UAE OIL INVESTMENT

PLATTS - The UAE is launching into an aggressive plan to expand its crude production capacity just as OPEC has announced new output cuts for 2019.

Energy minister Suhail al-Mazrouei, however, said he saw no conflict between OPEC's market balancing efforts and the country's field investments.

In an interview with S&P Global Platts, he cited long-term market forecasts showing US production growth slowing while global consumption was set to increase, necessitating more sources of oil.

"The UAE is investing because we feel there is a requirement for this production, but we are not going to put that production into the market unless we feel there is a need for it," Mazrouei said after last week's OPEC meeting in Vienna.

Rather, the projects will boost the country's spare capacity, which it can tap when the market gets tight, he said.

"We need that swing to allow us to contribute to production as needed," Mazrouei said, noting the OPEC production cuts were only set to last through June.

The UAE, along with other OPEC members, agreed Friday to cut production about 2% over the next six months in a bid to support global crude prices.

Abu Dhabi National Oil Company, which pumps the vast majority of the country's crude, immediately announced significant cuts to its customer crude allocations for January.

Onshore-produced Murban crude allocations will be reduced by 15%, while offshore Das and Upper Zakum will each be cut 5%. No announcement was made on ADNOC's new Umm Lulu grade.

That came one month after the Supreme Petroleum Council, Abu Dhabi's highest hydrocarbon policy-making body, announced crude output targets of up to 4 million b/d by 2020 and 5 million b/d by 2030.

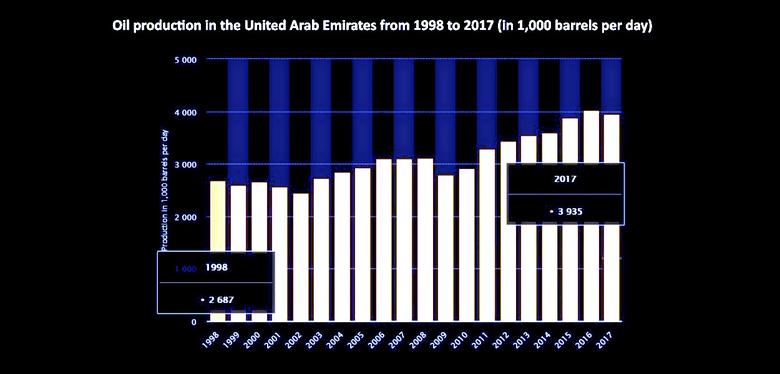

The UAE -- now OPEC'S third largest producer, surpassing sanctions-hit Iran in November -- pumped an all-time high 3.30 million b/d last month, according to the latest Platts OPEC production survey.

Carole Nakhle, an oil analyst who heads the consultancy Crystol Energy, agreed with Mazrouei that the OPEC cut should not derail the UAE's expansion plans in the long term.

However, she said: "Should the cuts extend over a longer period and become more sizeable, they can constrain the company's finances, which in turn can negatively affect its investment plans, everything else being the same."

OPEC will meet next in April to reassess market conditions and decide on next steps.

FLEXIBLE SWING

With the start-up of Umm Lulu production in September, ADNOC was on target to reach its year-end output capacity target of 3.5 million b/d.

Market sources have said the grade's production was around 50,000-60,000 b/d, with ADNOC hoping to ramp that up to 250,000 b/d by 2022-2023.

ADNOC last month also announced a $1.4 billion deal to upgrade its Bu Hasa field, which will add 100,000 b/d of output capacity to the UAE's portfolio.

Mohammad Darwazah, an analyst with Medley Global Advisors, said ADNOC could use some new production capacity in the short term, but matching the expansion plans to longer-term demand could be tricky.

The International Energy Agency, for instance, forecast in its five-year oil market outlook that output gains from the US will cover 80% of global demand growth through 2020, while Brazil, Canada and Norway would be able to cover the rest.

"Freeing up a bit of spare capacity is not a bad thing. I think the fields are worked pretty hard right now," Darwazah said. "On a medium-term basis, the 4 million [b/d target figure by 2020] could maybe be a bit aggressive. There could be a bit of downside to that."

