MEXICO'S GAS DOWN

РОСАТОМ - Команда экспертов Международного агентства по атомной энергии (МАГАТЭ) подтвердила приверженность АО «Концерн Росэнергоатом» (входит в Электроэнергетический дивизион Росатома) принципам безопасности. Эксперты также выявили несколько хороших практик концерна, которые могут принести пользу всему мировому ядерному сообществу.

Напомним, 11-27 ноября 2018 года Росэнергоатом впервые принял у себя миссию OSART МАГАТЭ. Итоги 17-дневной миссии были подведены 27 ноября 2018 года.

В команду миссии вошли 12 экспертов и два наблюдателя - из Германии, Китая, Канады, ЮАР, Словении, Великобритании, Франции, Японии, Чехии, Словакии и Ирана. Проверка Концерна и трех его филиалов - Балаковской, Кольской и Смоленской АЭС - проводилась по следующим девяти направлениям: «Корпоративное управление», «Независимый ядерный надзор», «Человеческие ресурсы», «Коммуникации», «Техническое обслуживание и ремонт», «Техническая поддержка», «Опыт эксплуатации», «Закупки» и «Управление авариями и противоаварийная готовность».

Эксперты интервьюировали персонал центрального аппарата и атомных станций, наблюдали за совещаниями в центральном аппарате Росэнергоатома и на атомных станциях, анализировали документацию, связанную с конкретным направлением оценки, а также изучали способы и содержание коммуникаций с заинтересованными сторонами. При этом они не оценивали Концерн на соответствие требованиям регулирующего органа или безопасность конкретной АЭС, и не сравнивали эксплуатационную безопасность российских станций с другими атомными станциями мира.

Особое внимание было уделено эффективности применения политик по безопасности, отношению персонала к работе и способности ее выполнять, методам поддержки, мотивации и контроля, используемым руководством, а также поведению персонала, состоянию объектов и сооружений АЭС.

Помимо трех лучших практик по всем девяти направлениям также было выявлено 32 области хорошей работы. В ходе работы эксперты также определили шесть областей, где возможны дальнейшие улучшения: корпоративное управление, независимый ядерный надзор, ремонты, опыт эксплуатации, противоаварийная готовность и закупки.

На пресс-конференции, посвященной подведению итогов, руководитель группы экспертов МАГАТЭ Питер Таррен отметил: «С точки зрения МАГАТЭ эта миссия прошла очень успешно. Эксперты пришли к выводу, что в Росэнергоатоме всё очень хорошо работает. Каждая организация может стремиться к улучшению, но то, что я увидел здесь, в Концерне - это реальная приверженность принципам безопасности. Особо отмечу, что мы обнаружили очень хорошие практики, используемые в Концерне, которые будут полезны для мировой общественности, и позволят повышать ядерную безопасность не только на уровне конкретного государства, но и в мировом масштабе: две из них - в области коммуникаций, и в одна – в области закупок».

Команда передала проект отчета руководству Концерна, которое направит свои комментарии по проекту отчета на рассмотрение МАГАТЭ. Итоговый отчёт будет направлен Правительству РФ в течение трех месяцев. Отчеты миссий OSART являются общедоступными.

«Прошедшая в Концерне «Росэнергоатом» миссия OSART стала для нашей компании не только очередным шагом на пути к совершенствованию работы по различным направлениям, но уникальной возможностью впервые пройти независимую оценку всей компании со стороны МАГАТЭ, - сказал генеральный директор АО «Концерн Росэнергоатом» Андрей Петров. - До этого в мире были проведены лишь две подобных корпоративные миссии - в чешской компании CEZ и во французской EDF. Выполнение предложений, сделанных командой МАГАТЭ, поможет нам и в дальнейшем повышать уровень эксплуатационной безопасности АЭС, а выявленные хорошие практики будут содействовать повышению уровня безопасности во всем мире».

Для справки:

Миссия OSART (Operating SАfety Review Team) - старейший вид миссий МАГАТЭ, признанных во всем мире мощным инструментом независимой оценки эксплуатационной безопасности атомных станций. Она нацелена на дальнейшее развитие и совершенствование безопасности АЭС путем распространения передового опыта. Организует проведение миссии МАГАТЭ - межправительственная организация системы ООН, которая уже на протяжении нескольких десятилетий вырабатывает нормы безопасности, и обеспечивает применение этих норм к любому виду деятельности в области атомной энергии.

Миссия OSART в Концерне «Росэнергоатом» прошла по приглашению Правительства РФ и Госкорпорации «Росатом». Цель корпоративной миссии - вместе с экспертами МАГАТЭ найти области для дальнейшего совершенствования работы эксплуатирующей организации в сфере ядерной безопасности. В России опыт проведения миссий уже есть у Ленинградской, Балаковской, Ростовской, Смоленской, Кольской и Нововоронежской АЭС.

