OIL PRICE: NEAR $65

REUTERS - Oil struggled to find its footing on Wednesday after plunging 7 percent the previous session, with surging supply and the specter of faltering demand scaring off investors.

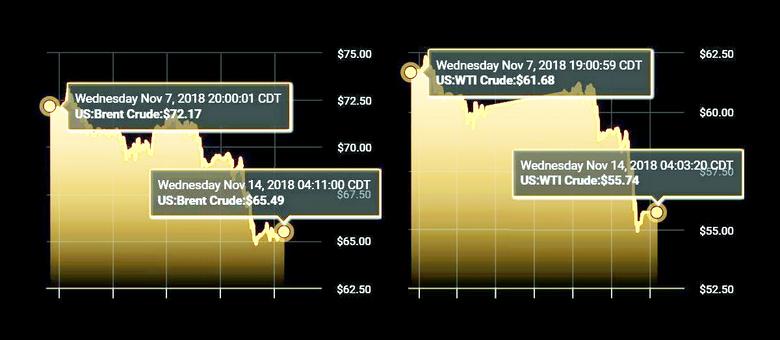

U.S. West Texas Intermediate (WTI) crude oil futures were at $55.52 per barrel at 0732 GMT, down 17 cents, or 0.3 percent, from their last settlement.

International benchmark Brent crude oil futures LCOc1 were down 9 cents at $65.38 per barrel.

Crude oil has lost over a quarter of its value since early October in what has become one of the biggest declines since a price collapse in 2014.

"Crude oil futures succumbed to overwhelmingly bearish pressure amidst ... weaker market fundamentals," said Benjamin Lu, analyst at brokerage Phillip Futures in Singapore.

The slump in spot prices has turned the entire forward curve for crude oil upside down.

Spot prices in September were significantly higher than those for later delivery, a structure known as backwardation that implies a tight market as it is unattractive to put oil into storage.

By mid-November, the curve had flipped into contango, when crude prices for immediate delivery are cheaper than those for later dispatch. That implies an oversupplied market as it makes it attractive to store oil for later sale.

Oil markets are being pressured from two sides: a surge in supply and increasing concerns about an economic slowdown, as seen with the economic contractions in powerhouses Japan and Germany during the third quarter as well as in China's falling car sales.

U.S. crude oil output from its seven major shale basins is expected to hit a record 7.94 million barrels per day (bpd) in December, the U.S. Department of Energy's Energy Information Administration (EIA) said on Tuesday.

That surge in onshore output has helped overall U.S. crude production hit a record 11.6 million bpd, making the United States the world's biggest oil producer ahead of Russia and Saudi Arabia.

Most analysts expect U.S. output to climb above 12 million bpd within the first half of 2019.

"This will, in our view, cap any upside above $85 per barrel (for oil prices)," said Jon Andersson, head of commodities at Vontobel Asset Management.

The surge in U.S. production is contributing to rising stockpiles.

Official storage data is due on Wednesday from the Energy Information Administration, with analysts expecting a 3 million barrel rise in commercial crude inventories.

The producer cartel of the Organization of the Petroleum Exporting Countries (OPEC) has been watching the jump in supply and price slump with concern.

OPEC has been making increasingly frequent public statements that it would start withholding crude in 2019 to tighten supply and prop up prices.

"OPEC and Russia are under pressure to reduce current production levels, which is a decision that we expect to be taken at the next OPEC meeting on Dec. 6," said Andersson.

That puts OPEC on a collision course with U.S. President Donald Trump, who publicly supports low oil prices and who has called on OPEC not to cut production.

-----

Earlier:

2018, November, 12, 12:30:00

OIL PRICE: NEAR $71REUTERS - Front-month Brent crude futures LCOc1, a benchmark for global oil prices, were at $71.59 per barrel at 0749 GMT, up 2 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures rose 1.6 percent to $61.15 per barrel.

|

2018, November, 12, 12:25:00

CONFORMITY LEVEL 104%OPEC - In advance of the scheduled meetings in December 2018, the JMMC directed the JTC to continue closely monitoring oil market conditions and further refine the scenario analysis based on updated data, with regard to options on new 2019 production adjustments, which may require new strategies to balance the market. |

2018, November, 12, 12:20:00

РОССИЙСКО-САУДОВСКИЕ ПЕРСПЕКТИВЫМИНЭНЕРГО РОССИИ - «Российско-саудовские отношения обладают солидными перспективами в сфере энергетики. Нами рассматриваются ряд масштабных совместных проектов, которые выведут российско-саудовское сотрудничество на принципиально новый уровень», - отметил российской министр.

|

2018, November, 12, 12:15:00

SAUDIS CUTS OILPLATTS - Saudi Arabia expects to cut its oil exports next month but emerging signs of a crude glut in the US are not an indication that the global oil market is currently oversupplied, the kingdom's energy minister Khalid al-Falih said Sunday, attributing a two-week slide in oil prices to trader overreaction.

|

2018, November, 12, 12:10:00

OIL PRICES WILL UPCNBC - "In the 2020's we are going to have a clear physical shortage of oil because nobody is allowed to fully invest in future oil production," Michele Della Vigna, Head of EMEA Natural Resources Research at Goldman Sachs told CNBC Friday.

|

2018, November, 9, 15:45:00

OIL PRICE: NEAR $69REUTERS - Brent dropped $1.52 to a low of $69.13 before recovering to around $69.60 by 1135 GMT, down 4.5 percent for the week and approaching 16 percent this quarter. U.S. light crude CLc1 fell to an eight-month low below $60 a barrel, hitting a trough of $59.28, down $1.39 and off more than 20 percent since early October. That puts the U.S. contract officially in “bear market” territory, borrowing a definition commonly used in stock markets.

|

2018, November, 9, 15:35:00

SAUDIS OIL RECORD: 10.67 MBDPLATTS - Saudi Arabia pumped 10.67 million b/d in the month, its most in the 30-year history of the Platts OPEC survey, while key ally the UAE also set an all-time high at 3.17 million b/d. Libya produced its most since June 2013 at 1.10 million b/d. |