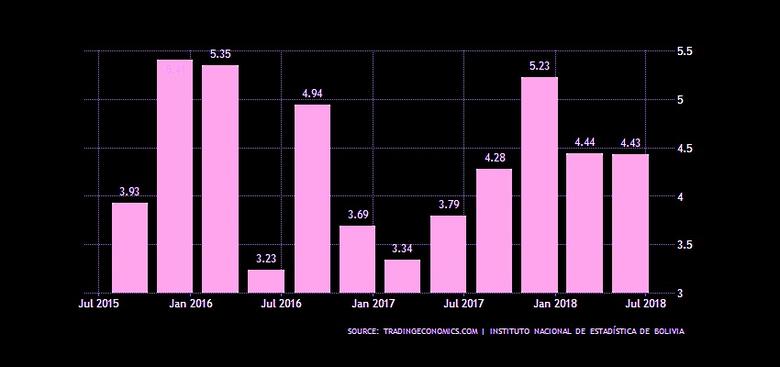

BOLIVIA'S GDP UP BY 4.5%

IMF - IMF Executive Board Concludes 2018 Article IV Consultation with Bolivia

On November 9, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Bolivia. [1]

After fifteen years of strong growth and poverty reduction, Bolivia is facing a more challenging period. The country registered annual real GDP growth of 4.8 percent on average between 2004–17 and built up sizable foreign reserves and fiscal buffers, while the share of the population living in extreme poverty fell by half to 17 percent. Since the commodity price drop in 2014, the authorities have conducted accommodative fiscal and credit policies to support growth. This approach has succeeded in maintaining robust growth but has resulted in large fiscal and external current account deficits, reserve losses, and a sharp increase in public debt. External competitiveness has been negatively affected in recent years by the appreciating US dollar and high wage growth in the context of a stabilized exchange rate.

Real GDP growth is projected at 4.5 percent in 2018, one of the highest rates in the region. Growth is supported by continued accommodative policies, a second economy-wide wage bonus, and strong agriculture output. Growth is forecast to moderate to 3.7 percent in the medium-term, reflecting limited impulse from macro policies and lower total factor productivity in the post-commodity boom period. The government’s decision to limit the growth of public investment will help reduce the fiscal deficit over time and slow the growth in public debt. The external current account deficit is expected to narrow slowly owing to a moderation in imports of capital goods, but with capital inflows and remittances expected to be weaker, international reserves are forecast to decline slowly, falling below the Fund’s reserve adequacy metric by 2020. The main risks to the outlook are related to political uncertainty surrounding the 2019 elections, failure to lower public investment as envisaged, and commodity-related shocks, including failure to discover new natural gas fields .

Executive Board Assessment [2]

Executive Directors agreed with the thrust of the staff appraisal. They commended Bolivia’s impressive economic growth and improvement in social indicators in the last decade. However, Directors noted that continued accommodative macroeconomic policies, lower commodity prices, and political uncertainty are posing challenges. Going forward, they emphasized that policy adjustments are needed to reduce internal and external imbalances and ensure macroeconomic stability. In addition, further structural reforms will help promote sustainable growth.

Directors welcomed the authorities’ decision to contain public investment which would help reduce the fiscal deficit over the medium term. However, they underscored that the current large fiscal deficit and loss of foreign reserves warrant further policy tightening to restore external balance and limit the build‑up in vulnerabilities. Directors concurred that fiscal adjustment should come more from the spending side and recommended implementing a medium‑term fiscal framework anchored by a debt target to guide fiscal policy. Directors commended the significant declines in poverty and inequality and encouraged the authorities to ensure that social schemes are directed to the most vulnerable groups.

Directors agreed that monetary policy should focus primarily on price stability and preserving the nominal exchange rate anchor. Noting that strong credit growth and central bank lending to state‑owned enterprises has contributed to pressure on international reserves, they advised normalizing monetary conditions as inflation pressures resume. Directors encouraged the authorities to strengthen the independence of the central bank. They also called for steps to cease direct lending by the central bank to state‑owned enterprises to avoid potential conflicts in the conduct of monetary policy.