АО «Концерн Росэнергоатом» – ведущее предприятие крупнейшего дивизиона «Электроэнергетический» Госкорпорации «Росатом». Концерн является крупнейшей генерирующей компанией в России и 2-й в мире по объему атомных генерирующих мощностей. В его состав входят все 10 атомных станций России, которые наделены статусом филиалов, а также предприятия, обеспечивающие деятельность генерирующей компании. В общей сложности на 10 АЭС России в эксплуатации находятся 35 энергоблоков суммарной установленной мощностью около 30 ГВт. В настоящее время на АЭС России производится порядка 19% от всего объема выработки электроэнергии в стране.

-----

Раньше:

2018, November, 22, 11:35:00

МИНЭНЕРГО РОССИИ - «В реализации проекта сооружения АЭС «Аккую» достигнут существенный прогресс с точки зрения выполнения основной задачи – физического пуска первого энергоблока в 2023 году к 100-летней годовщине Турецкой Республики. Ведется работа над привлечением инвесторов в проект, а также обучением будущих кадров на территории России», - рассказал Министр.

|

2018, November, 16, 09:40:00

МИНЭНЕРГО РОССИИ - Россия расширяет сотрудничество с Малайзией в энергетической сфере, причем не только по линии нефтегазового сектора, но и в использовании мирного атома, отметил по итогам встречи Александр Новак. По его словам, российские компании заинтересованы в дальнейшем развитии отношений, в том числе в части добычи и поставок продуктов ТЭК.

|

2018, October, 29, 12:35:00

МИНЭНЕРГО РОССИИ - В газовой сфере сотрудничество России и Болгарии насчитывает более 40 лет, поставки ведутся с 1974 года. За это время в страну поставлено около 167 млрд куб. м российского природного газа. В прошлом 2017 году Россия поставила Болгарии 3,3 млрд куб. м.

|

2018, October, 8, 11:00:00

PLATTS - The two leaders, who met during a state visit to India by Putin, said in a statement that companies should "consider a wide range of opportunities for cooperation, including long-term contracts, joint ventures and acquisitions of energy assets in both countries, as well as possible cooperation in third countries".

|

2018, October, 4, 14:50:00

МИНЭНЕРГО РОССИИ - Александр Новак отметил, что двустороннее сотрудничество в сфере энергетики между Россией и Венгрией развивается в позитивном ключе. Работа ведется по основным отраслям ТЭК – газовой и нефтяной, а также в сфере атомной промышленности.

|

2018, August, 15, 10:50:00

ASIAN REVIEW - Russia accounts for 67% of the world's nuclear plant deals currently in development. By 2030, Rosatom aims to increase its overseas sales to two-thirds of total sales, from 50% at currently. Vladimir Putin's government is looking to expand Russian influence through nuclear diplomacy, vying with China -- which is promoting its own nuclear plants -- for the status of nuclear energy superpower.

|

2018, July, 6, 11:40:00

РОСАТОМ - Госкорпорация "Росатом" рассчитывает в ближайшее время заключить контракты на строительство АЭС с новыми странами. На данный момент Росатом занимает 67% мирового рынка сооружения атомных станций, доложил премьер-министру РФ Дмитрию Медведеву глава Госкорпорации Алексей Лихачёв.

