OIL PRICE: NOT ABOVE $73

REUTERS - Oil prices seesawed on Friday as markets were lifted by hopes the United States and China may resolve their trade disputes soon, before being weighed down by a report Washington had granted several countries waivers on Iran sanctions.

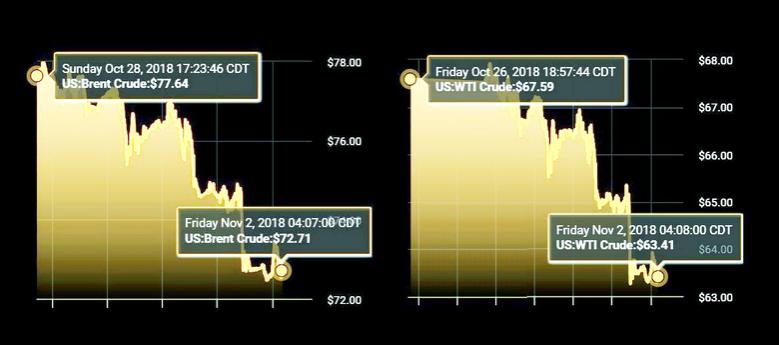

Front-month Brent crude futures were at $72.88 per barrel at 0737 GMT on Friday, 1 cent below their last close. They first fell on Friday on surging supplies, before rising with global markets and then dipping again on the back of the reported Iran sanctions waivers.

U.S. West Texas Intermediate (WTI) crude futures were down 33 cents, or 0.5 percent, at $63.36 a barrel.

Global markets, including oil, were lifted earlier on Friday by hopes that the trade dispute between the world's two biggest economies could be resolved soon.

Pulling crude back down, however, was a report that several governments had received waivers that would still allow countries to import some Iranian crude once U.S. sanctions are reimposed from next week.

The U.S. government has agreed to let eight countries, including close allies South Korea and Japan, as well as India, keep buying Iranian oil aid the upcoming sanctions, Bloomberg reported on Friday, citing a U.S. official.

A Chinese official told Reuters that discussions with the U.S. government were ongoing and that a result was expected over the next couple of days.

A list of all countries getting waivers is expected to be released officially on Monday, several briefed industry sources said.

Despite these efforts, analysts said any potential Iranian oil sanction waivers would likely only be temporary.

Goldman Sachs said it expects Iran's crude oil exports to fall to 1.15 million bpd by the end of the year, down from around 2.5 million bpd in mid-2018.

"We still expect that the global oil market will be in deficit in 4Q18," the U.S. bank said.

By the end of 2019, however, Goldman expects Brent to fall to $65 a barrel, largely due to "the unleashing of Permian (U.S. shale) supply growth once new pipelines come online."

SUPPLY SURGE

Beyond Iran sanctions, oil output has been rising significantly in the past two months.

Russian Energy Ministry data showed on Friday that the country pumped 11.41 million barrels per day (bpd) of crude oil in October, a 30-year high, and up from 11.36 million bpd in September.

The Middle East-dominated Organization of the Petroleum Exporting Countries (OPEC) boosted oil production in October to 33.31 million bpd, a Reuters survey found this week, up 390,000 bpd from September and the highest by OPEC since December 2016.

In the United States, crude production has established itself well over 11 million bpd, putting the U.S. in a neck and neck race with Russia for the title of top producer.

With Saudi Arabia pumping 10.65 million bpd in October, combined output from the top-three oil producers is at a record 33.41 million bpd, meaning that Russia, the United States and Saudi Arabia meet more than a third of the world's almost 100 million bpd of consumption.

"This surge has driven the market into oversupply," Jefferies said.

-----

Earlier:

2018, October, 31, 13:20:00

OIL PRICE: NEAR $77 AGAINREUTERS - Benchmark Brent crude oil LCOc1 was up 80 cents at $76.71 a barrel by 0840 GMT. The contract fell 1.8 percent on Tuesday, at one point touching its lowest since Aug. 24 at $75.09. U.S. light crude CLc1 was up 60 cents at $66.78. It hit a two-month low of $65.33 a barrel on Tuesday.

|

2018, October, 29, 12:55:00

OIL PRICE: NEAR $77REUTERS - Front-month Brent crude oil futures LCOc1 were trading down 46 cents, or 0.6 percent, at $77.16 a barrel at 0745 GMT. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $67.19 a barrel, down 40 cents, or 0.6 percent. |

2018, October, 29, 12:45:00

OPEC: CONFORMITY LEVEL 111%OPEC - The JMMC noted that countries participating in the ‘Declaration of Cooperation’ achieved a conformity level of 111% in September 2018, which shows significant progress towards the goal set at the 4th OPEC and non-OPEC Ministerial Meeting of 23 June 2018. |

2018, October, 29, 12:40:00

RUSSIA: NO REASON OIL FREESEREUTERS - Russian Energy Minister Alexander Novak said on Saturday there was no reason for Russia to freeze or cut its oil production levels, noting that there were risks that global oil markets could be facing a deficit.

|

2018, October, 26, 13:00:00

OIL PRICE: NOT ABOVE $77REUTERS - Brent crude oil LCOc1 was down 70 cents at $76.19 per barrel by 0740 GMT, on course for a weekly loss of more than 4 percent. It has fallen by close to $10 in the last three weeks. U.S. crude CLc1 was 70 cents lower at $66.63, set for a 3.5 percent loss this week.

|

2018, October, 24, 11:40:00

OIL PRICE: NEAR $76REUTERS - Front-month Brent crude oil futures LCOc1 were at $76.52 a barrel at 0658 GMT, up 1 cent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were weaker, down 10 cents at $66.33 a barrel, pressured by a report by the American Petroleum Institute (API) that U.S. crude stocks rose by 9.9 million barrels in the week to Oct. 19 to 418.4 million barrels. |

2018, October, 24, 11:35:00

NO OIL EMBARGOTASS - Saudi Arabia is a very responsible country, for decades we used our oil policy as responsible economic tool and isolated it from politics. So lets hope that the world would deal with the political crisis, including the one with Saudi citizen in Turkey, with wisdom. And we will exercise our wisdom both in political and economic fronts. |