MALAYSIA'S GDP UP BY 4.7%

IMF - IMF Staff Completes 2019 Article IV Consultation to Malaysia

- The Malaysian economy has shown resilience. Real GDP growth is projected at 4.7 percent for 2018, underpinned by domestic demand.

- Fiscal policy should follow a gradual consolidation path while making room for increased pro-growth social spending. Revenues should be strengthened. Maintaining the current broadly neutral monetary policy stance is appropriate.

- A comprehensive structural reform agenda, along the lines laid out in the Mid-Term Review of the Eleventh Malaysia Plan, is needed to help Malaysia achieve high-income status and inclusive economic development.

An International Monetary Fund (IMF) team, led by Nada Choueiri, visited Kuala Lumpur and Putrajaya from November 29 to December 12, 2018, to conduct discussions for the 2019 Article IV Consultation with Malaysia. At the conclusion of the visit, Ms. Choueiri issued the following statement:

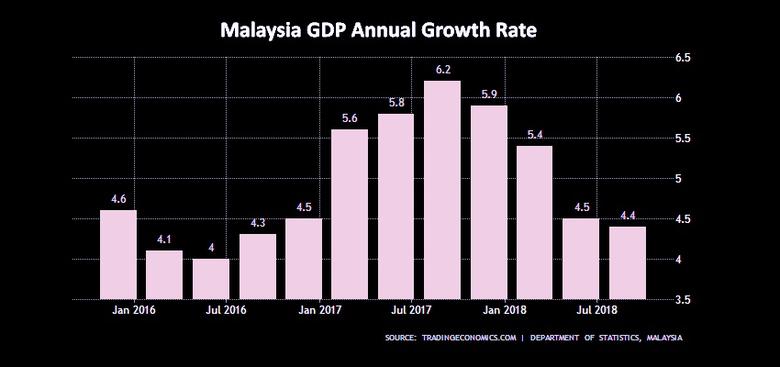

“The Malaysian economy has shown resilience in recent years and continues to perform well. Real GDP growth is moderating in line with expectations and is projected at 4.7 percent for 2018, driven by domestic demand. Headline inflation is declining and is expected to average around 1.1 percent this year. Credit growth has rebounded recently, and capital outflows have been manageable. The current account surplus is projected to decline to 2.1 percent of GDP.

“Looking ahead, real GDP growth is projected at 4.5 to 5.0 percent in 2019, with domestic demand remaining the main driver of growth, while the U.S. tariffs on imports from China are expected to have an overall adverse impact on Malaysia’s growth. Inflation should average 2.2 percent, as the effect of GST removal dissipates.

“The risks to the growth outlook are to the downside. On the external side, Malaysia is vulnerable to rising protectionism, a sharp tightening of global financial conditions, and weaker-than-expected growth in trading partners. Domestically, contingent liabilities could necessitate additional measures to ensure medium-term fiscal sustainability.

“While the budget deficit projected for 2018 represents a delay to the fiscal adjustment, the government’s planned pace of fiscal consolidation for 2019 is appropriate and will help build buffers and maintain financial market confidence. In the medium term, fiscal policy should follow a gradual consolidation path. The composition of adjustment should be improved to make it more revenue based, making room for increased social spending to support inclusive growth.

“Malaysia’s monetary policy framework has performed well, delivering price and output stability. The current broadly neutral monetary policy stance is appropriate given close-to-potential growth, no inflationary pressures, and gradually tightening financial conditions. Continued reliance on exchange rate flexibility and macroeconomic policy adjustments should be the first line of defense against external shocks.

“The financial system seems well positioned to cope with standard shocks. Bank profitability and liquidity are sound, and the corporate sector is only moderately leveraged. Household debt is high, but declining as a share of GDP, and risks in the housing market appear manageable. Although the financial sector is resilient at present, the authorities’ close monitoring and active consideration of measures to mitigate risks are welcome.

“Governance reforms could help improve transparency and accountability and the efficiency of public services. It will be important to sustain the momentum in governance reforms and anchor them in appropriate legislation to secure the independence of key institutions and strengthen checks and balances.

“A comprehensive structural reform agenda, along the lines laid out in the Mid-Term Review of the Eleventh Malaysia Plan, is needed to help Malaysia achieve high-income status and inclusive economic development. Priority should be given to effective implementation of policies that lift productivity growth by, among others: (i) improving education; (ii) accelerating innovation and technology adoption; and (iii) encouraging a move up the value chain.

“The IMF team would like to thank the officials of the Government of Malaysia and Bank Negara Malaysia, as well as representatives from think tanks, NGOs, and the private sector for the helpful discussions. We would also like to thank the authorities for their generous hospitality during our stay. We look forward to maintaining a close and productive relationship with Malaysia. The IMF team will prepare a staff report and present it to the Executive Board of the IMF, currently expected in February 2019.”

-----

Earlier:

2018, December, 5, 09:20:00

VACA MUERTA INVESTMENT $2.3 BLNPLATTS - Argentina's state-run energy company YPF and Malaysia's Petronas agreed Tuesday to invest $2.3 billion in a shale oil project in Vaca Muerta, with a target of reaching 60,000 b/d of oil equivalent by 2022.

|

2018, June, 1, 09:00:00

PETRONAS BUYS LNG CANADAREUTERS - Malaysia’s state-owned oil and gas company Petroliam Nasional Bhd [PETR.UL] said on Thursday it is buying a 25 percent stake in a Canadian liquefied natural gas (LNG) export project, nearly a year after cancelling its own planned terminal.

|

2018, March, 30, 11:10:00

PETRONAS - ARAMCO COLLABORATIONSAUDI ARAMCO - Petroliam Nasional Berhad (PETRONAS), the national oil company of Malaysia, and Saudi Aramco, the national oil company of Saudi Arabia, are pleased to announce the formation of two joint ventures for the Refinery and Petrochemical Integrated Development (RAPID) project.

|

2018, January, 22, 07:55:00

RUSSIAN LNG TO U.S.BLOOMBERG - Engie bought the cargo from Petroliam Nasional Bhd and that the Malaysian company in turn bought it from Yamal LNG operator Novatek PJSC. It was the first cargo from the Siberian plant.

|

2017, April, 6, 18:45:00

SOUTH CHINA SEA SOVEREIGNTYChina claims almost all of a large stretch of sea between Taiwan, Malaysia, Indonesia, the Philippines, Brunei, Vietnam and Japan. The trouble is, between them, these seven other states all do too.

|

2017, March, 3, 18:35:00

MALAYSIA'S EXPORTS UP 13.6%Exports in January expanded 13.6 percent from a year earlier, the biggest gain since October 2015, but just missing the 15.0 percent increase forecast. In December, exports rose 10.7 percent. Data from the International Trade and Industry Ministry showed exports of mining goods increased 18.8 percent on stronger demand for crude oil and liquefied natural gas.

|

2017, February, 28, 18:45:00

SAUDI BUYS PETRONAS: $7 BLNSaudi oil giant Aramco IPO-ARMO.SE will buy an equity stake in Malaysian firm Petronas' refining and petrochemicals project in the southeast Asian country, the companies confirmed on Tuesday, investing a total of $7 billion. |