|

MEXICO'S GAS DOWN

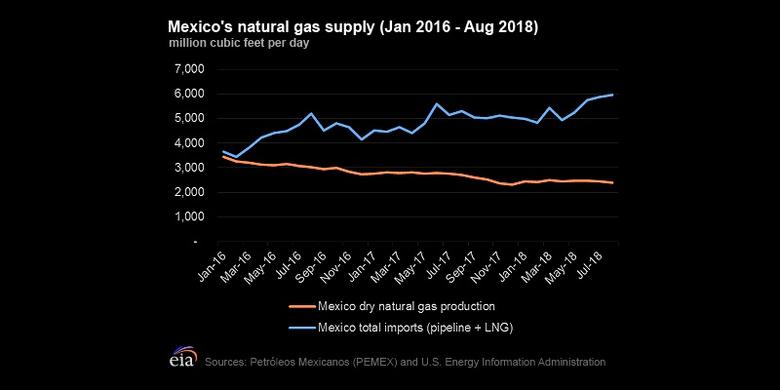

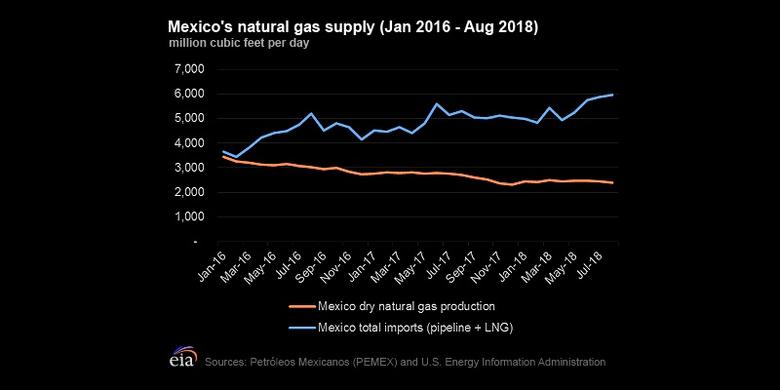

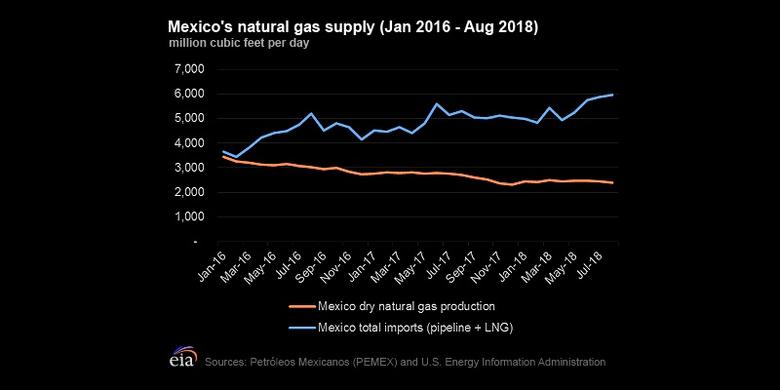

U.S. EIA - Dry natural gas production in Mexico has fallen 38% since 2012 because of declining reserves, a low price environment, and limited exploration and production of new wells. Mexico's dry natural gas production was 2.4 billion cubic feet per day (Bcf/d) in October 2018, according to Petróleos Mexicanos (PEMEX). This level is down 7% from year-ago levels, when production averaged 2.5 Bcf/d, and down 21% from two years ago, when production averaged 3.0 Bcf/d.

President-elect Andrés Manuel López Obrador from the National Regeneration Movement, a Social Democratic party, is set to take office on December 1. One of his initiatives is to reevaluate Mexico's current energy reforms, enacted in 2013 by the previous administration.

Because of declining production and increasing demand, Mexico has had to rely on natural gas imports—from the United States by pipelines and liquefied natural gas (LNG) shipments by vessel—to meet demand. EIA's data show that for the month of August, U.S. natural gas pipeline exports to Mexico grew 13% from year-ago levels as a result of several new pipeline projects that have entered service. U.S. pipeline exports to Mexico were 5.1 Bcf/d in August 2018 compared with 4.5 Bcf/d in August 2017. They comprised an average of 60% of Mexico's natural gas supplies in 2018 through August, compared with 58% for the entirety of 2017.

LNG imports are generally more expensive than pipeline natural gas imports because of the infrastructure required to liquefy and re-gasify natural gas and the relatively high transportation costs associated with using specialized LNG vessels. The President-elect has denounced the high cost of LNG.

LNG imports into Mexico are currently necessary to meet demand. The interior of Mexico relies primarily on LNG imports from the west coast's Manzanillo terminal until domestic pipelines connecting to pipeline supplies from the United States are placed in service. More specifically, Wahalajara, the pipeline corridor connecting Permian natural gas from the Waha hub in western Texas to the population centers of Mexico City and Guadalajara, is currently scheduled to be in service in May 2019, according to S&P Global Platts.

Before 2016, Mexico's LNG imports averaged 0.7 Bcf/d annually and did not include any U.S LNG imports. Mexico began receiving U.S. LNG in August 2016 after the first liquefaction facility in the Lower 48 was placed in service earlier in the year. Since then, LNG imports from the United States have been growing and currently account for 77% of the total Mexican LNG imports as of August 2018, up from 63% in 2017, based on data from EIA and Mexico's Secretaría de Economía. LNG imports in August 2018 totaled 0.86 Bcf/d, an increase compared with year-ago levels of 0.8 Bcf/d.

To transition from LNG imports to increased natural gas via pipeline, Mexico has made US $10 billion in capital investments in its natural gas pipeline infrastructure. It added 2,883 miles of pipeline since 2013, expanding the system by 41%. However, most domestic pipelines under construction have faced long delays. For example, on November 19, TransCanada Corporation announced it had halted construction on the Tuxpan-Tula and Tula-Villa de Reyes pipelines.

EIA's Annual Energy Outlook projects U.S. pipeline exports to Mexico to average 4.7 Bcf/d in 2018, 5.5 Bcf/d in 2019, and 6.0 Bcf/d in 2020.

-----

Earlier: