BRAZILIAN OIL PRODUCTION UP 5%

PLATTS - Brazil's domestic crude oil output rose for the first time in five months in October as production from the subsalt region continued to grow and fewer floating production units were idled by maintenance shutdowns during the month.

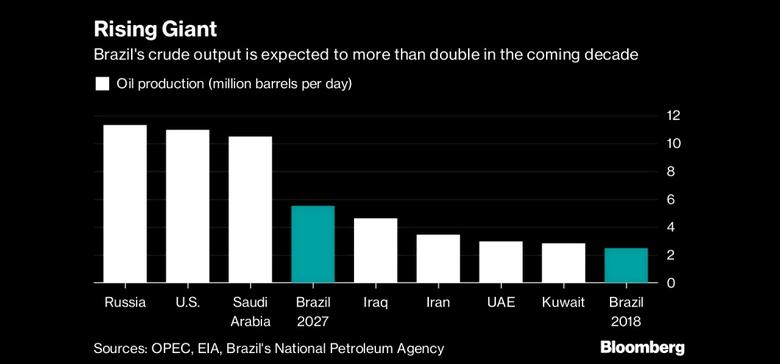

Oil production averaged 2.614 million b/d in October, jumping 5.2% from 2.486 million b/d in September, Brazil's National Petroleum Agency, or ANP, said late Monday. October's output, however, was down 0.5% from 2.627 million b/d in October 2017, the ANP said.

Crude output finally started to show results from the startup of four new floating production, storage and offloading vessels installed earlier this year as maintenance shutdowns at subsalt fields by state-led producer Petrobras started to ease.

The FPSO overhauls peaked in the third quarter, with the number of vessels temporarily shuttered expected to fall dramatically in the final quarter of the year, Petrobras officials said in November.

Petrobras expects to end 2018 with average output of 2.1 million b/d, down from 2.154 million b/d in 2017, the company's exploration and production director Solange Guedes said. The decline was attributed to sales of production assets, including the transfer of stakes in the Roncador field to Norway's Equinor and the Lapa field to France's Total in separate deals.

In October, Petrobras completed maintenance work on three FPSOs in the Campos Basin. The FPSO P-57 at the Jubarte Field, the FPSO P-52 at the Roncador Field and the FPSOs P-25 and P31 at the Albacora Field all returned to full output capacity during the month, the company said.

Petrobras also continued to ramp up output from the new FPSOs installed earlier this year, with plans to bring two additional vessels onstream in December-January. The FPSO P-75, the second FPSO installed at the Buzios field, pumped first oil in November, while the FPSO P-69 started output from the Lula Extremo Sul area of the Lula field in October. The FPSO P-74 pumped first oil from Buzios in April and the FPSO Cidade de Campos dos Goytacazes started production from the Tartaruga Verde field in June.

The new FPSOs continued the ongoing growth from subsalt fields seen throughout 2018, according to the ANP. Brazil's subsalt fields produced 1.471 million b/d and 58.8 million cu m/d from 88 wells in October, up from 1.419 million b/d and 57.9 million cu m/d from 85 wells in September, the ANP said.

Lula, which now features eight separate FPSOs in production, remained the country's biggest producer in October, the ANP said. Lula produced 898,691 b/d and 37.9 million cu m/d in October, up from 851,006 b/d and 35.5 million cu m/d in September, the ANP said.

NATURAL GAS JUMP

Natural gas production, meanwhile, advanced strongly in October with the return to full operations of the Mexilhao platform. Petrobras shuttered the Mexilhao platform, which produces gas from the Mexilhao field and also acts as an export hub for subsalt fields, for 45 days to connect a new tranche of the Route 1 pipeline to the platform.

The additional pipeline capacity should help increase oil production from the subsalt fields, which contain high volumes of associated gas.

Gas export capacity is seen as a key limiting factor for oil output in the frontier.

Brazil produced 117.0 million cu m/d in October, an increase of 3.6% from 112.9 million cu m/d produced in September, the ANP said. October's gas output was also up 2.1% from 114.6 million cu m/d in October 2017, the ANP data showed.

Total hydrocarbons output also advanced month on month in October, climbing 4.8% to 3.350 million boe/d versus 3.196 million boe/d in September, the ANP said. October's oil and gas output was in line with the 3.348 million boe/d produced in October 2017, ANP data showed.

Petrobras remained the country's leading oil and gas producer by concession area in October, pumping 1.922 million b/d and 83.9 million cu m/d, the ANP said. Shell was second at 338,096 b/d and 13.3 million cu m/d, while Portugal's Galp Energia was third at 90,027 b/d and 3.9 million cu m/d in October, the ANP said.

-----

Earlier:

2018, October, 17, 09:55:00

PETROBRAS - CNPC COOPERATIONPLATTS - Petrobras is to form two joint venture companies with China National Petroleum Corp. (CNPC) to complete construction of a refinery and revitalize four mature fields in the offshore Campos Basin, the state-owned Brazilian company said |

2018, September, 26, 09:00:00

NOVATEK LNG FOR BRAZILNOVATEK - PAO NOVATEK (“NOVATEK” and/or the “Company”) announced today that its wholly owned subsidiary, NOVATEK Gas and Power Asia Pte. Ltd. has shipped its first LNG cargo to the Brazilian market with LNG produced from the Yamal LNG project. The cargo was delivered to the Bahia Regasification Terminal owned by Petrobras. |

2018, August, 8, 11:35:00

PETROBRAS NET INCOME R$ 17 BLNPETROBRAS - Petrobras reported net income of R$ 17 billion in the first half of 2018. The positive result was mainly influenced by the increase in international oil prices, associated with the depreciation of the Brazilian Real against the US dollar. In the same period, net debt fell 13% compared to December 2017, to US$ 73.66 billion.

|

2018, July, 30, 13:40:00

PETROBRAS NEEDS CHINAREUTERS - The new supply could enlarge Brazil’s market share in China as buyers there cut oil imports from the United States following Beijing’s announcement it would impose tariffs on U.S. crude in retaliation against similar moves by Washington.

|

2018, July, 16, 10:15:00

BRAZIL'S GDP UP 1.8%IMF - Following the severe recession in 2015−16, real GDP grew by 1 percent in 2017. Growth is projected to be 1.8 and 2.5 percent in 2018 and 2019, respectively, driven by a recovery in domestic consumption and investment. Even if federal expenditure remains constant in real terms at its 2016 level, as mandated by a constitutional rule, public debt is expected to rise further and peak in 2023 at above 90 percent of GDP.

|

2018, May, 30, 13:25:00

BRAZIL'S ECONOMY GROWTH 2%IMF - The fiscal stance is also supportive with the primary deficit projected to widen from 1.7 to 2.4 percent of GDP in 2018, as implied by the budget. GDP growth is projected to accelerate from 1 percent in 2017 to about 2 percent in 2018, driven by private consumption and investment.

|

2018, March, 30, 11:05:00

EXXON PARTNERSHIP IN BRAZILREUTERS - Exxon along with Petrobras and Qatar Petroleum Intl shelled out 2.8 billion reais ($844 million) for a block in Brazil’s offshore Campos basin as the American oil major seeks to aggressively replace dwindling reserves. |