PETRONAS PROFIT UP BY 67%

PETRONAS - INTERIM FINANCIAL REPORT OR HIRD QUARTER 2018

Third quarter

• PETRONAS Group's revenue for the third quarter of 2018 increased by 19% as compared to the third quarter of 2017 mainly due to the impact of higher average realised prices recorded for key products partially offset by the effect of strengthening of Ringgit against US Dollar exchange rate and the impact of lower sales volume mainly for LNG.

• The Group recorded Profit Before Taxation ("PBT") of RM18.9 billion and Profit After Tax ("PAT") of RM14.3 billion for the third quarter of 2018, increased by 26% and 43% respectively, as compared to the third quarter of 2017, primarily due to higher revenue partially offset by higher net product and production costs coupled with higher depreciation and amortisation recorded for the quarter. Earnings Before Interest, Tax, Depreciation and Amortisation ("EBITDA") increased by 25% as compared to the third quarter of 2017 in line with higher PBT.

• Cash flows from operating activities decreased by 19% as compared to the third quarter of 2017 mainly due to higher working capital and taxes paid partially offset by higher average realised prices.

• Capital investments for the third quarter of 2018 amounted to RM6.7 billion, mainly attributed to Upstream projects.

• Crude oil, condensate and natural gas entitlement volume for the third quarter of 2018 was 1,514 thousand barrels of oil equivalent ("boe") per day as compared to 1,671 thousand boe per day in the third quarter of 2017. Total production volume was 2,176 thousand boe per day as compared to 2,206 thousand boe per day in the third quarter of 2017.

Cumulative quarter

• PETRONAS Group's revenue for the period ended 30 September 2018 increased by 12% as compared to the same period in 2017 mainly due to the impact of higher average realised prices recorded for key products partially offset by the effect of strengthening of Ringgit against US Dollar exchange rate.

• The Group recorded PBT of RM56.3 billion and PAT of RM41.0 billion for the period ended 30 September 2018, increased by 37% and 50% respectively, as compared to the same period in 2017, primarily due to higher revenue, lower net impairment on assets and well costs, lower net foreign exchange losses as well as non-FID costs for Pacific NorthWest LNG project in Canada which was recognised in 2017. These were partially offset by higher net product and production costs, depreciation and amortisation as well as tax expenses. EBITDA for the period ended 30 September 2018 was RM79.1 billion, increased by 19% as compared to the same period in 2017 in line with higher PBT.

• Cash flows from operating activities for the period ended 30 September 2018 decreased by 3% as compared to the same period in 2017 due to higher working capital and taxes paid partially offset by higher average realised p rices.

• Capital investments for the period ended 30 September 2018 amounted to RM26.5 billion, mainly attributed to Upstream projects.

• Crude oil, condensate and natural gas entitlement volume for the period ended 30 September 2018 was 1,624 thousand boe per day as compared to 1,742 thousand boe per day in the same period in 2017. Total production volume was 2,313 thousand boe per day as compared to 2,296 thousand boe per day in the same period in 2017.

More information is here.

-----

Earlier:

2018, October, 12, 11:15:00

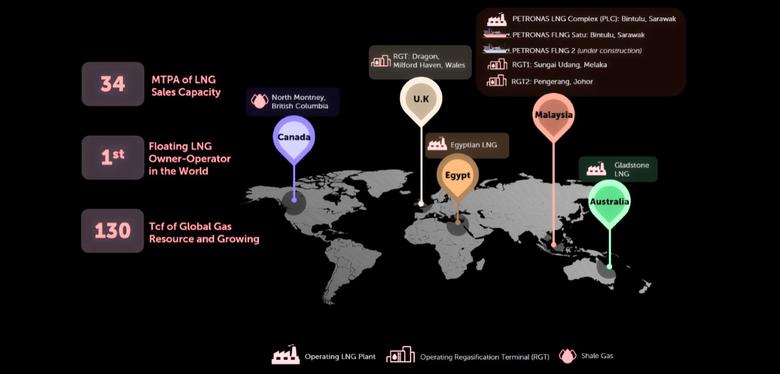

THE FIRST LNG CANADAEIA - The project is a joint venture between Royal Dutch Shell (which holds a 40% stake in the project), Petronas (25%), Mitsubishi (15%), PetroChina (15%), and Korea Gas (5%).

|

2018, June, 1, 09:00:00

PETRONAS BUYS LNG CANADAREUTERS - Malaysia’s state-owned oil and gas company Petroliam Nasional Bhd [PETR.UL] said on Thursday it is buying a 25 percent stake in a Canadian liquefied natural gas (LNG) export project, nearly a year after cancelling its own planned terminal.

|

2018, March, 30, 11:10:00

PETRONAS - ARAMCO COLLABORATIONSAUDI ARAMCO - Petroliam Nasional Berhad (PETRONAS), the national oil company of Malaysia, and Saudi Aramco, the national oil company of Saudi Arabia, are pleased to announce the formation of two joint ventures for the Refinery and Petrochemical Integrated Development (RAPID) project.

|

2018, March, 4, 10:52:00

AUSTRALIA'S LNG INVESTMENT: $900 MLNGT - Santos and its GLNG partners—Petronas, Total and KOGAS—will make a massive capital investment of $900 million in upstream developments in the Maranoa, Western Downs, Central Highlands and Banana regions in Queensland this year.

|

2018, March, 4, 10:40:00

PETRONAS PROFIT UP BY 91%PETRONAS - PETRONAS’ Profit After Tax (PAT) jumped by 91 per cent in 2017 at RM45.5 billion, compared to RM23.8 billion recorded in 2016. The increase was achieved on the back of higher revenue, lower net impairment on assets and well costs and continuous efforts to optimise costs in 2017.

|

2017, February, 28, 18:45:00

SAUDI BUYS PETRONAS: $7 BLNSaudi oil giant Aramco IPO-ARMO.SE will buy an equity stake in Malaysian firm Petronas' refining and petrochemicals project in the southeast Asian country, the companies confirmed on Tuesday, investing a total of $7 billion.

|

2016, September, 29, 18:35:00

MALAYSIAN - CANADIAN LNG: $27 BLNPetronas, Malaysia’s state-owned oil and gas group, has gained approval from the Canadian government for a controversial $27bn liquefied natural gas project — but said it would have to consider the environmental conditions attached before deciding to proceed. |