OIL PRICE: NEAR $53 YET

REUTERS - Oil prices steadied on Friday after a week of volatile trading ahead of the New Year holiday, supported by a rise in U.S. equity markets but pressured by worries about a global glut of crude.

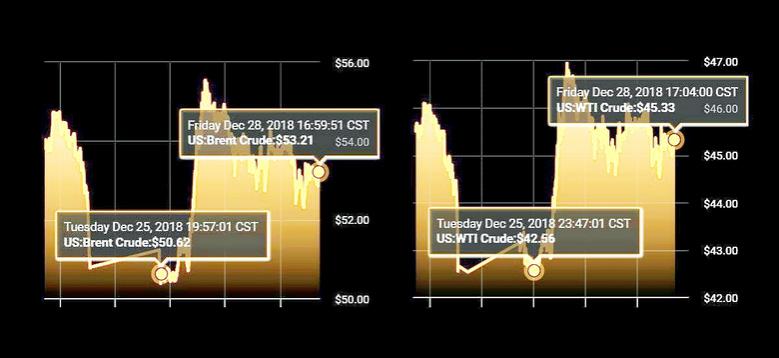

Brent crude LCOc1 futures rose 4 cents to settle at $52.20 a barrel, off the session high of $53.80 a barrel.

U.S. West Texas Intermediate (WTI) crude CLc1 futures rose 72 cents to settle at $45.33 a barrel, after earlier reaching $46.22 a barrel.

Both benchmarks posted third straight weekly declines, with Brent losing about 3 percent and WTI nearly 0.4 percent.

Crude prices were pushed higher by a rally in the U.S. equities market on Friday, markets participants said. Oil prices have tracked closely with Wall Street, and both asset classes saw volatile sessions throughout the week.

Oil prices fell to their lowest in a year and a half earlier this week and are down more than 20 percent for 2018, depressed in part by rising supply.

U.S. crude inventories were down by 46,000 barrels in the week to Dec. 21, the Energy Information Administration said, a smaller draw than the 2.9 million barrels analysts polled by Reuters had expected.

Gasoline stocks rose by 3 million barrels, trouncing analysts' expectations for a gain of 28,000 barrels.

The crude draw "failed to spur much buying interest," Jim Ritterbusch, president of Ritterbusch and Associates, said in a note. "Nonetheless, we viewed the data as price supportive with the exception of the 3 million barrel gasoline supply build."

U.S. energy firms added two oil rigs in the week to Dec. 28, General Electric Co's (GE.N) Baker Hughes energy services firm said on Friday. The data was seen as an indication of future production.

The United States has emerged as the world's biggest crude producer this year, pumping 11.6 million barrels per day (bpd), more than Saudi Arabia or Russia. Oil production has been at or near record highs in the three countries.

This month, the Organization of the Petroleum Exporting Countries and its allies including Russia agreed to cut output by 1.2 million bpd, or more than 1 percent of global consumption, starting in January.

Russian Energy Minister Alexander Novak said on Thursday that Russia would cut its crude output by between 3 million and 5 million tonnes in the first half of 2019 as part of the deal.

Novak also told reporters the U.S. decision to allow some countries to trade Iranian oil after putting Tehran under sanctions was one of the key factors behind the OPEC deal.

Imports of Iranian crude oil by major buyers in Asia hit their lowest level in more than five years in November as the U.S. sanctions on Iran's oil exports took effect, government and ship-tracking data showed.

-----

Earlier:

2018, December, 27, 17:45:00

OIL PRICE: NEAR $54 AGAINREUTERS - Brent crude oil LCOc1 dropped $1.67 a barrel, or 3.1 percent, to a low of $52.80 before recovering to around $53.45 by 1205 GMT. U.S. light crude oil CLc1 slipped $1.30 to $44.92 and was last 80 cents lower at $45.42.

|

2018, December, 26, 07:45:00

OIL PRICE: NEAR $50REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1, were up 29 cents, or 0.68 percent, at $42.82 per barrel, at 0355 GMT, having at one point risen as high as 2 percent from the last close. They had slumped 6.7 percent in the previous session to $42.53 a barrel - the lowest since June 2017. Meanwhile Brent crude oil futures LCOc1 were down 11 cents or 0.22 percent at $50.36 a barrel, having skidded 6.2 percent in the previous session to $50.47 a barrel, the weakest since August 2017.

|

2018, December, 26, 07:40:00

ОПЕК + РОССИЯ: МИНУС 2.5%МИНЭНЕРГО РОССИИ - Принято консолидированное решение о совместных действиях с коллегами из ОПЕК и не ОПЕК по сокращению добычи на 2,5% для стран ОПЕК и 2% для стран не ОПЕК.

|

2018, December, 26, 07:35:00

MARKET WILL BE BALANCEDREUTERS - “I think that during the first half, due to joint efforts, which were confirmed by the OPEC and non-OPEC countries this December, the situation will be more stable, more balanced,” Novak said in an interview on Rossiya-24 TV. |

2018, December, 26, 07:25:00

OPEC: 26 MBBL SURPLUSAN - “Based on available figures, we have around 26 million barrels of surplus ... compared to 340 million barrels in early 2017,” Al-Mazrouei told a press conference in Kuwait City.

|

2018, December, 24, 12:10:00

OIL PRICE: NEAR $54 YETREUTERS - International benchmark Brent crude LCOc1 futures rose 60 cents, or 1.1 percent, to $54.42 a barrel at 0408 GMT. Prices climbed to as high as $54.66. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 37 cents, or 0.8 percent, to $45.96 a barrel after earlier climbing to as high as $46.24.

|

2018, December, 24, 11:55:00

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices. |