U.S. ENERGY PRESSURE

FT - Throughout the US shale oil and gas boom of the past 15 years, one of investors' greatest concerns has been that the exploration and production companies needed continual infusions of cash to finance their investment programmes.

After the rise in crude prices this year, it looked as though those fears could be put to rest: in the third quarter of this year the US E&P sector was able to cover its capital spending from its operating cash flows, if only barely. The plunge in oil prices over the past two months is bringing those concerns gushing to the surface again.

In the third quarter, a sample of 50 of the largest listed US E&P companies in aggregate reported operating cash flows that were higher than their capital spending, for the first time since 2011. ExxonMobil and Chevron, the country's largest oil groups, also reported healthy profits from their US operations, which lost money in 2017.

However, those results were achieved during a quarter in which the benchmark US West Texas Intermediate crude price averaged $73 a barrel. WTI has fallen steadily since the beginning of October, and after a slight rebound on Monday morning was trading at about $51.50 a barrel.

One of the key factors driving prices down has been a surge in supply. US oil output has soared over the past two years, and this year, the country has become the world's largest crude producer. Russia and Saudi Arabia are also pumping oil at record rates. Meanwhile, concerns over the world economy, in part because of tensions over trade, have led to diminished expectations for global demand growth.

Over the weekend, President Donald Trump again claimed credit for the fall in oil prices, writing on Twitter: "So great that oil prices are falling (thank you President T)."

His administration has contributed to the decline in prices by easing off on the reinstated sanctions on Iran, allowing the country's biggest customers including China and India to continue buying some of its crude. Mr Trump has also put pressure on Saudi Arabia not to back oil production cuts when ministers from Opec and its allies meet in Vienna on December 6, linking the kingdom's policy to the US response over the murder of the journalist Jamal Khashoggi.

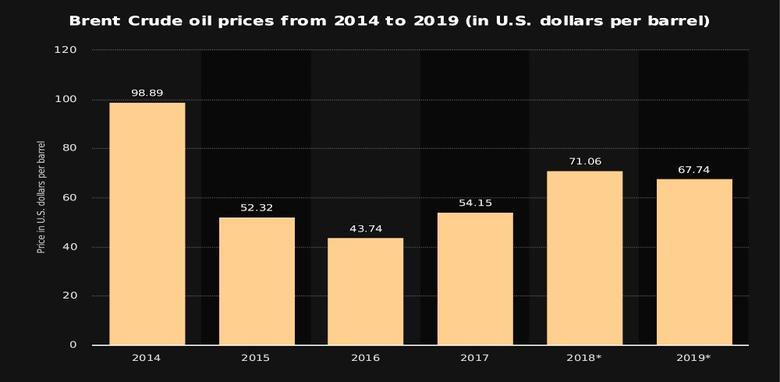

Jason Bordoff of Columbia University's Center on Global Energy Policy said the outlook was similar to the position in 2014, which led to a crash in prices and a sharp downturn in the oil industry worldwide.

"In some respects, we are seeing 2014 play out all over again," he said. "Opec and its allies are going to have to decide how they want to respond."

The improvement in the aggregate financial position of the US E&P sector reflects the health of a handful of the stronger companies, including ConocoPhillips, Occidental Petroleum, Marathon Oil and Devon Energy. Many others, meanwhile, are still raising cash from asset sales and external financing to support their investment programmes.

Of the 50 leading E&P companies, only 15 could cover their capital spending from their operating cash flows in the third quarter.

The recent rise in natural gas prices, and US producers' use of derivatives to lock in revenues at higher levels for oil, will help support their finances. But the sharp decline in the price of crude will pressure their cash flows and increase their reliance on financing from banks and bond and share sales.

Over the past decade, US E&P companies have borrowed about $300bn from bond sales and $780bn in bank loans, while raising about $140bn from share sales, according to Dealogic.

Since last year, investors have been signalling that they do not have unlimited patience for sustaining those capital inflows. Executives at E&P companies typically stress their intention to live within their means by paying for their investment programmes out of operating cash flows, in the near future if not always immediately. Some such as Devon and Anadarko Petroleum have been using available cash to buy back shares, rather than to drill and complete more wells.

Since last year, investors have been signalling that they do not have unlimited patience for sustaining those capital inflows. Executives at E&P companies typically stress their intention to live within their means by paying for their investment programmes out of operating cash flows, in the near future if not always immediately. Some such as Devon and Anadarko Petroleum have been using available cash to buy back shares, rather than to drill and complete more wells.

