MAJOR PLAYER: RUSSIA

WSJ - Russia is expanding its foothold in the fast-growing natural gas market despite Western efforts to limit Moscow's energy influence.

Directly squaring off against U.S. shale exporters, Russia has emerged this year as a major player in the burgeoning market for liquefied natural gas, which is exported across the oceans on special ships. Meanwhile, Russia has been pumping gas into Europe at a record pace in existing pipelines, and to the East it's close to opening a major pipeline into China, the world's fastest-growing major gas market.

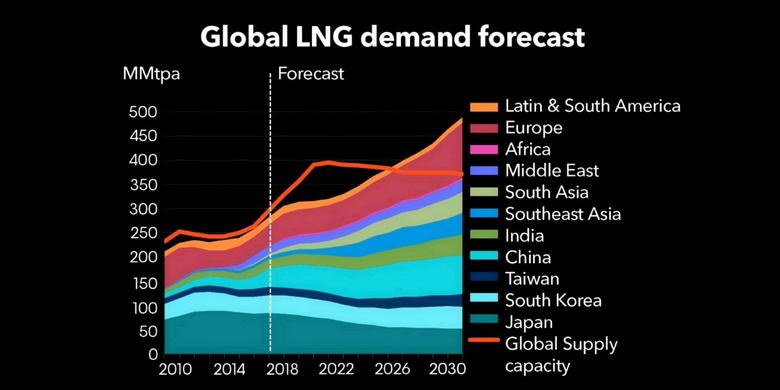

Natural gas, a vital energy source for homes, factories and power plants, is the world's fastest-growing fossil fuel. Supplying it to the West, and increasingly to Asian powers like China and India, gives Russia hard cash and a seat at the geopolitical table.

"Our main goal is to preserve our current markets, primarily Europe, and to gain a foothold in new ones, especially Asia," said Alexey Teksler, Russia's first deputy Minister of Energy in an interview at his Moscow office. A giant map of Russia's gas connections to Europe and Asia covered one wall.

Washington has been looking to curb Russia's expansion, pressuring Berlin to halt construction of Nord Stream 2, a major gas pipeline connecting Germany with Russia. The U.S. has used trade negotiations to squeeze promises from the European Union and Asian countries to buy more U.S. gas.

But so far, only a handful of U.S. gas cargoes have reached European shores. In an investor presentation earlier this year, Russian state-owned energy giant Gazprom illustrated U.S. gas exports into Europe as a few drops of water beside a steaming teacup that depicted Russian exports.

In June, India received its first shipment of Russian LNG under a $25 billion contract, having previously imported U.S. gas.

China recently imposed tariffs on U.S. LNG, which could also provide an opening for Russia to supply it with more gas.

"They've ramped up their efforts. It looks like Russia's ambitions are being realized bit by bit," Tim Boersma, a researcher at Columbia University's Center on Global Energy Policy.

Oil and gas brings in around 40% of Russia's budget revenues, and a good chunk of that comes from the country's 35% share of the European gas market.

Two years ago, when the first cargoes of U.S. LNG left a Louisiana terminal for Europe, European politicians predicted that this dominance was set to end in a wave of new gas from American shale fields, as well as from Qatar, the world's largest gas producer.

Around the same time the EU imposed regulations on Moscow's gas infrastructure. It later settled an antitrust case against Gazprom, Russia's biggest gas exporter, that clinched promises of cheaper and freer natural-gas flows.

Russia has quickly adapted to the restrictions and new competition. It's increasingly moving to auctions, where gas is offered to the highest bidder, and away from its traditional model of locking customers into long-term contracts linked to oil prices. That has given its customers more flexibility and lowered their prices.

"Russia is ready for fair competition," said. Mr. Teksler, the Ministry of Energy official.

Gazprom's average selling price fell by almost 50% since 2013, according to the company's annual reports. That compares with a 20% fall in U.S. Henry Hub benchmark prices over the same period.

The company's share price has risen by almost 20% over the past year while Russia's RTS stock index has been broadly flat.

The country has also invested heavily in its gas industry, including Gazprom's $55 billion 3,000 km-long Power of Siberia pipeline to China. It's due to begin operations in December 2019, passing through some of the world's most inhospitable terrain, where temperatures fall to as low as minus 62 degrees Celsius.