Directors noted that the banking sector remains broadly stable. They encouraged the authorities to remove credit quotas and interest rate caps to limit the build‑up of vulnerabilities and to ensure that lending decisions better reflect intrinsic risks.

Directors emphasized that accelerating the pace of structural reforms is critical to strengthen productivity and competitiveness, and to support diverse and broad‑based growth. They agreed that reform efforts should focus on unleashing private investment to support export diversification, including reform of trade policies and product and labor markets to improve cost competitiveness. Directors called for discontinuation of the practices of centralized wage setting and indexing national bonuses to the GDP growth rate.

Directors welcomed the government’s efforts to reduce bureaucracy in business processes and to combat corruption. They encouraged further reforms, including moving to digital processes for tax and business‑related payments, reforming the legislative framework governing state‑owned enterprises, and including the activities of all subsidiaries in the fiscal accounts of the non‑financial public sector. They also encouraged Bolivia’s adoption of standards under the Extractive Industries Transparency Initiative and further strengthening of the AML/CFT framework. Addressing weaknesses in data provision will also be important.

It is expected that the next Article IV consultation with Bolivia will be held on the standard 12‑month cycle.

| Bolivia: Selected Economic and Financial Indicators | ||||||||||

|

I. Social and Demographic Indicators |

||||||||||

|

GDP per capita (U.S. dollars, 2017) |

3,382 |

Poverty headcount ratio (percent of population, 2016) |

39.5 |

|||||||

|

Population (millions, 2017) |

11.2 |

Gini index (2016) |

44.6 |

|||||||

|

Life expectancy at birth (years, 2015) |

69 |

Adult literacy rate (percent, 2015) |

92.5 |

|||||||

|

Mortality rate, under-5 (per thousand, 2016) |

36.9 |

Gross enrollment ratio, primary, both sexes (2015) |

97.1 |

|||||||

|

II. Economic Indicators |

||||||||||

| Baseline projections | ||||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|||||