Richard Dealy, chief financial officer of Pioneer Natural Resources, told investors at a Bank of America Merrill Lynch conference this month the company was expecting "extra cash flow in 2019", and would be looking at "what is the right form for that to . . . return money to shareholders".

At the same event, Michael Stevens, chief financial officer of Whiting Petroleum, said: "Disciplined growth, free cash flow, that's the big story here."

But the fall in crude prices, if sustained, will mean that some of those companies' plans for future free cash flow may have to be deferred.

As oil has plummeted, so have the E&P companies' shares and bonds. The S&P oil and gas E&P industry index has lost 25 per cent since the end of September, and the average bond yield for junk-rated borrowers in the energy sector last week rose to 5.4 percentage points over investment-grade US Treasuries. That was the highest spread for 15 months, although still well below its heights of just under 20 percentage points at the peak of the last industry downturn in 2016.

Analysts at Mizuho wrote in a note this month that while oil prices continued to weaken, they expected outperformance from shares of companies such as Occidental and EOG Resources that had "clear free cash flow trajectories in 2019".

US oil production growth was already expected to slow somewhat in 2019, in part because of a temporary shortage of pipeline capacity for crude coming out of the Permian Basin of Texas and New Mexico, the heart of the renewed boom. A sustained drop in prices could cause further disruption.

Analysts at Tudor Pickering Holt argued last week that unless Opec and its allies agreed significant production cuts in Vienna next month, "crude could swiftly plunge below $45 [a barrel] WTI to cause a screeching halt to US supply growth".

However, US oil companies have been building up a large backlog of wells that have been drilled but not yet completed to start production, especially in the Permian Basin. They can be completed at roughly half the cost of starting a well from the beginning, creating substantial volumes of potential additional oil that could come on to the market even if prices continue to fall.

-----

Earlier:

2018, November, 19, 11:30:00

U.S. PETROLEUM DEMAND 20.8 MBDU.S. API - U.S. petroleum demand in October of 20.8 million barrels per day (mb/d) was the strongest for the month since 2006 and a continued reflection of solid economic activity.

|

2018, November, 16, 09:20:00

U.S. FINANCIAL RISKSU.S. OFR - The U.S. Office of Financial Research (OFR) released its 2018 Annual Report to Congress, stating that risks to U.S. financial stability remain in the medium range, reflecting a mix of high, moderate, and low risks to the financial system.

|

2018, November, 14, 12:00:00

U.S. PRODUCTION: OIL + 113 TBD, GAS + 1,038 MCFDU.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 113,000 b/d month-over-month in December from 7,831 to 7,944 thousand barrels/day , gas production to increase 1,038 million cubic feet/day from 74,041 to 75,079 million cubic feet/day .

|

2018, November, 5, 12:05:00

U.S. DEFICIT UP $0.7 BLN TO $54.0 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $54.0 billion in September, up $0.7 billion from $53.3 billion in August,

|

2018, October, 3, 08:50:00

U.S. GAS EXPORTS UP TWICEU.S. EIA - From January through June of 2018, net natural gas exports from the United States averaged 0.87 billion cubic feet per day (Bcf/d), more than double the average daily net exports during all of 2017 (0.34 Bcf/d). The United States, which became a net natural gas exporter on an annual basis in 2017 for the first time in almost 60 years, has continued to export more natural gas than it imports for five of the first six months in 2018.

|

2018, September, 26, 09:25:00

U.S. OIL EXPORT RECORDU.S. EIA - Crude oil surpassed hydrocarbon gas liquids (HGL) to become the largest U.S. petroleum export, with 1.8 million barrels per day (b/d) of exports in the first half of 2018. U.S. crude oil exports increased by 787,000 b/d, or almost 80%, from the first half of 2017 to the first half of 2018 and set a new monthly record of 2.2 million b/d in June. |

2018, September, 24, 15:15:00

THE TRADE WAR LIMITING U.S.API - “Placing constraints on exports of American-made energy works against America’s energy future,” said API Chief Economist Dean Foreman. “While the picture is still a bit muddied, it seems to be getting clearer – the trade war appears to be limiting the United States’ access to crude export markets. As we produce more energy here at home, the U.S. needs markets for its products in order for our economy to continue to grow. There’s no question that the 1.6 MBD increase U.S. petroleum net imports, which undid a full year’s worth progress, is a setback to the United States’ goal of energy dominance.” |