ЦЕНА НЕФТИ: ОПЯТЬ ВЫШЕ $67

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель.

Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

Как говорят эксперты в отрасли, упрямый рост нефтедобычи в США остаётся одним из основных факторов, сдерживающих подъём рынка в условиях действия пакта ОПЕК+.

В декабре 2016 года Организация стран-нефтеэкспортёров (ОПЕК) и несколько стран вне картеля, включая Россию, договорились сократить добычу сырья примерно на 1,8 миллиона баррелей в сутки ради выравнивания баланса глобального спроса и предложения.

Соглашение действует до конца текущего года.

По данным Управления энергетической информации (EIA), объём производства нефти в США держался на уровне 10,27 миллиона баррелей в сутки на неделе к 16 февраля.

Таким образом, США уже опережают Саудовскую Аравию и лишь немного отстают от России.

В фокусе внимания инвесторов – данные о недельных запасах нефти и нефтепродуктов в США от Американского института нефти (API) и Управления энергетической информации (EIA).

-----

Раньше:

2018, February, 16, 23:45:00

REUTERS - NYMEX crude for March delivery CLc1 was up 17 cents, or 0.3 percent, at $61.51 a barrel by 0750 GMT, after earlier touching a one-week high of $61.82. For the week, the contract has risen about 4 percent after losing nearly 10 percent last week. London Brent crude LCOc1 was up 25 cents, or 0.4 percent, at $64.58 after settling down 3 cents. Brent is up nearly 3 percent for the week after falling more than 8 percent last week.

|

2018, February, 14, 10:05:00

IEA - Our demand growth estimate for 2017 remains strong at 1.6 mb/d, reinforced by November data for the US. For 2018, the more positive global economic picture published by the International Monetary Fund is a key factor in raising our growth outlook to 1.4 mb/d. It was thought that the significant increase in the dollar price of crude oil since the middle of 2017 would dampen growth, and this might be the case to some extent, but the impact of higher prices has been partly offset in some countries by currency appreciations.

|

2018, February, 9, 11:10:00

РЕЙТЕР - К 9.00 МСК фьючерсы на североморскую смесь Brent опустились на 0,63 процента до $64,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $60,54 за баррель, что на 1,00 процента ниже предыдущего закрытия.

|

2018, February, 2, 12:30:00

РЕЙТЕР - К 9.20 МСК фьючерсы на североморскую смесь Brent поднялись на 0,29 процента до $69,85 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $66,11 за баррель, что на 0,47 процента выше предыдущего закрытия.

|

2018, February, 2, 12:22:00

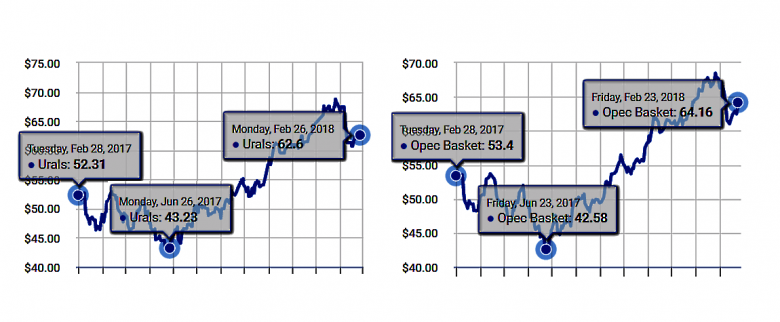

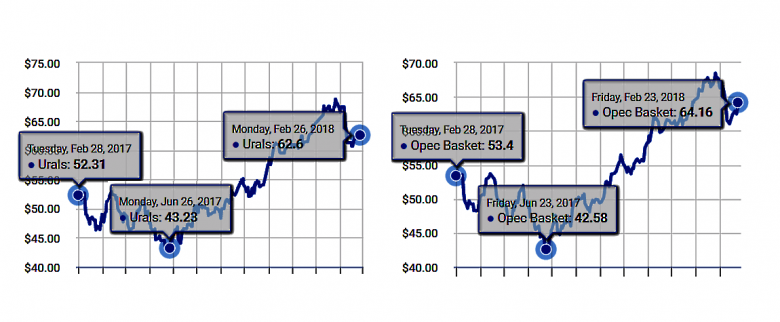

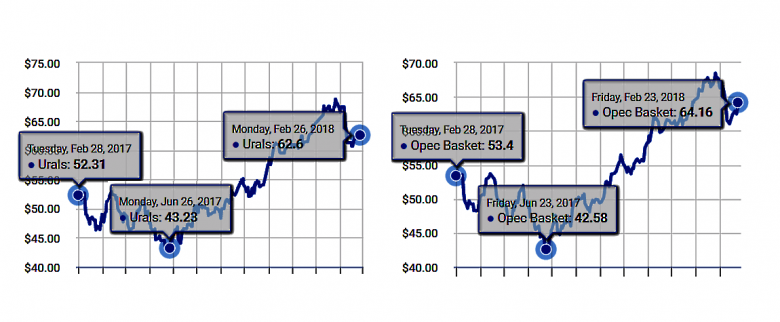

МИНФИН РОССИИ - Средняя цена на нефть марки Urals в январе 2018 года сложилась в размере $ 68,46 за баррель, что в 1,29 раза выше, чем в январе 2017 года ($53,16 за баррель).

|

2018, January, 31, 11:10:00

РЕЙТЕР - К 9.20 МСК фьючерсы на североморскую смесь Brent опустились на 0,71 процента до $68,53 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,92 за баррель, на 0,9 процента ниже предыдущего закрытия.

|

2018, January, 24, 12:20:00

РЕЙТЕР - К 9.25 МСК фьючерсы на европейский маркерный сорт Brent опустились на 0,07 процента до $69,91 за баррель. Фьючерсные контракты на американскую легкую нефть WTI к этому времени торговались у отметки $64,53 за баррель, на 0,09 процента выше предыдущего закрытия.

|

OIL PRICE: ABOVE $67 AGAIN

REUTERS - U.S. West Texas Intermediate (WTI) crude for April delivery CLc1 was down 13 cents, or 0.2 percent, at $63.78 a barrel by 0753 GMT. The contract on Monday rose to its highest since Feb. 6 at $64.24.

