OIL PRICE: ABOVE $62

REUTERS, BLOOMBERG - Oil prices ended largely unchanged on Tuesday as a weaker dollar spurred a rebound from an early slide after the International Energy Agency forecast supply could outstrip demand.

The market dipped in post-settlement trading after industry group The American Petroleum Institute said U.S. crude inventories rose by 3.9 million barrels in the week ending Feb. 9. Analysts had expected stocks to rise by 2.8 million barrels.

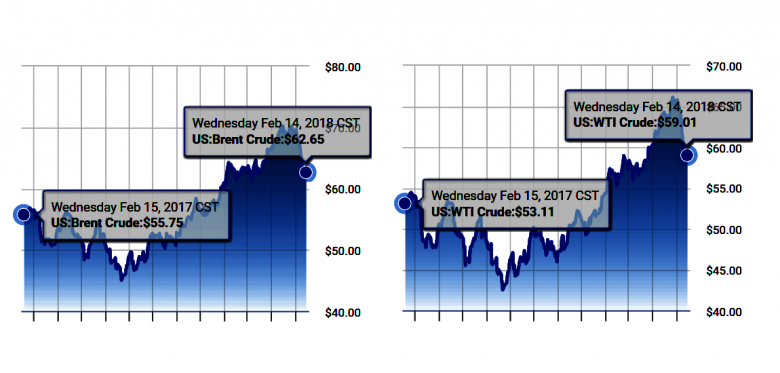

Brent futures LCOc1 hit a two-month low early in the day's session, but the benchmark settled at $62.72 a barrel, up 13 cents or 0.2 percent. U.S. West Texas Intermediate crude futures CLc1 closed 10 cents, or 0.2 percent, lower at $59.19 a barrel.

The day's recovery earlier was supported by the dollar, which .DXY slid to a one-week low, which made crude cheaper for buyers using other currencies.

But in thin post-close trading, U.S. crude futures were down 34 cents at $58.95 a barrel.

Gasoline futures also turned negative in post-settlement trading. Inventories rose by 4.6 million barrels, compared with expectations for a 1.2 million-barrel gain. Gasoline futures RBc1 fell 0.3 percent to $1.6737 a gallon.

The API figures underline wider concerns of oversupply. The Paris-based International Energy Agency said global oil supply would outstrip demand this year, prompting fears that efforts to reduce inventories would fall short of expectations.

"We've been under pressure ... it's all been a function of the IEA report," said Bob Yawger, director of energy futures at Mizuho.

The IEA revised its global demand forecast upward by 7.7 percent. Still, rising production, particularly from the United States may outweigh demand gains. The United States overtook Saudi Arabia last week to become the second-largest global producer.

Production is increasing against a backdrop of broader market uncertainty. Since the stock market began falling early this month, oil prices have wiped away the year's gains.

"There are a lot of people who are praying that last week's collapse in crude ... was some anomaly, and that as soon as the stock market recovered, the crude market would recover with it," said Walter Zimmerman, chief technical analyst at United-ICAP.

"So far it's looking a little ominous but WTI has not broken down," Zimmerman said, adding the contract would have to decline more to enter a bear market.

Seasonality may also be affecting prices, analysts said.

"A driving force behind the next few weeks of pricing vulnerability stems from the current peak in U.S. refinery maintenance season," Michael Tran, commodity strategist at RBC Capital Markets, wrote in a research note.

The U.S. Energy Information Administration will release weekly inventory data on Wednesday.

-----

Earlier:

2018, February, 12, 07:40:00

OIL PRICE: ABOVE $63REUTERS - Brent crude futures were at $63.42 per barrel at 0250 GMT, up 63 cents, or 1 percent, from the previous close. U.S. West Texas Intermediate (WTI) crude futures were at $59.83 a barrel. That was up 63 cents, or 1.1 percent, from their last settlement.

|

2018, February, 12, 07:25:00

U.S. SALES 100 MBPLATTS - Congress early Friday approved a two-year budget agreement which mandates the sale of 100 million barrels of crude oil from the Strategic Petroleum Reserve within a decade and authorizes sales of another $350 million of government-owned crude this fiscal year.

|

2018, February, 9, 11:10:00

OIL PRICE: ABOVE $64REUTERS - Brent futures were down 44 cents or 0.7 percent, at $64.37 a barrel by around 0700 GMT. On Thursday, Brent fell 1.1 percent to its lowest close since Dec. 20. U.S. West Texas Intermediate (WTI) crude was down 62 cents, or 1 percent, at $60.53 a barrel, having settled down 1 percent in the previous session at its lowest close since Jan. 2. |

2018, February, 7, 08:25:00

OIL PRICE: ABOVE $67 YETBLOOMBERG - West Texas Intermediate for March delivery rose as much as 79 cents to $64.18 a barrel and traded at $63.88 as of 11:39 a.m. in Singapore. The contract fell 76 cents to $63.39 on Tuesday. Total volume traded was about 16 percent above the 100-day average. Brent for April settlement rose 46 cents to $67.32 a barrel on the London-based ICE Futures Europe exchange, snapping a three-day decline. The global benchmark crude traded at a premium of $3.73 to April WTI.

|

2018, February, 5, 08:00:00

OIL PRICE: ABOVE $67REUTERS - Brent was down 68 cents, or 1 percent, at $67.91 a barrel at 0344 GMT, after falling 1.5 percent on Friday. Brent’s weekly drop was 2.75 percent last week. U.S. West Texas Intermediate (WTI) crude declined 72 cents to $64.73 a barrel, after dropping 0.5 percent in the previous session. WTI fell by 1 percent during the last week.

|

2018, February, 2, 12:30:00

OIL PRICE: STILL ABOVE $69REUTERS - Brent futures, the global benchmark, were up 24 cents, or 0.3 percent, at $69.89 a barrel by 0635 GMT. U.S. West Texas Intermediate (WTI) crude was up 33 cents, or 0.5 percent, at $66.13 a barrel. |

2018, January, 31, 11:10:00

OIL PRICE: ABOVE $68 AGAINREUTERS - Brent crude futures LCOc1 for March delivery settled down 44 cents, or 0.6 percent, at $69.02 a barrel after touching a session low of $68.40. U.S. West Texas Intermediate futures CLc1 fell $1.06, or 1.6 percent, to close at $64.50 a barrel. |