OIL PRICE: NEAR $54 AGAIN

REUTERS - Oil prices fell on Thursday after rebounding 8 percent in the previous session, as worries over a glut in crude supply and concerns over a faltering global economy pressured prices even as a stock market rally offered support.

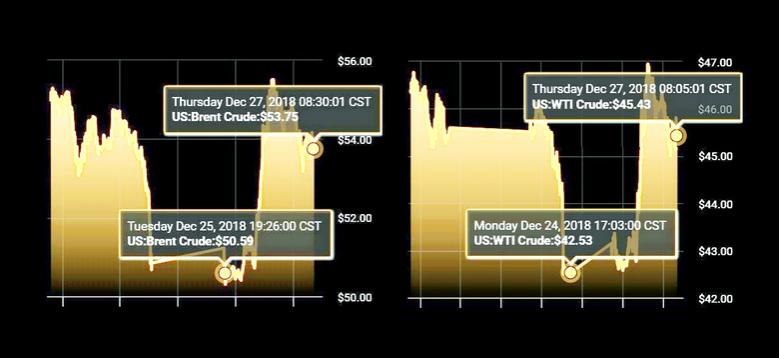

Brent crude oil LCOc1 dropped $1.67 a barrel, or 3.1 percent, to a low of $52.80 before recovering to around $53.45 by 1205 GMT. U.S. light crude oil CLc1 slipped $1.30 to $44.92 and was last 80 cents lower at $45.42.

Oil prices reached multi-year highs in early October but are now approaching their lowest levels for 18 months.

Both crude oil benchmarks have lost more than a third of their value since the beginning of October and are heading for losses of more than 20 percent in 2018.

"Fear of a bear market remains in place," said Johannes Gross at Vienna-based consultancy JBC Energy.

Three months ago it looked as if the global oil market would be under-supplied through the northern hemisphere winter as U.S. sanctions removed large volumes of Iranian crude.

But other oil exporters have more than compensated for any shortfall, filling global inventories and depressing prices.

The fuel glut has combined with faltering investor sentiment in other asset classes, producing a bear market for oil.

Stock markets rebounded on Wednesday after U.S. President Donald Trump's administration attempted to shore up investor confidence.

The Organization of the Petroleum Exporting Countries met earlier this month with other producers including Russia and agreed to reduce output by 1.2 million barrels per day (bpd), equivalent to more than 1 percent of global consumption.

But the cuts won't take effect until next month and oil production has been at or near record highs in the United States, Russia and Saudi Arabia, with the U.S. pumping 11.6 million bpd of crude, more than both Saudi Arabia and Russia.

Although U.S. sanctions have put a cap on Iran's oil sales, Tehran has said its private exporters have "no problems" selling its oil.

"Markets need more concrete evidence on improving fundamental metrics and to bring the supply-demand relationship back to balance before oil prices can reach a real bottom," said Margaret Yang, market analyst for CMC Markets.

Data on the U.S. market will appear in the next couple of days with figures from the American Petroleum Institute on Thursday and a report from the U.S. Energy Information Administration on Friday.

A Reuters survey estimated that U.S. crude inventories dropped 2.7 million barrels in the week to Dec. 21.

-----

Earlier:

2018, December, 26, 07:45:00

OIL PRICE: NEAR $50REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1, were up 29 cents, or 0.68 percent, at $42.82 per barrel, at 0355 GMT, having at one point risen as high as 2 percent from the last close. They had slumped 6.7 percent in the previous session to $42.53 a barrel - the lowest since June 2017. Meanwhile Brent crude oil futures LCOc1 were down 11 cents or 0.22 percent at $50.36 a barrel, having skidded 6.2 percent in the previous session to $50.47 a barrel, the weakest since August 2017.

|

2018, December, 26, 07:40:00

ОПЕК + РОССИЯ: МИНУС 2.5%МИНЭНЕРГО РОССИИ - Принято консолидированное решение о совместных действиях с коллегами из ОПЕК и не ОПЕК по сокращению добычи на 2,5% для стран ОПЕК и 2% для стран не ОПЕК.

|

2018, December, 26, 07:35:00

MARKET WILL BE BALANCEDREUTERS - “I think that during the first half, due to joint efforts, which were confirmed by the OPEC and non-OPEC countries this December, the situation will be more stable, more balanced,” Novak said in an interview on Rossiya-24 TV. |

2018, December, 26, 07:25:00

OPEC: 26 MBBL SURPLUSAN - “Based on available figures, we have around 26 million barrels of surplus ... compared to 340 million barrels in early 2017,” Al-Mazrouei told a press conference in Kuwait City.

|

2018, December, 24, 12:10:00

OIL PRICE: NEAR $54 YETREUTERS - International benchmark Brent crude LCOc1 futures rose 60 cents, or 1.1 percent, to $54.42 a barrel at 0408 GMT. Prices climbed to as high as $54.66. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 37 cents, or 0.8 percent, to $45.96 a barrel after earlier climbing to as high as $46.24.

|

2018, December, 24, 11:55:00

U.S. OIL CAPEX DOWNPLATTS - Three aggressive independent Permian Basin upstream operators released capital budgets for 2019 in the last few days that are lower than either prior expectations or actual 2018 spending by at least 12% to 15%, as corporate executives attributed reduced activity to the recent plunge in oil prices.

|

2018, December, 21, 14:45:00

OIL PRICE: NEAR $54REUTERS - Brent crude LCOc1 fell 77 cents to a low of $53.58 a barrel, its weakest since September 2017, before rallying to trade around $53.75, down 10.8 percent on the week, by 1055 GMT. U.S. light crude oil CLc1 was down 20 cents at $45.68, also on course for a decline of 10.8 percent for the week. |