Last year, Russian President Vladimir Putin launched the Yamal LNG facility, which will deliver gas from an icy Arctic peninsula to the Asian market. Russia is also working on connecting its major gas developments on the Pacific Island of Sakhalin with China via a pipeline.

"China will be the main source of energy growth in the next 20-25 years" Pavel Sorokin, another Minister of Energy official, said in an interview. "This puts us in the same position as with Europe—whoever can offer the most competitive price, gets the market share."

Price has been Russia's competitive advantage. The June delivery to India, the first under a 20-year deal, was priced at around $7 per million British thermal units, around $1 to $1.50 cheaper than comparable deliveries from Qatar or the U.S., analysts say.

The Gazprom price "is very competitive," Indian oil minister Dharmendra Pradhan told Indian media in June as he watched the giant tanker LNG Kano dock in the West Indian port of Dahej.

The industry in Russia has its own challenges. There are currently about six LNG projects in development or on the drawing board in Europe, most of them in countries that are in Russia's former sphere of influence, that can turn to gas shipments from the U.S. and Qatar, analysts say.

-----

Earlier:

2018, November, 23, 12:15:00

GAZPROM INVESTMENT: RUB 1,325.724 BLNGAZPROM - Pursuant to the draft investment program for 2019, the overall amount of investments will stand at RUB 1,325.724 billion, with RUB 963.019 billion intended for capital investments, RUB 151.505 billion for the acquisition of non-current assets, and RUB 211.2 billion for long-term financial investments. |

2018, November, 23, 12:10:00

START OF YAMAL LNG - 3NOVATEK - PAO NOVATEK (“NOVATEK” and/or the “Company) announced that its joint venture Yamal LNG has commenced initial production of LNG at the plant’s third LNG train. The total nameplate capacity of all three LNG trains is 16.5 mmtpa, or 5.5 mmtpa per LNG train. |

2018, November, 22, 11:25:00

GAZPROM: THE LARGESTGAZPROM - the growth in natural gas consumption around the world continued unabated. In 2016–2017, it added more than 3 per cent on a yearly basis. The growth rate for 2018 may be even higher. |

2018, November, 19, 11:40:00

RUSSIAN GAS FOR EVERYONEBLOOMBERG - The $11 billion pipeline is one of three giant projects helping the world’s biggest gas producer strengthen its grip on Europe and Asia. Thousands of miles to the east, the Power of Siberia pipeline will connect with China, and a project under the Black Sea will deliver fuel to Turkey and southeast Europe.

|

2018, October, 26, 12:50:00

БОЛЬШЕ РУССКОГО СПГМИНЭНЕРГО РОССИИ - «Мировой спрос на СПГ к 2035 году удвоится и составит 600 млн тонн, основным локомотивом станут страны АТР, Китай и Индия в частности. При этом, строящийся и одобренные СПГ-заводы обеспечат потребность в газе только до середины следующего десятилетия. После 2025 года для России появляется окно возможностей, суммарно для удовлетворения спроса нужно будет построить еще 250 млн т», - отметил Министр. Россия может обеспечить до 40% от уровня дополнительного спроса, заявил Александр Новак.

|

2018, October, 26, 12:10:00

NOVATEK'S PROFIT RUB 45.9 BLNNOVATEK - In the third quarter and the nine months of 2018, profit attributable to shareholders of PAO NOVATEK increased to RR 45.9 billion (RR 15.23 per share), or by 21.6%, and to RR 121.1 billion (RR 40.17 per share), or by 8.1%, respectively, as compared to the corresponding periods in 2017. |

2018, October, 24, 11:30:00

РУССКИЙ ГАЗ БЕЗАЛЬТЕРНАТИВЕНМИНЭНЕРГО РОССИИ - Наш товар безальтернативен. Ни американцы, ни катарцы, ни норвежцы, ни африканцы не могут поставить такие объемы за такую низкую цену. Поэтому надо дать возможность нашим партнёрам сходить ко всем трём продавцам, попробовать договориться. Они в итоге все равно к нам вернутся, лишние деньги никто тратить не хочет. |