Brent crude LCOc1 in London was down 12 cents, or 0.2 percent, at $67.38 a barrel.

Soaring U.S. production is upending global oil markets, coming at a time when other major producers - including Russia and members of the Middle East-dominated Organization of the Petroleum Exporting Countries (OPEC) - have been withholding output to prop up prices LCOc1.

The United States will overtake Russia as the world's biggest oil producer by 2019 at the latest, the International Energy Agency (IEA) Executive Director Fatih Birol said on Tuesday.

"U.S. shale growth is very strong, the pace is very strong ... The United States will become the No.1 oil producer sometime very soon," he told Reuters separately.

U.S. output was 10.27 million barrels per day (bpd), according to weekly government data released last Thursday, higher than the latest figures for Saudi Arabia, the world's largest exporter, and just below Russia.

Earlier on Tuesday prices gained, extending multi-day rises for both crude futures. Last week, the U.S. Energy Information Administration (EIA) said there was a surprise draw on oil stockpiles amid a drop in imports and a surge in exports.

"It's the dwindling Cushing inventories that continue to resonate with oil traders, while another supply disruption in Libya has provided that extra fillip," said Stephen Innes, head of trading for the Asia-Pacific region at futures brokerage Oanda in Singapore.

He was referring to Libya's National Oil Corp's declaration of force majeure on Saturday for the 70,000-bpd El Feel oilfield after it was closed by a protest by guards.

"Given last week's Cushing collapse in oil stockpiles, traders are keenly awaiting this week's U.S. inventories data," Innes added. Cushing, Oklahoma, is an oil storage hub and the delivery point for the WTI futures contract.

U.S. crude inventories are forecast to have risen by 2.7 million barrels last week, a preliminary Reuters poll showed on Monday.

Gasoline stocks are expected to fall by 600,000 barrels, while distillate inventories, which include heating oil and diesel fuel, may decline by 700,000 barrels.

The American Petroleum Institute is scheduled to release its weekly data later on Tuesday, followed by the EIA on Wednesday.

-----

Earlier:

2018, February, 16, 23:45:00

REUTERS - NYMEX crude for March delivery CLc1 was up 17 cents, or 0.3 percent, at $61.51 a barrel by 0750 GMT, after earlier touching a one-week high of $61.82. For the week, the contract has risen about 4 percent after losing nearly 10 percent last week. London Brent crude LCOc1 was up 25 cents, or 0.4 percent, at $64.58 after settling down 3 cents. Brent is up nearly 3 percent for the week after falling more than 8 percent last week.

|

2018, February, 14, 10:05:00

IEA - Our demand growth estimate for 2017 remains strong at 1.6 mb/d, reinforced by November data for the US. For 2018, the more positive global economic picture published by the International Monetary Fund is a key factor in raising our growth outlook to 1.4 mb/d. It was thought that the significant increase in the dollar price of crude oil since the middle of 2017 would dampen growth, and this might be the case to some extent, but the impact of higher prices has been partly offset in some countries by currency appreciations.

|

2018, February, 14, 10:00:00

PLATTS - As a result, demand for OPEC crude will average 32.86 million b/d in 2018, the organization calculated.

|

2018, February, 9, 11:10:00

REUTERS - Brent futures were down 44 cents or 0.7 percent, at $64.37 a barrel by around 0700 GMT. On Thursday, Brent fell 1.1 percent to its lowest close since Dec. 20. U.S. West Texas Intermediate (WTI) crude was down 62 cents, or 1 percent, at $60.53 a barrel, having settled down 1 percent in the previous session at its lowest close since Jan. 2.

|

2018, February, 12, 07:40:00

REUTERS - Brent crude futures were at $63.42 per barrel at 0250 GMT, up 63 cents, or 1 percent, from the previous close. U.S. West Texas Intermediate (WTI) crude futures were at $59.83 a barrel. That was up 63 cents, or 1.1 percent, from their last settlement.

|

2018, February, 9, 11:10:00

REUTERS - Brent futures were down 44 cents or 0.7 percent, at $64.37 a barrel by around 0700 GMT. On Thursday, Brent fell 1.1 percent to its lowest close since Dec. 20. U.S. West Texas Intermediate (WTI) crude was down 62 cents, or 1 percent, at $60.53 a barrel, having settled down 1 percent in the previous session at its lowest close since Jan. 2.

|

2018, January, 31, 11:10:00

REUTERS - Brent crude futures LCOc1 for March delivery settled down 44 cents, or 0.6 percent, at $69.02 a barrel after touching a session low of $68.40. U.S. West Texas Intermediate futures CLc1 fell $1.06, or 1.6 percent, to close at $64.50 a barrel.

|

Tags:

OIL,

PRICE,

BRENT,

WTI,

URALS,

OPEC,

НЕФТЬ,

ЦЕНА