KAZAKHSTAN WILL UP BY 3.1%

IMF - An IMF staff team visited Kazakhstan during November 6-14, 2018 to review developments, prospects, and policies. Discussions focused on the outlook and risks, monetary policy and operations, the financial sector, budget execution, the 2019 budget, the fiscal framework, and structural reforms. The team thanks the authorities and other counterparts for excellent cooperation and productive discussions.

Developments and outlook

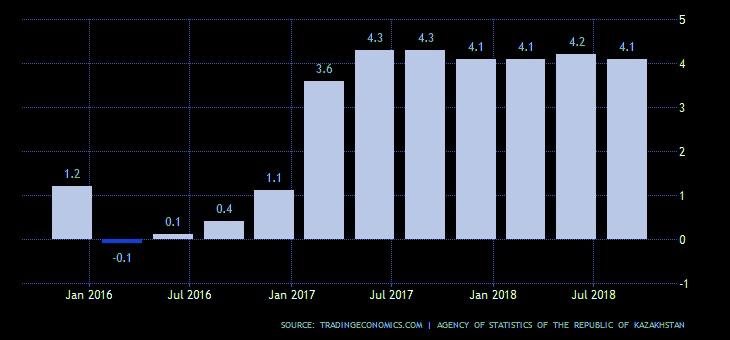

1. Growth was strong in the first half of 2018 at 4.2 percent, led by manufacturing, oil, and a recovery of credit growth. With base effects from high growth in late 2017, the team forecasts growth of 3.7 percent in 2018, and as oil production gains moderate, 3.1 percent in 2019. Inflation has come down to 5.3 percent in October. Stronger exports, especially oil, have supported improvement of the current account. For the medium term, the team projects a pickup of non-oil growth to 4 percent, reflecting structural reforms and financial sector repair. Risks are from lower commodity prices, geopolitical and trade tensions affecting major trading partners, and possible gaps in implementation of reforms.

Monetary and exchange rate (ER) policy

2. Monetary policy has continued to focus on price stability. With favorable inflation dynamics, the NBK cut interest rates until October, when the policy rate was raised, due to an escalation of inflation risks, including from ER developments. The tenge has been under pressure recently, mainly reflecting spillovers from Russia. The NBK stayed out of the FX market until September, when it sold FX due to severe short-term pressures. This was appropriate, given that the pressures appeared to be transitory. Also, in the team’s view, the latest policy rate decision was justified, given risks, both domestic (wage increases and other fiscal initiatives) and external, and expected ER pass-through to prices. The decision sent an important signal that monetary policy remains focused on price stability. The team also welcomes publication of new data and other information by the NBK.

3. A key challenge is to improve monetary transmission. The NBK has successfully managed a structural liquidity surplus through its notes, which have proven to be an effective instrument. Staff sees merit in their continued use, especially as they are tradeable and can be pledged in repo transactions. To promote enhanced liquidity management by banks, the NBK could move from daily note auctions to lower frequency issuance of 7-day notes.

4. The pass-through of NBK policy rate reductions to lending and deposit rates has been limited, and credit growth has been under pressure of structural changes in the banking sector. This has intensified calls for state intervention to provide cheaper, longer-term loans to businesses and households. Examples include the “7-20-25” mortgage program, a KZT 200 billion bank bond program, and a new initiative to provide KZT 600 billion for sectoral projects. While the team understands the case for actions to overcome obstacles and lower borrowing costs, support should be targeted and temporary and come from the budget, not the NBK or the pension fund (UAPF). Scale and timing are important too: credit is picking up and a further boost could fuel inflation. Credit subsidies introduce distortions and run counter to the strategic goal of reducing the footprint of the state in the economy. Also, the case for new state measures is diminished by abundant bank liquidity. Work should continue to enhance banking sector stability. Increased confidence in banks would lower uncertainty and reduce deposit volatility, supporting channeling of longer-term liquidity to the real economy.

Financial sector

5. Assisted by the NBK’s Bank Recovery Program (BRP), banking system stability has been preserved. Capitalization, asset quality, liquidity, and profitability have all been improving. Accounting for the significant write-off of nonperforming loans, there has been an increase in credit, particularly retail loans. In the past few months, the NBK rightly revoked the licenses of several small banks for systematic non-compliance with prudential requirements. However, the recent additional financial support for Tsesna Bank raises concerns. Difficulties at Tsesna Bank led to purchase of KZT 450 billion of bad assets by the Problem Loan Fund (PLF) at face value. Tsesna’s shareholders remain in place, having agreed to provide new share capital. We understand that the bank is now undergoing much needed, comprehensive restructuring, including improved credit risk management.

