REPSOL NET INCOME €2.171 BLN

REPSOL - Results January-September 2018

Repsol net income increases 37% to 2.171 billion euros

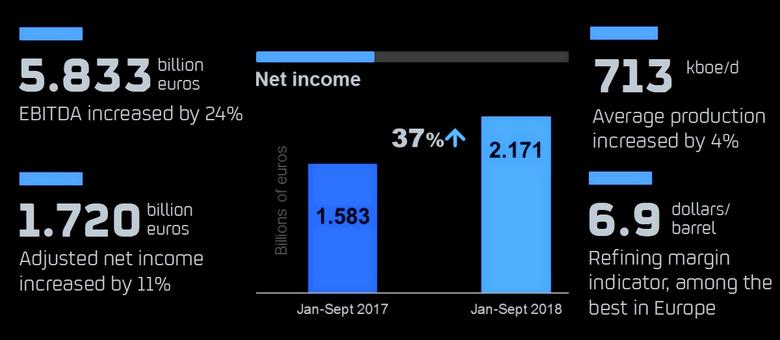

- Repsol posted net income of 2.171 billion euros in the first nine months of the year, an increase of 37% over the same period of the previous year, and the highest 9-month result in the last decade.

- Adjusted net income, which specifically measures the performance of the company's businesses, increased by 11% to 1.720 billion euros. EBITDA rose to 5.833 billion euros, representing a 24% increase over the same period in 2017.

- Repsol increased its hydrocarbon production by 4% in comparison with the same period in 2017 to an average of 713,000 barrels of oil equivalent per day. This growth was supported by the startup of projects in Trinidad and Tobago, the United Kingdom, Algeria, Peru, and Malaysia.

- The Upstream unit (Exploration and Production) earned 1.015 billion euros, twice the result obtained between January and September of last year, as a result of implemented efficiency measures, higher volumes and rising international prices.

- The Downstream (Refining, Chemicals, Marketing, Lubricants, Trading, LPG and Gas & Power) earnings stood at 1.098 billion euros, with growth in the Gas & Power, Marketing, and LPG units.

- In late June, Repsol announced the purchase of Viesgo's non-regulated, low-emissions electricity generation assets as well as its gas and electricity distributor. The acquisition adds 750,000 customers and increases the company's total installed capacity to 2,950 MW.

Repsol posted net income of 2.171 billion euros in the first nine months of the year. This represents a 37% increase from the 1.583 billion euros earned in the same period of 2017.

Adjusted net income, which specifically measures the progress of the company's businesses, increased to 1.720 billion euros, a 11% increase over the 1.543 billion euros earned between January and September of 2017.

Repsol's integrated business model continued to demonstrate its flexibility and strength and, together with the efficiency and value-creation measures the company has implemented, resulted in the highest earnings recorded at the end of the third quarter in the last decade. The company achieved this in a period of higher crude oil prices (with Brent at an average of 39% higher than in the same period of 2017) and lower gas prices (with an 8% average decrease in the Henry Hub benchmark.)

The Upstream unit maintained the positive performance shown throughout 2018 with earnings of 1.015 billion euros - more than double the result obtained between January and September of 2017 (487 million euros). The implementation of the synergies and efficiencies program, increased production and higher crude oil and gas prices (+38% and +16%, respectively, both outperforming the international benchmark prices) were decisive factors for a strong performance.

The Downstream unit earned 1.098 billion euros in this period, with an improved performance from the Gas & Power, Marketing and LPG units. The Refining and Chemicals units continued to be affected by the weakness of the dollar against the euro, a more complex international environment and maintenance shutdowns at some industrial facilities.

The company's overall EBITDA stood at 5.833 billion euros—24% higher than the 4.715 billion euros earned in the same period of 2017—demonstrating the strength of Repsol's integrated model.

Net debt decreased to 2.304 billion euros, a reduction of 63% from the end of the previous year. Meanwhile, Repsol's liquidity at the end of September stood at approximately 9.3 billion euros.

