INTEGRATED INDIAN OIL

PLATTS - India's ambitious move to allow state-owned Oil and Natural Gas Corp to take a majority stake in state-owned Hindustan Petroleum Corp Ltd will create the country's first integrated state-owned oil major, giving the combined entity an edge when competing in international markets.

With ONGC firming up plans to aggressively push oil and gas production at home, analysts said that the move made sense as it would help the combined entity to have a better grip across the entire value chain -- from exploration to retail -- at a time when domestic demand is set to grow rapidly.

"Effectively, the Indian government is endorsing a model of 'bigger is better' as it seeks to create companies which can champion Indian energy needs both domestically and globally," Bernstein Research said in a paper.

"The objective is to create bigger companies with more stable cash flow profiles which can better meet India's long-term energy needs," it added.

ONGC said earlier in January that it had agreed to buy the government's entire 51.11% stake in HPCL and the transaction would be completed by the end the month. The strategic sale requires ONGC to pay around Rupees 370 billion ($5.8 billion) for the stake.

Both ONGC and HPCL are listed on the Bombay Stock Exchange and the deal has been exempted from open offers as both companies are state-owned.

"The integrated entity will have the capacity to neutralize the impact of volatility in global crude oil prices," said oil minister Dharmendra Pradhan. "The integrated entity will have the advantage of having enhanced capacity to bear higher risks and take higher investment decisions."

HPCL will continue to be listed as a separate entity on BSE for some time even after the acquisition is completed. In addition, HPCL's management will be allowed to make commercial decisions in the initial years. ONGC will also retain the HPCL brand in the retail space.

"Historically, integration has provided a natural hedge to commodity prices, with E&P providing the performance during higher oil prices and refining outperforming when oil prices fall. The logic of the model is that both segments smooth out financial performance across volatile industry cycles and provide greater financial stability," Bernstein said.

ONE STONE, TWO BIRDS

Analysts said that the transaction would help the government cross its disinvestment target of Rupees 200 billion for fiscal 2017-2018 (April-March) at one go.

"The Indian government is hitting two birds with one stone. The merger will help it accomplish the dream of creating a vertically integrated national oil company. And in the process, it will meet its own divestment target," said Sri Paravaikkarasu, head of oil, East of Suez, at Facts Global Energy.

"The deal no doubt brings a variety of benefits to ONGC. As an integrated company, ONGC will be in a better position to weather volatile oil prices as earnings will be diverse across the supply chain. Also, its balance sheet will be much stronger, enabling the company to bid for bigger oil fields. The company has often lagged behind its Chinese peers such as CNPC in overseas upstream acquisitions," she added.

ONGC, the largest producer of crude oil and natural gas in India, contributes around 70% of domestic production. In 2016-2017, the company's oil and gas production reached 61.6 million mt of oil equivalent.

The acquisition of the 51.11% equity share in HPCL would make ONGC the third-largest refiner in the country, the company said in a statement quoting D.D. Misra, ONGC's human resources director.

"ONGC has one of the most exciting growth profiles of any E&P company in the Asia-Pacific region, with 6% CAGR growth over the next five years," Bernstein said.

ONGC's crude production in the April-December period was about 16.89 million mt, about 1.5% higher from a year earlier. It's natural gas output in 2016-17 (April-March) witnessed a growth of 4.29% to 22.09 Bcm. And natural gas production grew close to 8% in the same period.

LONG-TERM GAINS

ONGC's board has approved projects worth over Rupees 780 billion over the past three years to boost the country's oil and gas output.

Upstream-focused ONGC, however, is no stranger to the downstream segment. It took over Mangalore Refinery and Petrochemicals Ltd. in March 2003. MRPL runs a 15 million mt/year (300,000 b/d) refinery at New Mangalore and exports mainly naphtha, gasoil and jet fuel.

On the other hand, HPCL sells around 35.2 million mt of petroleum products and has a 21% share in the domestic market. It also owns the biggest lube refinery in India and also runs the country's second-largest cross-country product pipeline network of 3,500 km.

The acquisition will give ONGC ownership of HPCL's two refineries -- at Mumbai and Visakhapatnam -- as well as 15,000 retail outlets.

HPCL also has a joint venture refinery at Bhatinda and is setting up a greenfield 9 million mt/year refinery and petrochemical complex in Rajasthan that is scheduled to come on stream in 2023. HPCL owns and operates an LPG cavern at Visakhapatnam in a joint venture with Total.

But analysts pointed to the challenges and the unfinished agenda.

"To derive maximum benefit, the refining operations should be consolidated under one umbrella with full integration with petrochemical units. By doing so, the oil firm will be optimizing every single molecule it gets on ground," FGE's Paravaikkarasu said.

