OIL MARKET UNCERTAINTY

CNBC - The oil market looks poised to swing into oversupply next year as growing global crude output swamps shaky demand, a committee of allied producer nations said on Sunday.

The committee of several OPEC members and other crude exporters says a larger group of roughly two dozen nations may have to launch a fresh round of output cuts in order to keep the oil market balanced. The announcement comes as rising supply and a weaker outlook for demand have contributed to a sharp pullback in oil prices that has plunged U.S. crude into a bear market.

The committee's communique sets up a potential agreement to throttle back production when the entire group meets next month.

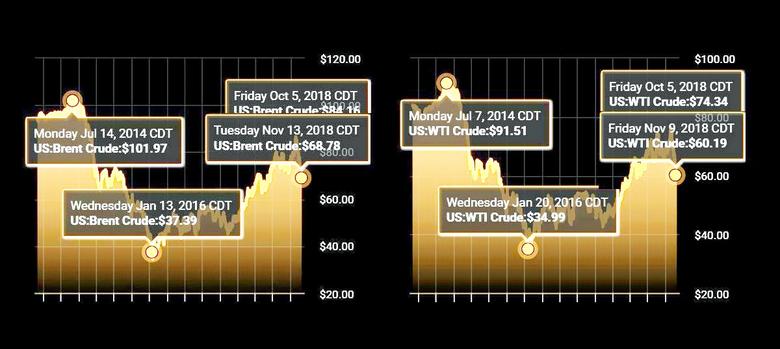

OPEC and a group of oil producers including Russia began cutting their output in January 2017 in order to drain a global crude glut that sent oil prices from over $100 a barrel to under $30. In June, the group agreed to restore some of that output after its members cut more deeply than they intended and as oil prices hit 3-½-year highs.

Since then, the world's top three oil producers — the United States, Russia and Saudi Arabia — have all hit new production records. Meanwhile, U.S.-China trade tensions, rising interest rates and currency weakness in emerging markets have raised concerns about a slowdown in global economic growth and oil demand.

Last month, the committee tasked with monitoring compliance to the oil alliance's production quotas said the group may have to reverse course and begin cutting output again. On Sunday, it said the current situation "may require new strategies to balance the market."

"The Committee reviewed current oil supply and demand fundamentals and noted that 2019 prospects point to higher supply growth than global requirements, taking into account current uncertainties," the Joint Ministerial Monitoring Committee said.

"The Committee also noted that the dampening of global economic growth prospects, in addition to associated uncertainties, could have repercussions for global oil demand in 2019 – and could lead to widening the gap between supply and demand."

Saudi Arabia, OPEC's biggest producer and the world's top crude exporter, intends to cut shipments by 500,000 barrels a day in December, Khalid al Falih, the country's energy minister said on Sunday.

Falih told CNBC on Sunday the market overreacted last month when it sent oil prices to four-year highs. He said the more than 20-percent pullback in prices over the last five weeks shows investors are now overreacting in the other direction.

Russian Energy Minister Alexander Novak said on Sunday he wasn't convinced the oil market would be oversupplied in 2019. Russia is the world's second biggest oil producer after the United States and, along with Saudi Arabia, plays an influential role in the oil alliance.

Oil prices rallied to their highest levels since late 2014 through the beginning of October, fueled by concerns that U.S. sanctions on Iran would leave some parts of the world short of oil. The sanctions went into effect this month, but the Trump administration is allowing eight nations to continue importing some Iranian oil over the next 180 days, further easing fears of impending shortages.

Crude futures have plunged over the last five weeks amid a wider sell-off in global markets that saw investors shed risky assets. The oil market rout has continued on signs of growing supply and forecasts for lower-than-anticipated growth in crude demand.

-----

Earlier:

2018, November, 12, 12:25:00

CONFORMITY LEVEL 104%OPEC - In advance of the scheduled meetings in December 2018, the JMMC directed the JTC to continue closely monitoring oil market conditions and further refine the scenario analysis based on updated data, with regard to options on new 2019 production adjustments, which may require new strategies to balance the market. |

2018, November, 12, 12:20:00

РОССИЙСКО-САУДОВСКИЕ ПЕРСПЕКТИВЫМИНЭНЕРГО РОССИИ - «Российско-саудовские отношения обладают солидными перспективами в сфере энергетики. Нами рассматриваются ряд масштабных совместных проектов, которые выведут российско-саудовское сотрудничество на принципиально новый уровень», - отметил российской министр.

|

2018, November, 12, 12:15:00

SAUDIS CUTS OILPLATTS - Saudi Arabia expects to cut its oil exports next month but emerging signs of a crude glut in the US are not an indication that the global oil market is currently oversupplied, the kingdom's energy minister Khalid al-Falih said Sunday, attributing a two-week slide in oil prices to trader overreaction.

|

2018, November, 12, 12:10:00

OIL PRICES WILL UPCNBC - "In the 2020's we are going to have a clear physical shortage of oil because nobody is allowed to fully invest in future oil production," Michele Della Vigna, Head of EMEA Natural Resources Research at Goldman Sachs told CNBC Friday.

|

2018, November, 9, 15:35:00

SAUDIS OIL RECORD: 10.67 MBDPLATTS - Saudi Arabia pumped 10.67 million b/d in the month, its most in the 30-year history of the Platts OPEC survey, while key ally the UAE also set an all-time high at 3.17 million b/d. Libya produced its most since June 2013 at 1.10 million b/d.

|

2018, November, 9, 15:25:00

IRAN SANCTIONS ANEWPLATTS - US sanctions are expected to bring Iranian crude exports down to 1.1 million b/d in November, and 850,000 b/d in the fourth quarter of 2019, down from an average of 2.686 million b/d in April and May,

|

2018, November, 9, 15:20:00

GLOBAL OIL INVENTORIES WILL UPU.S. EIA - Global inventories are projected to increase and put downward pressure on crude oil prices. |