The company updated its strategy last June after meeting its previous objectives two years ahead of schedule, and after the sale of its stake in Naturgy Energy Group (formerly known as Gas Natural SDG.) The 2020 strategy update is based on three pillars: an increase in shareholder compensation; profitable business growth in Upstream and Downstream and the development of new businesses connected to the energy transition.

Repsol at the end of June reached an agreement to purchase non-regulated, low- emissions electricity generation businesses from Viesgo as well as its gas and electricity distributor, which has 750,000 customers. The company expects to complete this operation in early November, achieving a total installed capacity of 2,950 MW.

In the third quarter, Repsol also acquired the Valdesolar photovoltaic project planned in the municipality of Valdecaballeros (Badajoz, Spain), which is in the administrative processing phase. The project will have an installed capacity of 264 MW. With these additions, Repsol will have achieved more than 70% of its strategic objective for low-emissions generation capacity of 4,500 MW by 2025.

In October the company completed the financing for the construction of one of the largest floating offshore wind farms in the world, offshore Portugal, which will have an installed capacity of 25 MW.

Repsol continued the implementation of its digitalization program, which is being rolled out throughout the organization to promote a cultural change and new ways of doing business. The program aims to increase cash flow by 1 billion euros in 2022.

Upstream: increased earnings and development of high-value projects

The adjusted net income of the Upstream unit reached 1.015 billion euros, representing an increase of 108% over the 487 million euros earned in the same period of 2017.

The management and implementation of the company's efficiency and synergies program boosted the unit's earnings. Improved crude oil and gas production prices and greater volumes sold were crucial to this increase.

In the international market, the environment has been different for oil and gas. While the average Brent price stood at 72 dollars per barrel, representing an increase of 39% from the same period of 2017, Henry Hub prices decreased by 8%, to an average 2.9 dollars per MBtu.

In the first nine months of the year, Repsol achieved an average hydrocarbon production of 713,000 barrels of oil equivalent (boe) per day – a 4% increase from the same period of the previous year and in line with the objective for the full year. This increase was largely due to the startup of organic projects in Trinidad and Tobago, the United Kingdom, Algeria, Peru, and Malaysia, as well as increased contributions from Libya and Norway.

The company completed 15 exploratory wells and one appraisal well during the period. Four were positive and two are under evaluation.

Repsol continued the development of projects that will support the growth of the Upstream unit. In Brazil, the company obtained de comercial license for the "Entorno Sapinhoá" area, which borders the highly productive Sapinhoá block in the country's prolific pre-salt region.

In Bolivia, the parliament approved exploration and production contracts in the Iñiguazú field. This field is adjacent to the Caipipendi area, where Repsol already operates the Margarita-Huacaya field—the largest in Bolivia, producing 19 million cubic meters of gas per day.

In Norway, the company signed an agreement in early February to acquire 7.7% of the Visund field, located in the North Sea. With this deal, Repsol significantly increases its production in the country to approximately 28,000 barrels of oil equivalent per day.

In the first nine months of the year, gas production also began in Bunga Pakma (Malaysia), and Repsol began development of the Buckskin project in the United States. In addition, the company installed the Angelin platform in the West Block field in Trinidad and Tobago from which gas production is expected in the first quarter of 2019.

Upstream investments during the first nine months of the year amounted to 1.423 billion euros, an increase of 50 million euros from the same period of 2017.

Downstream: solidity, innovation and expansion

The Downstream unit recorded an adjusted net income of 1.098 billion euros from January to September of this year, compared with the 1.431 billion euros earned in the same period last year.

The industrial businesses, Refining and Chemicals, were influenced by a less favorable environment and shutdowns for maintenance and improvements at the Puertollano, Tarragona (Spain) and Sines (Portugal) industrial facilities. These improvements enable the company to remain at the forefront of the sector in Europe thanks to innovation, efficiency and productivity gains.

