CHINA: THE WORLD'S LARGEST

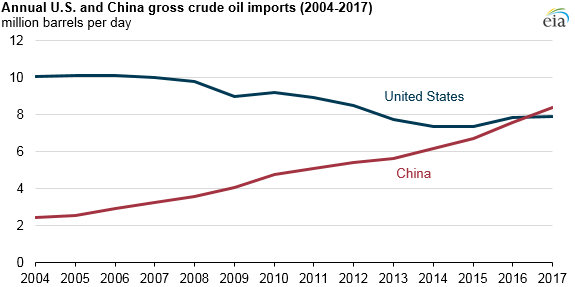

EIA - China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the United States. China had become the world's largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China's crude oil imports.

In 2017, 56% of China's crude oil imports came from countries within the Organization of the Petroleum Exporting Countries (OPEC), a decline from the peak of 67% in 2012. More so than other countries, Russia and Brazil increased their market shares of Chinese imports between those years from 9% to 14% and from 2% to 5%, respectively.

Russia surpassed Saudi Arabia as China's largest source of foreign crude oil in 2016, exporting 1.2 million b/d to China in 2017 compared with Saudi Arabia's 1.0 million b/d. OPEC countries and some non-OPEC countries, including Russia, agreed to reduce crude oil production through the end of 2018, which may have allowed other countries to increase their market shares in China in 2017.

Several factors are driving the increase in China's crude oil imports. China had the largest decline in domestic petroleum and other liquids production among non-OPEC countries in 2016, and EIA estimates it will have had the second-largest decline in 2017. Total liquids production in China averaged 4.8 million b/d in 2017, a year-over-year decline of 0.1 million b/d (2%) from 2016, and further declines in both 2018 and 2019 are forecasted in EIA's January 2018 Short-Term Energy Outlook (STEO).

In contrast to declining domestic production, EIA estimates that growth in China's consumption of petroleum and other liquid fuels in 2017 was the world's largest for the ninth consecutive year, growing 0.4 million b/d (3%) to 13.2 million b/d. As China has built up inventories of strategic petroleum reserves, China's crude oil imports have increased faster than their domestic consumption.

In addition, China has reformed its refining sector by reducing restrictions on both imports and exports. Since mid-2015, China granted crude oil import licenses to independent refineries in northeast China, which have since increased refinery utilization and crude oil imports.

China's crude oil imports have also increased because of higher refinery runs and expanding refinery capacity. China's refinery runs increased by an estimated 0.5 million b/d in 2017 to 11.4 million b/d, driven in part by two refinery expansions in the second half of the year. A 260,000 b/d refinery in Anning in Yunnan province started operating in the third quarter of 2017. The China National Offshore Oil Corporation's (CNOOC) Huizhou refinery increased capacity by 200,000 b/d and increased its imports from various sources in the third and fourth quarters of 2017.

Ongoing infrastructure expansions will likely contribute to further increases in China's crude oil imports. In January 2018, China and Russia began operating an expansion of the East Siberia-Pacific Ocean (ESPO) pipeline, doubling its delivery capacity to approximately 0.6 million b/d. According to trade press reports, as much as 1.4 million b/d of new refinery capacity is planned to open in China by the end of 2019. Given China's expected decline in domestic crude oil production, imports will likely continue to increase over at least the next two years.

-----

Earlier:

2018, February, 5, 07:50:00

CHINA'S GAS ISN'T ENOUGHREUTERS - Gas output in China rose to a record 147.4 billion cubic meters (bcm) last year, up 8.5 percent from 2016, data from the National Bureau of Statistics showed. Gas production is forecast to climb by between 6 percent to 8 percent per year through 2020, according to researchers at China National Petroleum Corp.

|

2018, February, 2, 12:20:00

HEAVY ASIAN DEMANDPLATTS - Asian demand for oil products will outweigh current and upcoming refinery capacity by 2025, Tushar Tarun Bansal, Director at McKinsey, told attendees at S&P Global Platts annual Middle Distillates Conference in Antwerp Thursday.

|

2018, February, 2, 12:15:00

CHINA'S OIL INVESTMENT UPBLOOMBERG - The Beijing-based explorer sees capital expenditures at 70 billion to 80 billion yuan ($11.1 billion to $12.7 billion) for 2018, it said in a statement to the Hong Kong stock exchange Thursday. That’s an increase of as much as 60 percent from the previous year, which came in under target. It also raised its production estimate to between 470 million and 480 million barrels of oil equivalent, poised for the the first increase in three years.

|

2018, January, 26, 12:25:00

CHINA'S ARCTIC ROADREUTERS - “China hopes to work with all parties to build a ‘Polar Silk Road’ through developing the Arctic shipping routes,” the paper, issued by the State Council Information Office, said.

|

2018, January, 17, 23:40:00

CHINA'S OIL DEMAND UP 4.6%PLATTS - China's apparent oil demand is expected to rise 4.6% year on year to hit 600 million mt (12.05 million b/d) in 2018, with net crude imports to increase 7.7% to 451 million mt, according to a report released Tuesday by state-owned China National Petroleum Corp.'s Economics and Technology Research Institute.

|

2018, January, 12, 12:35:00

CHINA - INDONESIA DEVELOPMENTPLATTS - China's state-controlled oil giants are sitting on record-high cash pile of $35 billion and their free cash flow generation is close to double-digit yields, paving the way for more mergers and acquisitions along with higher oil prices over coming years,

|

2018, January, 3, 15:55:00

RUSSIA - CHINA OIL FRIENDSHIPBLOOMBERG - After a glut sparked the biggest price crash in a generation and starved Russia of oil revenues, the nation sought to boost market share in the world’s top importer. It’s now supplanted Saudi Arabia as the top exporter to China, even as the two producers lead efforts to shrink the global oversupply by curbing output. A pipeline that transports crude from the East Siberia-Pacific Ocean system has helped its mission to increase volumes. |