6. A decisive strengthening of banks will require continuous efforts. Following recent legal changes, the NBK must use effectively its new supervisory powers, shifting to risk-based supervision. The NBK’s aim to complement the roll-out of risk-based supervision with an external asset quality review (AQR) of banks is commendable. An AQR is a key tool to assess capital adequacy of banks and establish follow-up actions. Also, as the team has noted in the past, state support to banks is justified only for systemic, viable banks, and should be linked to strict conditions on loss recognition before state capital is added (so that shareholders are not bailed out), a robust restructuring plan and corporate governance, enhanced supervision, and transparency.

Capital markets

7. The launch of the Astana International Financial Center (AIFC) provides an opportunity to deepen capital markets. AIFC is expected to handle initial public offerings (IPOs) of a several major state-owned enterprises in 2018-20 and to take the lead role in the government securities market. The operation of two exchanges with potentially overlapping traded instruments risks confusion and distortions. The team urges all stakeholders (government, NBK, AIFC, KASE) to lay out a clear vision for market operations and development. The vision should extend to pensions, where discussions on reintroducing private pension management have been underway. A clear statement by government and the NBK on objectives, principles, and plans in the pension area would be helpful.

Fiscal policy

8. With economic recovery, fiscal policy is rightly focused on adjustment and rebuilding of buffers, following implementation of large-scale economic support measures in 2014-17 (Nurly Zhol, Nurly Zher) and support for banks. Revenues are expected to increase in 2018, reflecting the improved economic environment, higher oil production and prices, and measures to strengthen administration and collections. Spending is set to remain broadly constant in nominal terms, allowing for a lower non-oil deficit and an increase of balances in the National Fund (NFRK).

9. The 2019 budget continues consolidation, while making room for new initiatives announced in September by the President. The budget envisages higher VAT and corporate income tax revenues. Increases of personal income tax rates for higher-income earners were reviewed and postponed, due to concerns with evasion and collections. On spending, wage increases will take place, along with higher social spending and support for SMEs and the agro-industrial and manufacturing sectors. The budget is in line with the deficit-reduction and buffer-rebuilding path in the 2016 NFRK concept.

10. The team broadly supports the policies in the draft budget, although it notes that a relaxation in 2019-21 relative to the previous baseline—reflecting higher wages and sectoral support—comes at a time of higher oil prices. While the medium-term consolidation is set to continue, the relaxation raises concern with procyclical policies and vulnerability to oil price changes. The team welcomes the authorities’ ambitious tax administration reforms and continues to see merit in greater tax progressivity. The team is concerned with the relatively low level of capital spending going forward. This could adversely affect medium-term growth. The move into PPPs in health, education and other areas could bring benefits (innovation, services, lower costs), if PPPs are carefully designed and managed to limit risks. Further efforts should be made in aligning the fiscal framework to best practices, especially in budget formulation and reporting. Risk management and transparency should be strengthened.

Structural reforms

11. The authorities rightly aim to reduce the state’s footprint and diversify the economy by improving the business environment, making public administration more service-oriented and efficient, investing in enabling infrastructure (transport, IT), and undertaking PPPs. These efforts represent a transition from substantial state support in recent years. Decisive implementation is needed. Privatization is advancing, with over 400 firms sold since 2016, and hundreds more undergoing liquidation. High-quality IPOs of “blue-chip” state companies in natural resources, electricity, transportation, and communications will be key to show commitment and build confidence. Special attention should be paid to agriculture, where poor risk management, ineffective operations, and high indebtedness have placed pressure on banks, notably Tsesna. The sector should be transformed to become an engine of investment, exports, and growth. More generally, structural reforms should aim to increase Kazakhstan’s attractiveness to foreign investors.

Article IV consultation

12. The team proposes that the 2019 Article IV consultation mission be held in April or May, with possible focus areas being further strengthening of the monetary policy operations and the inflation-targeting framework, continuing financial sector repair and deepening, the fiscal framework, and wage policy and competitiveness. The IMF has launched a new initiative for all member countries on strengthening governance and addressing corruption risks, and the team will also focus on this area.