"However, talks for such a full integration are on the back burner now. Rather, the government continues to affirm that HPCL will be allowed to operate as an independent company. Also, the two companies are culturally unique and tearing the walls down for seamless integration will face various [hurdles]," she added.

Bernstein also highlighted some of the risks.

"The current structure in India, which separates upstream from downstream, allows management teams to focus on what they are good at. Finally, there is the argument that the current structure allows investors to make a clear distinction between upstream and downstream. By integrating both the companies, it will remove the choice for domestic Indian investors in positioning themselves either upstream or downstream," it added.

-----

Earlier:

2018, February, 2, 12:20:00

HEAVY ASIAN DEMANDPLATTS - Asian demand for oil products will outweigh current and upcoming refinery capacity by 2025, Tushar Tarun Bansal, Director at McKinsey, told attendees at S&P Global Platts annual Middle Distillates Conference in Antwerp Thursday.

|

2018, January, 22, 08:00:00

ONGC BUYS FOR $5.78 BLNREUTERS - India’s biggest explorer Oil and Natural Gas Corp (ONGC) has agreed to buy the government’s majority stake in state-refiner Hindustan Petroleum Corp for 369 billion rupees ($5.78 billion).

|

2018, January, 10, 12:50:00

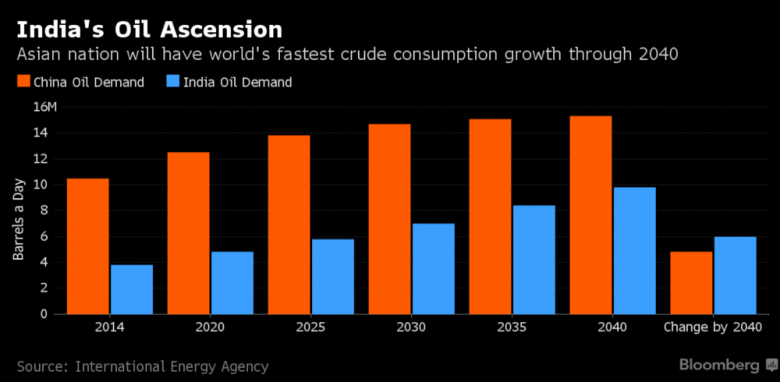

THE SLOWEST INDIA'S OIL DEMANDBLOOMBERG - The nation’s consumption of petroleum products rose 2 percent to about 200 million tons, the Oil Ministry’s Petroleum Planning and Analysis Cell said Wednesday. That’s the slowest since 2013, when demand grew 1.7 percent while global oil prices averaged about $109 a barrel, almost double last year’s level.

|

2017, December, 27, 12:35:00

INDIA'S STRONG GROWTHIMF - Since the 2011 Financial Sector Assessment Program (FSAP), India has recorded strong growth in both economic activity and financial assets, supported by important structural reforms and terms of trade gains.

|

2017, November, 1, 13:30:00

SOUTHEAST ASIA NEED ENERGYAccess to modern energy is incomplete. With a total population of nearly 640 million, an estimated 65 million people remain without electricity and 250 million are reliant on solid biomass as a cooking fuel. Investment in upstream oil and gas has been hit by lower prices since 2014 and the region faces a dwindling position as a gas exporter, and a rising dependency on imported oil.

|

2017, September, 13, 15:10:00

IMF: SOUTHEAST ASIA'S TRANSFORMATIONIMF - When we think about Asia’s economic future, we know that this future is being built on strong foundations—on the richness and diversity of its cultures, on the incredible energy and ingenuity of the people who have changed the world by transforming their own economies. China and India have been driving the greatest poverty reduction in human history by creating the world’s largest middle classes. In a single generation, Vietnam has moved from being one of the world’s poorest nations to being a middle-income country. |

2017, September, 6, 18:10:00

ПЕРСПЕКТИВНЫЙ АЗИАТСКИЙ РЫНОКГлава Минэнерго России подчеркнул, что рынок АТР для России очень перспективный, и в этом направлении будет развиваться соответствующая инфраструктура. «Первые поставки газа по «Силе Сибири» начнутся в конце 2019 года. Много проектов реализуется по разработке новых месторождений нефти, газа, угля, привлекаются инвестиции. В перспективе добыча газа и нефти на Дальнем Востоке увеличится в два раза. Наша задача - не только добыча и продажа, но также развитие инфраструктуры и более глубокая переработка сырья. Эта продукция будет востребована как на внутреннем, как и на внешнем рынке» - уверен Александр Новак. |