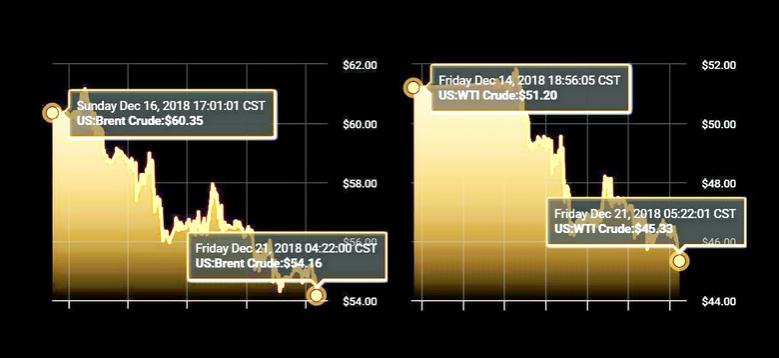

OIL PRICE: NEAR $54

REUTERS - Oil prices fell to their lowest since the third quarter of 2017 on Friday, heading for losses of more than 10 percent in a week, as global oversupply kept buyers away from the market ahead of the long festive break.

Brent crude LCOc1 fell 77 cents to a low of $53.58 a barrel, its weakest since September 2017, before rallying to trade around $53.75, down 10.8 percent on the week, by 1055 GMT.

U.S. light crude oil CLc1 was down 20 cents at $45.68, also on course for a decline of 10.8 percent for the week.

Crude has lost ground along with major equity markets as investors fret about the strength of the global economy heading into next year. The prospect of a possible government shutdown in the United States, the world's biggest oil consumer, added to investors' worries.

Falls were exaggerated by thin trading volumes and risk aversion ahead of Christmas and the New Year holidays, traders said.

"To say things are a bit negative (is) a significant understatement," said Stephen Innes, head of trading for Asia-Pacific at OANDA.

Since reaching multi-year highs at the beginning of October, both crude oil benchmarks have lost more than a third of their value in their steepest collapse for three years.

Driving the sell-off has been sustained oversupply as the United States has emerged as the world's biggest crude producer thanks to the success of its shale industry.

The United States now pumps 11.6 million barrels per day (bpd) of crude, putting it ahead of Saudi Arabia and Russia.

The big oil producers in the Organization of the Petroleum Exporting Countries, dominated by Middle East Gulf states which mostly rely on energy exports, have agreed to reduce production to try to push up prices.

But those output cuts - a reduction with Russia and other non-OPEC producers of 1.2 million bpd - do not kick in until next month, and meanwhile global inventories are filling up fast.

"The bear fest continues," said Stephen Brennock, analyst at London brokerage PVM Oil.

"According to OPEC's own forecasts, global oil stocks will build by 500,000 bpd in the first half of 2019. This will compound a glut in OECD commercial oil stocks."

In an effort to show its commitment to reducing supply, OPEC will release a table detailing output cut quotas for its members and allies such as Russia, OPEC Secretary General Mohammad Barkindo said in a letter reviewed by Reuters.

To reach the proposed cut of 1.2 million bpd, the effective reduction for member countries was 3.02 percent, Barkindo said.

That is higher than the initially discussed cuts of 2.5 percent as OPEC seeks to accommodate Iran, Libya and Venezuela, which are exempt from any requirement to cut.

-----

Earlier:

2018, December, 17, 10:50:00

OIL PRICE: NEAR $60PLATTS - At 10:30 am Singapore time (0250 GMT), February ICE Brent crude futures inched down 4 cents/b (0.07%) from Friday's settle to $60.24/b, while the NYMEX January light sweet crude contract rose 5 cents/b (0.1%) to $51.25/b

|

2018, December, 14, 09:25:00

OIL PRICE: NEAR $61 TOOREUTERS - Brent crude oil futures were at $61.09 per barrel at 0353 GMT, down 36 cents, or 0.6 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $52.47 per barrel, down 11 cents, or 0.2 percent, from their last settlement.

|

2018, December, 14, 09:10:00

2019: WORLD OIL DEMAND UP BY 1.29 MBDOPEC - In 2019, world oil demand is anticipated to rise by 1.29 mb/d. As a result, total world oil demand is anticipated to reach 100.08 mb/d. Oil demand growth is projected to originate from Other Asia, led by India, followed China, then OECD Americas. OECD countries will rise by 0.25 mb/d, while non-OECD countries will drive oil demand growth by adding an estimated 1.04 mb/d in 2019.

|

2018, December, 12, 09:15:00

OIL PRICE: NEAR $61 YETREUTERS - International Brent crude oil futures LCOc1 were at $60.86 per barrel at 0543 GMT, up 66 cents, or 1.1 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $52.22 per barrel, up 57 cents, or 1.1 percent.

|

2018, December, 11, 14:38:10

АЛЕКСАНДР НОВАК В ИНТЕРВЬЮ CNN: “НАШИ РЕШЕНИЯ ОСНОВАНЫ НА ФУНДАМЕНТАЛЬНЫХ ФАКТОРАХ РЫНКА”МИНЭНЕРГО РОССИИ - Как отметил Александр Новак, принятое решение о снижении суммарной добычи на 1,2 млн барр./сутки отражает ожидания рынка накануне встречи стран ОПЕК и не ОПЕК. As noted by Alexander Novak, the decision to reduce the total production by 1.2 million barrels per day reflects the market expectations on the eve of the meeting of OPEC and non-OPEC countries. |

2018, December, 10, 08:55:00

OIL PRODUCTION DOWN 1.2 MBDOPEC - Accordingly, the 5th OPEC and non-OPEC Ministerial Meeting, following deliberations on the immediate oil market prospects and in view of a growing imbalance between global oil supply and demand in 2019, hereby decided to adjust the overall production by 1.2 mb/d, effective as of January 2019 for an initial period of six months. The contributions from OPEC and the voluntary contributions from non-OPEC participating countries of the ‘Declaration of Cooperation’ will correspond to 0.8 mb/d (2.5%), and 0.4 mb/d (2.0%), respectively. |

2018, December, 10, 07:55:00

АЛЕКСАНДР НОВАК: “МЫ ПРИВЕРЖЕНЫ ДОГОВОРЕННОСТЯМ, И РЫНОК ЭТО ЦЕНИТ”“Было принято решение с 1 января сократить суммарно добычу на 1,2 млн барр в сутки, из них 800 тыс. возьмут на себя страны ОПЕК. Россия также примет участие в этом. Для нас это означает, что по отношению к октябрю 2018 года мы должны будем сократить производство на 2% или 220 тыс баррелей, это будет происходить постепенно”, - подчеркнул Министр. |