Concluding remarks

13. The authorities are rightly making the transition from strong state support to the economy in response to the difficult economic environment in 2014-17. The pickup of oil prices has provided more breathing room, but also raised risks of complacency and pro-cyclical policies. Challenges include: (i) continuing development of the inflation-targeting framework; (ii) moving decisively past longstanding weaknesses among Kazakhstan’s banks; (iii) scaling back fiscal support to the economy, while increasing non-oil revenues and improving the quality of spending; (iv) addressing fiscal risks (including from external shocks, guarantees, state-owned enterprises, PPPs, PLF); (v) and diversifying the economy and fostering the emergence of new sources of private-sector growth, especially in agriculture and services. The authorities appreciate these challenges and have devised appropriate policies. Implementation will be key. Cooperation with the IMF has been excellent, and the Fund stands ready to provide further policy advice and TA in areas such as monetary operations, modeling and communications, banking supervision and regulation, asset management, tax policy and revenue administration, public finance management and the fiscal framework, fiscal risks and transparency, and PPPs.

|

Table 1. Kazakhstan: Selected Economic Indicators, 2016–2022 |

|||||||

|

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Projections |

|||||||

|

(Annual percent change, unless otherwise indicated) |

|||||||

|

National accounts and prices |

|||||||

|

Real GDP |

1.1 |

4.0 |

3.7 |

3.2 |

3.2 |

3.3 |

3.3 |

|

Real oil |

-1.2 |

10.7 |

3.1 |

1.2 |

1.1 |

1.1 |

1.1 |

|

Real non-oil |

1.8 |

1.9 |

3.9 |

3.9 |

3.9 |

4.0 |

4.0 |

|

Real consumption |

1.6 |

1.7 |

2.9 |

3.2 |

3.1 |

3.5 |

3.0 |

|

Real investment |

2.7 |

2.5 |

2.8 |

3.4 |

3.8 |

3.2 |

4.0 |

|

Real exports |

-4.4 |

2.3 |

4.3 |

3.0 |

3.0 |

3.1 |

3.2 |

|

Real imports |

-1.9 |

-4.4 |

1.3 |

3.0 |

3.4 |

3.3 |

3.2 |

|

Output gap (in percent of potential GDP) |

-1.8 |

-1.2 |

-0.7 |

-0.5 |

-0.3 |

0.1 |

0.5 |

|

Consumer price index (eop) |

8.5 |

7.1 |

6.2 |

5.5 |

4.4 |

4.3 |

4.0 |

|

GDP deflator |

13.7 |

6.4 |

10.9 |

5.2 |

3.7 |

3.9 |

4.4 |

|

Official exchange rate (Tenge per U.S. dollar; eop) |

-1.8 |

-0.3 |

… |

… |

… |

… |

… |

|

(In percent of GDP, unless otherwise indicated) |

|||||||

|

General government fiscal accounts |

|||||||

|

Revenues and grants |

16.1 |

18.8 |

20.2 |

21.0 |

21.4 |

21.1 |

21.0 |

|

Oil revenues |

4.1 |

6.2 |

7.5 |

7.5 |

7.6 |

7.0 |

6.4 |

|

Non-oil revenues |

12.0 |

12.6 |

12.8 |

13.5 |

13.9 |

14.2 |

14.6 |

|

Of which : Income Tax |

5.5 |

5.9 |

6.4 |

6.4 |

6.4 |

6.4 |

6.4 |

|

VAT |

3.2 |

3.2 |

3.1 |

3.4 |

3.6 |

3.7 |

3.8 |

|

Expenditures and net lending |

21.5 |

25.2 |

19.6 |

18.9 |

19.1 |

19.0 |

19.0 |

|

Current expenditure 1/ |

18.0 |

21.3 |

16.7 |

16.1 |

16.2 |

16.1 |

16.0 |

|

Of which : Wages |

2.9 |

2.7 |

2.6 |

2.8 |

2.9 |

2.8 |

2.9 |

|

Goods and services |

6.1 |

6.2 |

4.0 |

4.0 |

4.0 |

4.0 |

4.0 |

|

Financial support to SOEs, banks and the Problem Loan Fund |

0.0 |

4.0 |

0.8 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Net transfers to other levels of government |

