OIL PRICE: NEAR $60

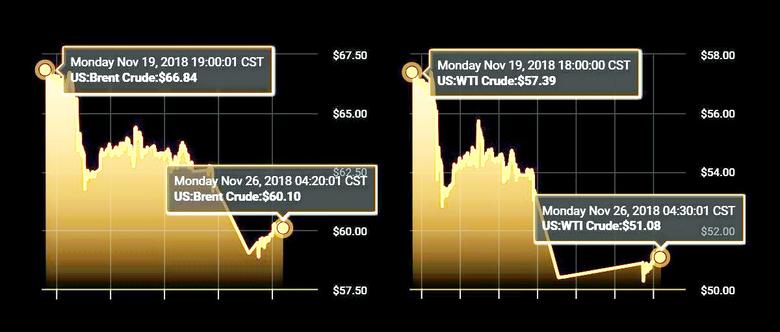

REUTERS - Oil prices on Monday clawed back some losses from a nearly 8-percent plunge the previous session, but Brent failed to hold above $60 per barrel amid generally weak financial markets.

Front-month Brent crude oil futures LCOc1 had risen by 96 cents, or 1.6 percent, to $59.76 per barrel by 0745 GMT.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 62 cents, or 1.2 percent, at $51.04 per barrel.

The gains partly made up for Friday's selloff, which traders have already dubbed 'Black Friday'.

Reacting to Friday's falls in Brent and WTI, China's Shanghai crude futures on Monday ISCcv1 fell by 5 percent, hitting their daily downside-limit.

Judging by exchange data, traders are preparing for more price falls.

Managed short positions in front-month WTI crude futures, which would profit from further price declines, have surged from record lows in July to the highest number of short positions since October 2017.

What's more, the number of puts - which give a trader the option though not obligation to sell a financial instrument at a certain price - in February Brent crude oil futures at $55 LCO5500N9 and $50 per barrel LCO5000N9 has surged to record levels since October.

The downward pressure comes from surging supply and a slowdown in demand growth which is expected to result in an oil supply overhang by next year.

"2019 will be a choppy year for the oil market as questions surrounding the prospect of a slowing global economy and a supply surplus are expected to increase," analysts at Fitch Solutions said on Monday.

Fitch said that even an expected supply cut led by the Organization of the Petroleum Exporting Countries (OPEC) following an official meeting on Dec. 6 "may not be enough to counteract the bearish forces".

WIDER DOWNTURN

Oil markets are also being affected by a downturn in wider financial markets.

"2018 clearly marked the end of the 10-year Asia credit bull market due to tightening financial conditions in Asia (especially China), and we expect this to remain the case in 2019," Morgan Stanley said in a note released on Sunday.

"We don't think that we are at the bottom of the cycle yet," the U.S. bank said.

Oil markets have also been weighed down by a strong U.S.-dollar .DXY, which has surged against most other currencies this year, thanks to rising interest rates that have pulled investor money out of other currencies and also assets like oil, which are seen as more risky than the greenback.

"Anything denominated against the USD is under pressure right now, said McKenna.

Another risk to global trade and overall economic growth is the trade war between the world's two biggest economies, the United States and China.

"The U.S.-China trade conflict poses a downside risk as we forecast the U.S. to impose 25 percent tariffs on all China imports by Q1 2019," U.S. bank J.P. Morgan said in a note published on Friday.

-----

Earlier:

2018, November, 23, 12:25:00

OIL PRICE: ABOVE $62 YETREUTERS - International benchmark Brent crude oil futures fell their lowest since December 2017 at $61.52 per barrel, before recovering to $62.13 by 0741 GMT. That was 47 cents, or 0.8 percent below their last close. U.S. West Texas Intermediate (WTI) crude futures slumped 2.3 percent, to $53.38 a barrel. Prices earlier fell to as low as $52.82, only 5 cents about the $52.77 level reached on Tuesday, which was the lowest since October 2017.

|

2018, November, 22, 11:45:00

OIL PRICE: ABOVE $63REUTERS - U.S. West Texas Intermediate (WTI) crude futures, were at $54.35 per barrel at 0534 GMT, 28 cents, or 0.5 percent below their last settlement. Front-month Brent crude oil futures were at $63.25 per barrel, down 23 cents, or 0.4 percent.

|

2018, November, 22, 11:20:00

SAUDIS OIL RECORD: 10.9 MBDBLOOMBERG - Saudi Arabian oil production surged to a record near 11 million barrels a day this month after the kingdom received stronger-than-usual demand from clients preparing for a disruption in Iranian supplies, according to industry executives who track Saudi output.

|

2018, November, 19, 11:50:00

OIL PRICE: ABOVE $67REUTERS - Front-month Brent crude oil futures were at $67.41 per barrel at 0746 GMT, up 65 cents, or 1 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures, were up 76 cents, or 1.4 percent, at $57.22 per barrel.

|

2018, November, 16, 10:10:00

OIL PRICE: NEAR $67 YETREUTERS - U.S. West Texas Intermediate (WTI) crude oil futures were at $56.84 per barrel at 0353 GMT, up 38 cents, or 0.7 percent, from their last settlement. Brent crude oil futures were up 48 cents, or 0.7 percent, at $67.10 per barrel.

|

2018, November, 16, 09:30:00

SAUDIS ARE ANGRYREUTERS - “The Saudis are very angry at Trump. They don’t trust him any more and feel very strongly about a cut. They had no heads-up about the waivers,” said one senior source briefed on Saudi energy policies.

|

2018, November, 14, 12:25:00

OIL PRICE: NEAR $65REUTERS - U.S. West Texas Intermediate (WTI) crude oil futures were at $55.52 per barrel at 0732 GMT, down 17 cents, or 0.3 percent, from their last settlement. International benchmark Brent crude oil futures LCOc1 were down 9 cents at $65.38 per barrel. |