The refining margin indicator stood at 6.9 dollars per barrel during the first nine months of the year, in line with the first half of this year and above the 6.8 dollars per barrel in the same period of 2017.

The Trading and Gas & Power unit increased its earnings from the same period of 2017, thanks primarily to higher margins. The LPG business also improved its performance, driven by an increase in sales in Spain due to lower temperatures.

For its part, the Marketing unit improved its performance, while continuing to provide greater value to customers. The company strengthened its partnerships with prestigious companies such as El Corte Inglés, with which Repsol is developing an expansion plan to open 1,000 Supercor Stop & Go stores at Repsol service stations in the next three years.

This is in addition to Repsol's acquisition of 70% of the digital platform Klikin, through which the Company is developing its Waylet mobile app: a universal means of payment that can be used at restaurants and stores as well as at the company's service stations.

Repsol also launched its new car-sharing service, WiBLE, in partnership with Kia. The service began operating in Madrid in July. This project is part of the new mobility solutions in which Repsol is involved.

Furthermore, in accordance with its commitment to gas as an essential part of the energy transition, Repsol signed an agreement with Venture Global LNG for the supply of one million metric tons per year of LNG (Liquefied Natural Gas) for 20 years.

In addition, the company continued its expansion in Mexico. Repsol now has over 120 service stations in operation in the country after just over six months of development of its long-term project, through which the company aims to achieve an 8-10% share in the Mexican market within the next five years.

Also in Mexico, Repsol continued the internationalization of its Lubricants unit with an agreement with local company Bardahl. This is the largest alliance carried out by Repsol in this business unit. The strategic plan for the Lubricants area aims to double its sales volume to 300,000 metric tons in 2021, of which 70% will be outside Spain.

The company invested 560 million euros in the Downstream unit in the first nine months of the year, 115 million euros more than in the same period of 2017.

More information is here.

-----

Earlier:

2018, June, 6, 11:50:00

REPSOL'S INVESTMENT: €15 BLNREPSOL - Between 2018 and 2020, Repsol plans to invest 15 billion euros: 53% in its Upstream unit (Exploration and Production) and 45% in Downstream (Refining, Chemicals, Marketing, Lubricants, Trading, LPG, Gas & Power) and low-emissions assets.

|

2018, May, 4, 15:00:00

REPSOL NET INCOME €610 MLNREPSOL - Repsol posted net income of 610 million euros in the first quarter of 2018. Adjusted net profit, which specifically measures the performance of the company’s business units, increased to 616 million euros.

|

2018, March, 28, 10:50:00

NORWAY'S OIL THREATBLOOMBERG - The government has paid out 109 billion kroner ($14 billion) since 2005 to explorers such as Lundin Petroleum AB and Repsol SA. It helped attract more companies to Norway, nearly doubling the pace of exploration and leading to key discoveries such as the multi-billion-barrel Johan Sverdrup field.

|

2017, December, 20, 19:05:00

REPSOL'S INVESTMENT NOK 8 BLNNPD - On Tuesday, operator Repsol submitted a new Plan for Development and Operation (PDO) for the Yme field in the North Sea. More eight billion kroner will be invested in the development. The planned start-up is 2020.

|

2017, July, 5, 12:05:00

REPSOL & GAZPROM DEALSpain’s Repsol has agreed to establish a joint venture with Russian oil company Gazprom Neft, in the latest move by a European oil and gas company to deepen co-operation with Russia despite western sanctions targeting the country’s energy sector. |

2016, June, 22, 18:00:00

REPSOL VS SINOPEC: $5.5 BLNThe claim relates to a U.K. joint venture between the Chinese and a Canadian firm which the Spanish oil producer acquired last year.

|

2016, May, 5, 18:35:00

REPSOL NET INCOME €572 MLNAdjusted net income was 572 million euros, compared with 928 million in the same quarter of the previous year, which included exceptional earnings of 500 million euros due mostly to the company’s dollar position after receiving funds for the expropriation of YPF, subsequently used for the acquisition of Talisman. |