0.0 |

0.0 |

1.6 |

1.6 |

1.6 |

1.6 |

1.6 |

|

Capital expenditure |

2.8 |

3.3 |

2.5 |

2.3 |

2.4 |

2.4 |

2.5 |

|

Overall fiscal balance |

-5.4 |

-6.5 |

0.6 |

2.1 |

2.3 |

2.2 |

2.0 |

|

Excluding the financial support to SOEs and banks |

-5.4 |

-2.5 |

1.4 |

2.1 |

2.3 |

2.2 |

2.0 |

|

Statistical discrepancy |

-0.1 |

-2.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Financing 2/ |

5.3 |

4.5 |

-0.6 |

-2.1 |

-2.3 |

-2.2 |

-2.0 |

|

Domestic financing |

2.1 |

2.3 |

-0.1 |

-0.5 |

-0.5 |

-0.5 |

-0.5 |

|

Foreign financing |

1.6 |

0.4 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

|

NFRK (net) |

1.7 |

1.8 |

-0.7 |

-1.7 |

-1.9 |

-1.8 |

-1.6 |

|

Gross public debt (percent of GDP) |

19.7 |

20.8 |

18.1 |

16.3 |

14.8 |

13.4 |

12.0 |

|

Non-oil fiscal balance (percent of GDP) |

-9.5 |

-12.7 |

-6.9 |

-5.4 |

-5.2 |

-4.8 |

-4.4 |

|

Non-oil fiscal balance (percent of non-oil GDP) |

-11.8 |

-15.8 |

-9.1 |

-7.0 |

-6.6 |

-5.9 |

-5.3 |

|

Structural non-oil fiscal balance (percent of non-oil GDP) |

-12.0 |

-10.7 |

-9.0 |

-7.1 |

-6.8 |

-6.2 |

-5.9 |

|

(Annual percent change, eop, unless otherwise indicated) |

|||||||

|

Monetary accounts 3/ |

|||||||

|

Reserve money |

8.7 |

7.3 |

7.0 |

8.1 |

7.0 |

7.7 |

7.9 |

|

Broad money |

15.6 |

-1.7 |

2.4 |

10.1 |

8.1 |

8.5 |

9.2 |

|

Credit to the private sector |

0.1 |

0.9 |

0.4 |

10.3 |

10.3 |

10.7 |

11.2 |

|

Credit to the private sector (percent of GDP) |

29.6 |

27.0 |

23.6 |

23.9 |

24.7 |

25.5 |

26.2 |

|

NBK policy rate (eop; percent) 4/ |

12.0 |

10.3 |

9.3 |

… |

… |

… |

… |

|

(In billions of U.S. dollars, unless otherwise indicated) |

|||||||

|

External accounts |

|||||||

|

Current account balance (percent of GDP) |

-6.5 |

-3.4 |

-0.7 |

-0.3 |

-0.4 |

-0.4 |

-0.4 |

|

Exports of goods and services |

43.6 |

55.9 |

69.4 |

70.9 |

71.4 |

72.1 |

73.3 |

|

Oil and gas condensate |

19.3 |

26.6 |

37.1 |

37.4 |

36.2 |

35.1 |

34.5 |

|

Non-oil exports and services |

24.3 |

29.3 |

32.3 |

33.5 |

35.2 |

37.0 |

38.9 |

|

Imports of goods and services |

39.1 |

43.0 |

45.9 |

47.0 |

48.5 |

50.1 |

51.5 |

|

NBK gross reserves (eop) |

29.7 |

30.7 |

30.2 |

31.1 |

32.1 |

33.1 |

34.1 |

|

NFRK assets (eop) |

61.2 |

58.3 |

59.5 |

62.9 |

67.0 |

70.9 |

74.9 |

|

Total external debt (percent of GDP) 5/ |

119.0 |

104.9 |

96.8 |

94.6 |

93.2 |

91.0 |

88.1 |

|

Excluding intracompany debt (percent of GDP) |

42.9 |

39.6 |

36.1 |

35.9 |

36.8 |

37.0 |

36.6 |

|

Memorandum items: |

|||||||

|

Nominal GDP (in billions of tenge) |

46,971 |

51,967 |

59,790 |

64,912 |

69,489 |

74,579 |

80,417 |

|

Nominal GDP (percentage change) |

14.9 |

10.6 |

15.1 |

8.6 |

7.1 |

7.3 |

7.8 |

|

Nominal GDP (in billions of U.S. dollars) |

137.3 |

159.4 |

183.8 |

195.3 |

209.1 |

224.4 |

242.0 |

|

Total Gross Transfers from the NFRK (in billions of U.S. dollars) |

8.3 |

10.2 |

8.0 |

6.9 |

6.0 |

6.0 |

6.0 |

|

Exchange rate (tenge per U.S. dollar; eop) 6/ |

333.3 |

332.3 |

372.7 |

… |

… |

… |

… |

|

Saving-Investment balance (percent of GDP) |

-6.5 |

-3.4 |

-0.7 |

-0.3 |

-0.4 |

-0.4 |

-0.4 |

|

Crude oil, gas cnds. production (millions of barrels/day) 7/ |

1.62 |

1.79 |

1.85 |

1.87 |

1.89 |