Mazrouei, however, said the UAE remained undeterred in its expansion drive.

As recently as June, OPEC and its 10 non-OPEC partners agreed to unwind production cuts and raise output by a combined 1 million b/d, to address fears of a tight market due to US sanctions on Iran and Venezuela's continued decline.

The US subsequently issued waivers to eight countries to continue purchasing Iranian oil which, combined with forecasts of tepid global economic growth, have tanked oil prices in recent weeks, spurring OPEC and its partners into a fresh round of cuts.

Mazrouei said the events demonstrated the need for more flexible production capabilities. As it stands, Saudi Arabia holds the bulk of the world's spare capacity and operates as the market's primary swing producer.

With its investments, the UAE will be able to meet new demand while keeping some capacity in reserve to address future volatility in coordination with OPEC, Mazrouei said.

"A few months back we were asked to raise production and we used our spare capacity to do so, as a responsible producer," he said. "We feel there is a requirement for a production [capacity] increase."

-----

Earlier:

2018, December, 12, 09:05:00

АЛЕКСАНДР НОВАК В ИНТЕРВЬЮ CNN: “НАШИ РЕШЕНИЯ ОСНОВАНЫ НА ФУНДАМЕНТАЛЬНЫХ ФАКТОРАХ РЫНКА”МИНЭНЕРГО РОССИИ - Как отметил Александр Новак, принятое решение о снижении суммарной добычи на 1,2 млн барр./сутки отражает ожидания рынка накануне встречи стран ОПЕК и не ОПЕК. As noted by Alexander Novak, the decision to reduce the total production by 1.2 million barrels per day reflects the market expectations on the eve of the meeting of OPEC and non-OPEC countries. |

2018, December, 10, 08:55:00

OIL PRODUCTION DOWN 1.2 MBDOPEC - Accordingly, the 5th OPEC and non-OPEC Ministerial Meeting, following deliberations on the immediate oil market prospects and in view of a growing imbalance between global oil supply and demand in 2019, hereby decided to adjust the overall production by 1.2 mb/d, effective as of January 2019 for an initial period of six months. The contributions from OPEC and the voluntary contributions from non-OPEC participating countries of the ‘Declaration of Cooperation’ will correspond to 0.8 mb/d (2.5%), and 0.4 mb/d (2.0%), respectively. |

2018, December, 10, 08:15:00

ADNOC INCREASES VALUEADNOC - The Abu Dhabi National Oil Company (ADNOC) has announced its successful collaboration with IBM, piloting a Blockchain-based automated system to integrate oil and gas production across the full value chain.

|

2018, November, 22, 11:10:00

ИНВЕСТИЦИОННЫЙ ФОРУМ АБУ ДАБИ - МОСКВАМИНЭКОНОМРАЗВИТИЯ РОССИИ - Максим Орешкин отметил широту взаимоотношений между Россией и ОАЭ. «Товарооборот между нашими странами растет, он приближается к 5 млрд долларов, тем не менее потенциал для роста здесь есть», - добавил он. «Заключено 40 сделок на сумму более 2 миллиардов рублей. Среди проектов - реконструкция аэропорта «Пулково» в Санкт-Петербурге, строительство онкоцентров в Московской области, инвестирование в нефтехимический комплекс «ЗапСиб-2», - сообщил Максим Орешкин.

|

2018, November, 14, 11:30:00

ADNOC & SAUDI ARAMCO COOPERATIONADNOC - The Abu Dhabi National Oil Company (ADNOC) signed a framework agreement with Saudi Aramco (Aramco), to explore potential opportunities for collaboration in the natural gas and Liquefied Natural Gas (LNG) sectors.

|

2018, November, 14, 11:25:00

ENI, ADNOC CONCESSIONADNOC - ADNOC signs First Hail, Ghasha and Dalma Ultra-Sour Gas Concession with Italy’s Eni

|

2018, November, 5, 11:50:00

ADNOC'S CAPEX $132 BLNMEOG - ADNOC plans $132bn Capex until 2023, gas self-sufficiency and oil production capacity of 4mn bpd in 2020 |