U.S. INDUSTRIAL PRODUCTION UP 0.6%

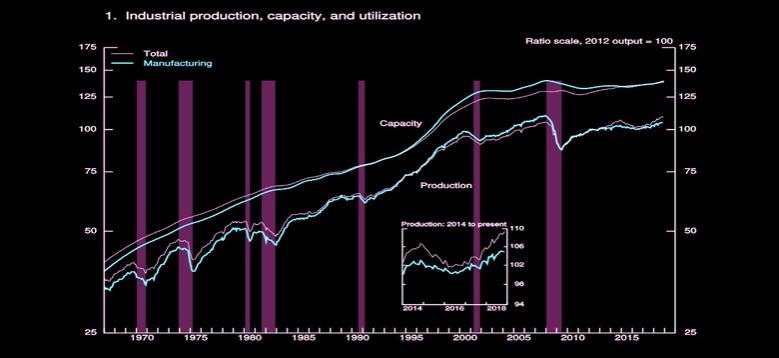

U.S. FRB - Industrial production rose 0.6 percent in November after moving down 0.2 percent in October; the index for October was previously reported to have edged up 0.1 percent. In November, manufacturing production was unchanged, the output of mining increased 1.7 percent, and the index for utilities gained 3.3 percent. At 109.4 percent of its 2012 average, total industrial production was 3.9 percent higher in November than it was a year earlier. Capacity utilization for the industrial sector rose 0.4 percentage point in November to 78.5 percent, a rate that is 1.3 percentage points below its long-run (1972–2017) average.

Market Groups

The major market groups posted mixed results in November. The index for consumer goods edged up, as a rise of nearly 2 percent for consumer energy products was mostly offset by a loss of 1/2 percent for non-energy nondurables. The index for business equipment moved down about 1/4 percent, and the index for defense and space equipment was unchanged.

Among nonindustrial supplies, the output of construction supplies declined nearly 1/4 percent in November, while the index for business supplies rose 1/2 percent. The output of industrial materials moved up more than 1 percent, with gains in durables, in nondurables, and in energy materials.

Industry Groups

Manufacturing output was unchanged in November, as an increase of 0.2 percent for durable manufacturing was offset by decreases of 0.2 percent and 0.9 percent for nondurable manufacturing and other manufacturing (publishing and logging), respectively. Within durable manufacturing, primary metals posted a gain of nearly 2 1/2 percent; no other major industry group recorded a gain of more than 1/2 percent and several recorded losses. Among nondurables, most major categories posted declines.

Mining output advanced 1.7 percent in November, with gains in oil and gas extraction, coal mining, and support activities for mining; the index for mining was 13.2 percent above its level of a year earlier. The output of utilities rose 3.3 percent in November, with increases for both electric and gas utilities; natural gas distribution rose sharply in both October and November, as unseasonably cold weather supported demand for heating.

Capacity utilization for manufacturing edged down in November to 75.7 percent, about 2 1/2 percentage points below its long-run average, as a slight rise for durables was outweighed by declines for nondurables and other manufacturing (publishing and logging). The utilization rate for mining increased to 94.1 percent and remained well above its long-run average of 87.0 percent. The operating rate for utilities moved up to 79.4 percent, a rate that is about 6 percentage points below its long-run average.

-----

Earlier:

2018, December, 10, 08:30:00

U.S. UNEMPLOYMENT: 3.7%U.S. BLS - Total nonfarm payroll employment increased by 155,000 in November, and the unemployment rate remained unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in manufacturing, and in transportation and warehousing.

|

2018, December, 7, 08:00:00

U.S. DEFICIT $55.5 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $55.5 billion in October, up $0.9 billion from $54.6 billion in September,

|

2018, December, 3, 11:55:00

U.S. PRODUCTION: OIL +1.1%, GAS +1.8%U.S. EIA - Crude oil production increases 1.1% in September from 11,346 to 11,475 thousand barrels/day , gas production increases 1.8% from 102,659 to 104,461 million cubic feet/day .

|

2018, November, 30, 11:30:00

U.S. GDP UP OF 3.5%U.S. BEA - Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent.

|

2018, November, 28, 12:55:00

U.S. ENERGY PRESSUREFT - in the third quarter of this year the US E&P sector was able to cover its capital spending from its operating cash flows, if only barely. The plunge in oil prices over the past two months is bringing those concerns gushing to the surface again.

|

2018, November, 28, 12:40:00

U.S. SUBSTANTIAL DAMAGESPLATTS - Overall, the report found that without more significant global mitigation, "climate change is projected to impose substantial damages on the US economy, human health and the environment." |

2018, November, 19, 11:30:00

U.S. PETROLEUM DEMAND 20.8 MBDU.S. API - U.S. petroleum demand in October of 20.8 million barrels per day (mb/d) was the strongest for the month since 2006 and a continued reflection of solid economic activity. |