1.92 |

1.94 |

|

Oil price (in U.S. dollars per barrel) |

42.8 |

52.8 |

69.4 |

68.8 |

65.7 |

63.1 |

61.3 |

|

Sources: Kazakhstani authorities and Fund staff estimates and projections. 1/ For 2015 it includes a transfer of USD 4.5 billion (2.4 percent of GDP) to KazMunaiGaz to make external debt payments. For 2017 it includes the support of the banking sector of about $6.4 (4 percent GDP) billion. For 2018 it includes a transfer of Tenge 450 billion (0.8 percent of GDP) to the Problem Loan Fund. 2/ Does not include revenues from IPOs 3/ The presentation of monetary accounts has been revised based on Standardized Report Form (SRF). Transactions carried out by the NBK on behalf of the government; in particular, custodian transactions related to the NFRK management are excluded. Credit to the private sector comprises credit to non-financial private enterprises and other resident sectors (mainly households). 4/ Refinancing rate through 2014 and base interest rate of the NBK from 2015. For 2018, latest available observation. 5/ Gross debt, including arrears and other short-term debt. 6/ Latest available observation. 7/ Based on a conversion factor of 7.6 barrels of oil per ton. |

|||||||

-----

Earlier:

2018, November, 5, 12:15:00

РОССИЯ: ОБЪЕДИНЕНИЕ ЭНЕРГОСИСТЕММИНЭНЕРГО РОССИИ - На фоне происходящих интеграционных процессов на Евразийском пространстве Электроэнергетический Совет СНГ продолжает играть важную роль в рамках объединения энергосистем государств Содружества.

|

2018, October, 29, 12:20:00

KAZAKHSTAN'S GAS FOR CHINANIKKEI ASIAN REVIEW - Annual gas exports from Kazakhstan to China are set to double in 2019, as Beijing moves to cushion the impact of its trade war with the U.S.

|

2018, October, 24, 11:05:00

KAZAKHSTAN'S URANIUM PRODUCTION : 21,600 MTPLATTS - Kazakhstan plans to produce a total of 21,600 mt of uranium in 2018, a decrease of almost 20% compared with the previously forecast 27,000 mt, Riaz Rizvi, Kazatomprom's chief commercial officer said.

|

2018, August, 31, 11:00:00

KASHAGAN OIL PRODUCTION: 470 TBDPLATTS - Oil production at Kazakhstan's giant Kashagan field could be as high as 470,000 b/d under its first development phase, the head of the consortium overseeing the field, Brune Jardin, has said, while also noting plans for a big maintenance shutdown, and for development of nearby fields with China's CMOC.

|

2018, August, 17, 11:55:00

ШИРОКИЕ ПЕРСПЕКТИВЫ СОТРУДНИЧЕСТВАМИНЭНЕРГО РОССИИ - «Если рассмотреть Конвенцию через призму энергетического сотрудничества прикаспийских государств, можно отметить, что она открывает большие перспективы для расширения и углубления взаимовыгодного сотрудничества в сфере ТЭК», - сказал глава российского энергетического ведомства.

|

2018, July, 6, 11:25:00

KASHAGAN'S OIL 300 TBDPLATTS - Kazakhstan's giant Kashagan oil field is achieving new production highs everymonth and has done better than 300,000 b/d, but development beyond the currentphase is likely to be about "discretionary step-ups" rather than giant steps,Shell country chair and vice president Olivier Lazare said Thursday.

|

2016, October, 14, 18:30:00

THE FIRST KASHAGAN'S OILThe project has been plagued by multiple delays and cost overruns. A 2008 budget estimate of $38 billion jumped to $53 billion by the end of last year as the partners replaced undersea links after sour gas cracked the pipes. |