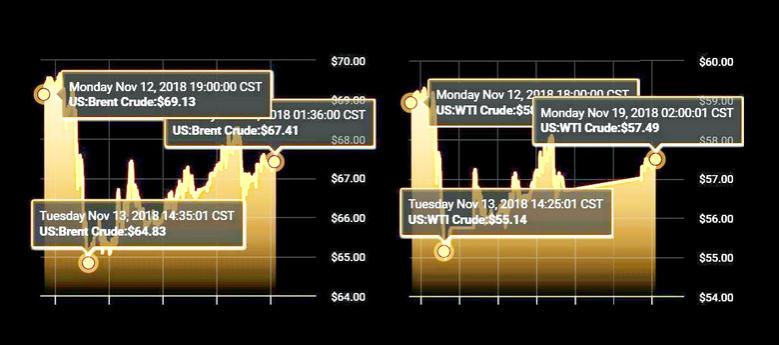

OIL PRICE: ABOVE $67

REUTERS - Oil prices rose by around 1 percent on Monday amid expectations that top exporter Saudi Arabia will push producer club OPEC as well as perhaps Russia to cut supply toward year-end.

Front-month Brent crude oil futures were at $67.41 per barrel at 0746 GMT, up 65 cents, or 1 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures, were up 76 cents, or 1.4 percent, at $57.22 per barrel.

"Oil prices continued to recover...(as) the market will be watching closely for the possible impact of a (supply) cut." said Sukrit Vijayakar, director of Indian energy consultancy Trifecta.

The Organization of the Petroleum Exporting Countries (OPEC), de facto led by Saudi Arabia, is pushing for the producer group and allies to cut 1 million to 1.4 million barrels per day (bpd) of supply to adjust for a slowdown in demand growth and prevent oversupply.

Russian Energy Minister Alexander Novak said on Monday that Russia, which is not an OPEC member, was planning to sign a partnership agreement with the group, and that details would be discussed at OPEC's Dec. 6 meeting in Vienna.

Despite Monday's gains, crude prices remain almost a quarter below their recent peaks in early October, weighed down by surging supply and a slowdown in demand growth.

This comes in part after Washington granted Iran's major oil customers, mostly in Asia, unexpectedly broad exemptions to sanctions it re-imposed on Tehran in November.

Japanese refiner Fuji Oil is set to resume Iranian crude purchases after Japan received one of those waivers, industry sources familiar with the matter said.

Japan had ceased all purchases of Iranian oil prior to receiving the waiver in early November.

Despite that, markets remained wary amid deep trade disputes between the world's two biggest economies, the United States and China, after the pair could not find a solution to their spat at the Asia-Pacific Economic Cooperation (APEC) last weekend.

Hussein Sayed, chief market strategist at futures brokerage FXTM said U.S. comments from APEC "suggest that a deal between President Trump and President Xi is unlikely to see the light when the leaders meet at the G20 Summit later this month".

MORE DRILLING, MORE OIL

Meanwhile, oil production in the United States is surging.

U.S. energy firms added two oil rigs in the week to Nov. 16, bringing the total count to 888, the highest level since March 2015, a weekly report by energy services firm Baker Hughes said on Friday.

The rising drilling activity points to a further increase in U.S. crude oil production, which has already jumped by almost a quarter this year, to a record 11.7 million bpd.

Put off by a surge in supply and the slowdown in demand, financial markets have become increasingly wary of the oil sector, with money managers cutting their bullish wagers on crude futures and options to the lowest level since June 2017, the U.S. Commodity Futures Trading Commission (CFTC) said on Friday.

The speculator group cut its combined futures and options positions on U.S. and Brent crude during the week ended Nov. 13 to the lowest since June 27, 2017.

-----

Earlier:

2018, November, 16, 10:10:00

OIL PRICE: NEAR $67 YETREUTERS - U.S. West Texas Intermediate (WTI) crude oil futures were at $56.84 per barrel at 0353 GMT, up 38 cents, or 0.7 percent, from their last settlement. Brent crude oil futures were up 48 cents, or 0.7 percent, at $67.10 per barrel.

|

2018, November, 16, 09:30:00

SAUDIS ARE ANGRYREUTERS - “The Saudis are very angry at Trump. They don’t trust him any more and feel very strongly about a cut. They had no heads-up about the waivers,” said one senior source briefed on Saudi energy policies.

|

2018, November, 14, 12:25:00

OIL PRICE: NEAR $65REUTERS - U.S. West Texas Intermediate (WTI) crude oil futures were at $55.52 per barrel at 0732 GMT, down 17 cents, or 0.3 percent, from their last settlement. International benchmark Brent crude oil futures LCOc1 were down 9 cents at $65.38 per barrel.

|

2018, November, 14, 12:15:00

OIL MARKET UNCERTAINTYCNBC - Saudi Arabia, OPEC's biggest producer and the world's top crude exporter, intends to cut shipments by 500,000 barrels a day in December, Khalid al Falih, the country's energy minister said on Sunday. Russian Energy Minister Alexander Novak said on Sunday he wasn't convinced the oil market would be oversupplied in 2019. Russia is the world's second biggest oil producer after the United States and, along with Saudi Arabia, plays an influential role in the oil alliance.

|

2018, November, 12, 12:30:00

OIL PRICE: NEAR $71REUTERS - Front-month Brent crude futures LCOc1, a benchmark for global oil prices, were at $71.59 per barrel at 0749 GMT, up 2 percent from their last close. U.S. West Texas Intermediate (WTI) crude futures rose 1.6 percent to $61.15 per barrel.

|

2018, November, 12, 12:25:00

CONFORMITY LEVEL 104%OPEC - In advance of the scheduled meetings in December 2018, the JMMC directed the JTC to continue closely monitoring oil market conditions and further refine the scenario analysis based on updated data, with regard to options on new 2019 production adjustments, which may require new strategies to balance the market. |

2018, November, 12, 12:20:00

РОССИЙСКО-САУДОВСКИЕ ПЕРСПЕКТИВЫМИНЭНЕРГО РОССИИ - «Российско-саудовские отношения обладают солидными перспективами в сфере энергетики. Нами рассматриваются ряд масштабных совместных проектов, которые выведут российско-саудовское сотрудничество на принципиально новый уровень», - отметил российской министр. |