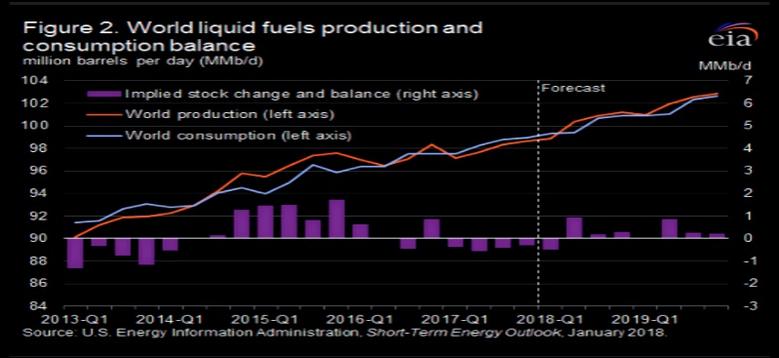

EIA forecasts that total global liquid fuels inventories will remain nearly flat in 2018. Although the previous STEO forecasted a stock draw of 200,000 b/d in 2018, EIA observed larger-than-anticipated stock builds in October. As a result, the November STEO forecasts a slight stock build of 20,000 b/d in 2018. The November STEO forecasts that in 2019 global liquid fuels inventories will increase by 640,000 b/d compared with the 280,000 b/d increase that was forecasted in the October STEO (Figure 2). The increase in expected global inventory growth is the result of both lower expectations for global crude oil demand and higher crude oil supply estimates.

U.S. crude oil production increased at a faster rate than EIA previously anticipated, putting further downward pressure on crude oil prices. Crude oil production reached a new monthly record of 11.3 million b/d in August 2018, according to EIA's latest Petroleum Supply Monthly, which was 0.3 million b/d higher than EIA forecasted in the October STEO. EIA now estimates that October U.S. crude oil production averaged 11.4 million b/d, compared with a forecast of 11.0 million b/d in the previous STEO. EIA now forecasts U.S. crude oil production to average 10.9 million b/d in 2018 and 12.1 million b/d in 2019, an increase of 160,000 b/d and 300,000 b/d, respectively, from last month's forecast.

In addition to greater than anticipated crude oil production, a heavy maintenance season for refineries in the Midwest, Petroleum Administration for Defense District (PADD) 2, contributed to the U.S. crude oil inventory increases. The four-week average refinery utilization for the week ending October 26 was 73%, which, if confirmed in EIA's monthly data, would be the lowest utilization rate in the region for any month recorded in EIA data back to 1985. The drop in refinery utilization was driven by planned month-long maintenance activities in several large refineries. As a result, total U.S. commercial crude oil inventories increased for six consecutive weeks from September 21, 2018, through October 26, 2018, and pushed the U.S. inventories higher than their five-year (2013-17) average. U.S. crude oil inventories are forecast to increase from 421 million barrels in 2018 to 472 million barrels in 2019.

Although EIA does not collect data about changes in global petroleum inventories directly, inventory data for the United States and other countries within the Organization for Economic Cooperation and Development (OECD) are available and provide some insight into global supply. In terms of days of supply, EIA expects OECD inventories to surpass their five-year average and climb to near the top of the five-year range in 2019 (Figure 3). Global inventories are also projected to increase (as indicated by the implied stock changes in Figure 2) and put downward pressure on crude oil prices.

Slowing demand growth also contributes to EIA's lower crude oil price forecast. Chinese economic growth was less than expectations, and leading economic indicators for several countries have slowed, leading to market concerns about the pace of oil demand growth in the coming months. Continued depreciation in emerging market countries' currencies—which makes the cost of crude oil imports more expensive—has also put downward pressure on the petroleum demand outlook. EIA is forecasting growth in global petroleum and other liquid fuels consumption to average 1.4 million b/d in 2019, which is 0.1 million b/d lower than forecast in the October STEO (Figure 4).

-----

Earlier:

2018, November, 15, 15:47:00

OPEC: OIL DEMAND 2019: 100 MBDOPEC - In 2018, oil demand growth is anticipated to increase by 1.50 mb/d y-o-y, a downward revision from the previous month of 40 tb/d, mainly due to weaker-than-expected oil demand data from the Middle East and, to a lesser extent, China during 3Q18. Expected total oil demand for the year is anticipated to reach 98.79 mb/d. In 2019, world oil demand growth is forecast to grow by 1.29 mb/d y-o-y, about 70 tb/d lower than last month’s projection, with total world consumption to reach 100.08 mb/d. |

2018, October, 22, 12:10:00

U.S. OIL PRODUCTION 11 MBDAPI - The American Petroleum Institute’s latest monthly statistical report shows the U.S. produced a record 11.0 million barrels of crude oil per day (mb/d) in September. U.S. liquid fuels production grew 2.2 mb/d year-over-year (y/y), and the U.S. met virtually all global oil demand growth. As supply increased, crude oil inventories also rose in September but remained nearly 14 percent below those of September 2017.

|

2018, October, 4, 14:40:00

U.S. OIL INVENTORIES DOWNU.S. EIA - Crude oil inventories held at Cushing, Oklahoma, decreased by more than half since this time last year, recently falling to lows last reached in 2014. Logistical factors and strong demand for crude oil from both domestic refining and exports markets have contributed to the steep year-over-year decrease.

|

2018, June, 6, 12:20:00

OPEC - RUSSIA OPINIONREUTERS - “We have to look into the situation which has panned out on the market today, from the point of view of the volume cuts, inventories decline, shortages on the market, and to adjust the figures,” Novak told reporters.

|

2018, May, 28, 11:20:00

OIL INVENTORIES DOWNPLATTS - "With Saudi Arabia stressing the need for more capex to meet future oil demand and replace the natural decline from aging fields, and thus presumably a higher price to incentivize investment, supply cuts, in one form or another, may be extended to 2019," the note said.

|

2018, May, 23, 10:30:00

RUSSIA'S OIL BENEFITBLOOMBERG - Oil has touched a level above $80 a barrel for the first time since November 2014. OPEC’s inventory target for output cuts has been met.

|

2018, May, 18, 09:15:00

MARKETS IN BALANCEEIA - The extended period of oversupply in global petroleum markets that began before the Organization of the Petroleum Exporting Countries (OPEC) November 2016 agreement to cut production has ended, and the large buildup of global inventories during that period has now been drawn down. As OPEC plans to reconvene on June 22, markets now appear more in balance, but uncertainty remains going forward. |