|

Income and prices |

(Annual percentage changes) |

|||||||||

|

Real GDP |

4.9 |

4.3 |

4.2 |

4.5 |

4.2 |

3.9 |

||||

|

Nominal GDP |

0.2 |

3.6 |

11.1 |

9.8 |

7.8 |

7.8 |

||||

|

CPI inflation (period average) |

4.1 |

3.6 |

2.8 |

2.8 |

4.0 |

4.0 |

||||

|

Investment and savings 1/ |

(In percent of GDP, unless otherwise indicated) |

|||||||||

|

Total investment |

20.7 |

21.8 |

24.2 |

24.3 |

22.9 |

21.8 |

||||

|

Of which : Public sector |

13.7 |

13.0 |

13.7 |

13.3 |

12.4 |

11.6 |

||||

|

Gross national savings |

13.3 |

15.1 |

16.0 |

16.3 |

15.0 |

13.8 |

||||

|

Combined public sector |

||||||||||

|

Revenues and grants |

38.1 |

32.8 |

30.7 |

31.3 |

31.9 |

31.6 |

||||

|

Expenditure |

45.0 |

40.0 |

38.5 |

38.8 |

38.2 |

37.2 |

||||

|

Net lending/borrowing (overall balance) |

-7.0 |

-7.3 |

-7.8 |

-7.4 |

-6.3 |

-5.7 |

||||

|

Of which : Non-hydrocarbon balance |

-14.2 |

-10.9 |

-11.7 |

-12.6 |

-11.7 |

-10.5 |

||||

|

Total gross NFPS debt 2/ |

41.3 |

46.6 |

51.1 |

53.5 |

54.6 |

54.6 |

||||

|

External sector |

||||||||||

|

Current account 1/ |

-5.9 |

-5.7 |

-5.3 |

-4.8 |

-4.6 |

-4.5 |

||||

|

Exports of goods and services |

30.2 |

24.3 |

25.1 |

25.2 |

24.7 |

24.6 |

||||

|

Imports of goods and services |

36.2 |

31.6 |

30.8 |

30.6 |

30.4 |

30.1 |

||||

|

Financial account |

-8.6 |

-6.6 |

-6.5 |

-6.2 |

-4.6 |

-4.5 |

||||

|

Terms of trade index (percent change) |

-23.1 |

-15.5 |

9.5 |

10.0 |

-2.9 |

-1.5 |

||||

|

Net Central Bank foreign reserves 3/ 4/ |

||||||||||

|

In percent of GDP |

39.7 |

29.6 |

27.1 |

21.1 |

18.6 |

16.4 |

||||

|

In months of imports of goods and services |

14.5 |

10.4 |

9.7 |

7.7 |

6.9 |

6.1 |

||||

|

Money and credit |

(Annual percentage changes, unless otherwise indicated) |

|||||||||

|

Credit to the private sector |

17.6 |

14.8 |

12.8 |

11.7 |

10.9 |

10.1 |

||||

|

Credit to the private sector (percent of GDP) |

52.0 |

57.6 |

58.5 |

59.5 |

61.2 |

62.5 |

||||

|

Broad money |

82.5 |

81.7 |

80.9 |

81.3 |

82.5 |

83.2 |

||||

|

Memorandum items: |

||||||||||

|

Nominal GDP (in billions of U.S. dollars) |

32.9 |

34.1 |

37.9 |

41.6 |

44.8 |

48.3 |

||||

|

Exchange rates 5/ |

||||||||||

|

Bolivianos/U.S. dollar (end-of-period) |

6.9 |

6.9 |

6.9 |

… |

… |

… |

||||

|

REER, period average 6/ (percent change) |

16.1 |

6.0 |

-1.4 |

… |

… |

… |

||||

|

Sources: Ministry of Economy and Public Finances, Central Bank of Bolivia, National Institute of Statistics, UDAPE, World Bank, and Fund staff calculations. 1/ The discrepancy between the current account and the savings-investment balances reflects methodological differences. For the projection years, the discrepancy is assumed to remain constant in dollar value. 2/ Public debt BCB lending to: FINPRO, FNDR, and SOES (but not SOE borrowing from other domestic institutions). 3/ Excludes reserves from the Latin American Reserve Fund (FLAR) and Offshore Liquidity Requirements (RAL). 4/ All foreign assets valued at market prices. 5/Official (buy) exchange rate. 6/ The REER based on authorities’ methodology is different from that of the IMF. |

||||||||||

[1] Under Article IV of the IMF's Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country's economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2] At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country's authorities. An explanation of any qualifiers used in Summing-ups can be found here:http://www.imf.org/external/np/sec/misc/qualifiers.htm .

-----

Earlier:

2017, December, 27, 12:25:00

IMPRESSIVE BOLIVIA'S ADVANCESIMF - Bolivia achieved impressive economic and social advances from 2006–2014. During that period, real GDP averaged about 5.1 percent annually and the share of population living in the extreme poverty fell by one half. These notable gains now face challenges related to the impact of lower commodity prices.

|

2016, August, 4, 18:45:00

TOTAL & GAZPROM IN BOLIVIA"Incahuasi is one of the largest gas and condensate fields brought on stream in Bolivia. Incahuasi’s production will contribute to Bolivia’s gas exports to Argentina and Brazil as well as domestic consumption”

|

2016, February, 20, 20:40:00

GAZPROM & BOLIVIA COOPERATIONTarija hosted a working meeting between Alexey Miller and Evo Morales, President of the Plurinational State of Bolivia. The parties discussed a wide range of issues relating to the ongoing and future energy cooperation. This collaboration was noted to be strategic and long-term. |

2015, December, 17, 19:35:00

RUSSIA BUYING UP AMERICA“Currently, they have their sights firmly on the Americas, having expressed interest in future gas projects in Mexico, Argentina, Venezuela, and Bolivia, among others.”

|

2014, March, 27, 08:11:00

BOLIVIA'S US$3BBolivia's hydrocarbon capex to surpass US$3bn |